Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Napoleon had cutlery made from aluminium and also the highest order of badges to decorate himself and a few generals for their campaigns. Back then aluminium was far more valuable than gold! When silver runs out or it's demand exceeds gold then yes look out.

Last edited:

The world has moved on from tea parties mate. It's a shame that very nice history goes into a melt bin but it's a realityLol won't someone think of all the antique silverware I'm gonna smash up and refine!!

I've already started

View attachment 13216

No doubt, as with the Hunt Brothers, they will “change” the “rules”I long for the day they're caught with their pants down while their house burns to the ground

Tulip mania just shows you how greed can take control. Another less known was indigo a dye made from flowers worth more a barrel than a kings head, black pepper worth twice its weight in gold! Tea , salt and so on. I don't need to go on

No doubt, as with the Hunt Brothers, they will “change” the “rules”

All the rule changes prior have been in the paper/digital markets. The next rule changes will be in the physical. I think it will start with Government Mints limiting sales, and eventually get to restricting private ownership...

The US is a rules based order demanding all nations to comply to it like they are gods ... but the rule maker has failed to comply to its own rules when they don't get their way with other countries. Hence the multiple wars they have subjected us troops to and the millions of innocent people they have slaughtered since ww2 in the name of democracy and the punitive sanctions against the human race.No doubt, as with the Hunt Brothers, they will “change” the “rules”

... Another less known was ...

Why Saffron Is More Expensive Than Gold

It takes up to 170,000 individual flowers to yield just 1 pound of saffron, and each individual strand, or stigma, is painstakingly picked from the flower by hand.

Yes, even today Saffron is still worth more than gold of the given weight. The point is once a commodity becomes scarce or in demand then it's through the roof... silver might just be on its way

Why Saffron Is More Expensive Than Gold

It takes up to 170,000 individual flowers to yield just 1 pound of saffron, and each individual strand, or stigma, is painstakingly picked from the flower by hand.recipes.howstuffworks.com

Sorry mate just want to ask you, do you grade that stuff by hallmarks? Or you don't give a care?Lol won't someone think of all the antique silverware I'm gonna smash up and refine!!

I've already started

View attachment 13216

Yes, that is what I said. Or in other words do as I say not what I do.The US is a rules based order ; one rule for you, another for thee

US senators worry Russia, China could cut undersea internet cables A bipartisan group of eight US senators urged President Biden to review the security of undersea communications cables, expressing concerns about vulnerabilities, including sabotage by Russia and China’s growing role in cable laying and repair. These cables handle nearly all global internet traffic - 400 of them carry over 95% of the world's data traffic - and their locations are often published to prevent accidental damage.All the rule changes prior have been in the paper/digital markets. The next rule changes will be in the physical. I think it will start with Government Mints limiting sales, and eventually get to restricting private ownership...

Silver is silver is silverSorry mate just want to ask you, do you grade that stuff by hallmarks? Or you don't give a care?

Alot of silver and gold is going to melt.

I have a beautiful gold watch on death row atm

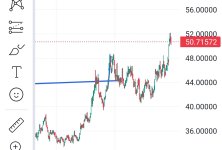

I see a push above $35 by the weekly close, then a pull back to $33-$34 next week, or at the beginning of November, before we set off towards $40.

But November is US elections month and the markets could become very volatile.

But November is US elections month and the markets could become very volatile.