Looking at the longer-term charts, I will put my neck on the line and say a dump is inline with the Elliott wave theory as the POS is struggling to advance above my charted uptrend line in previous posts.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Some people think the GSR is irrelevant, and it surely behaves that way, but I think it's completely relevant because it's based off the natural ratio of abundance in the earth's crust. You can't have something mined out of the ground at a 7:1 ratio and it be priced at 100:1 for very long.

Here's some facts:

Gold demand for 2024 was approximately 160 million Oz's. Gold supply was exactly the same.

Silver demand is 1.16 Billion Oz's. Silver supply was 187 Million Oz's less, almost a 20% deficit.

The mining GSR is 7:1 but Silver is in a significant deficit.

The GSR matters. Once they cannot use (run out of) aboveground silver to feed this growing deficit, the price of silver will narrow down to the 7:1 ratio. It's inevitable. We already have more people wanting silver than the market can produce, that's not happening to Gold right now (although I'm suspicious of the figures) but the price is climbing. Watch the frenzy unfold with Silver when we have a lot of hungry mouths that cannot be fed. Silver still is the buy of the century.

Here's some facts:

Gold demand for 2024 was approximately 160 million Oz's. Gold supply was exactly the same.

Silver demand is 1.16 Billion Oz's. Silver supply was 187 Million Oz's less, almost a 20% deficit.

The mining GSR is 7:1 but Silver is in a significant deficit.

The GSR matters. Once they cannot use (run out of) aboveground silver to feed this growing deficit, the price of silver will narrow down to the 7:1 ratio. It's inevitable. We already have more people wanting silver than the market can produce, that's not happening to Gold right now (although I'm suspicious of the figures) but the price is climbing. Watch the frenzy unfold with Silver when we have a lot of hungry mouths that cannot be fed. Silver still is the buy of the century.

Oh, and BTW - 7:1 in Aussie dollar terms is $714 an oz.

Does anyone think Samsung will give a fuck when their smartphones use $7 of silver instead of 50 cents? Maybe that's why they're securing supply by contracting directly with the mines. They don't care if it costs 14x more, they only care about being the ones that have it.

Does anyone think Samsung will give a fuck when their smartphones use $7 of silver instead of 50 cents? Maybe that's why they're securing supply by contracting directly with the mines. They don't care if it costs 14x more, they only care about being the ones that have it.

... You can't have something mined out of the ground at a 7:1 ratio and it be priced at 100:1 for very long. ...

Price is a function of supply *and* demand. GSR does not express any market dynamic between gold and silver demand. Gold demand is monetary and jewelry. Silver demand is mainly industrial (currently).

Of course, but at what point does the mining ratio become relevant? Especially if silver is in a multi-year deficit. Historically, and for the very reason of scarcity of the metals in the earth's crust, silver has been valued at ratios varying from 18:1 down to 3:1. Never throughout our known history has it been valued at 100:1 except for in the past few years. The GSR isn't some new construct, it has been around for millennia and has consistently been lower than 20:1 for a very good reason.Price is a function of supply *and* demand. GSR does not express any market dynamic between gold and silver demand. Gold demand is monetary and jewelry. Silver demand is mainly industrial (currently).

What I find curious is how we have a rather comprehensive survey from the Silver Institute and Metals Focus but they never indicate where the silver is entering the market to satisfy the deficit and keep the price stable. Gold is not in a deficit yet the price explodes. Silver is in a considerable deficit and the price remains stagnant. I would argue (when you factor in the market manipulators), price is a function of whatever the fuck they want to set it as for as long as they're willing to intervene. There is no free market until they're incapable of their interventions. The moment it does become a free market, we will see the GSR return to historical levels.

Of course, but at what point does the mining ratio become relevant? ...

I posit that it is irrelevant as long as the demand vectors remain disjointed. Should silver revert to a monetary metal (ie. demand driven by the same channels that drive gold demand), I would expect the mining ratio to gain relevance as a determining factor rather than a simple observation.

A couple of further points on this topic:

- Is gold currently in a structural deficit? Is global demand greater than global production? I'm honestly not sure about that. I haven't been watching stock inventory for the COMEX, LBMA and SGE/SFE on gold over the last year+ like I have for silver. I suspect that it might be, but I haven't seen any analysis on the subject.

- Silver *is* in a structural deficit going on five years now (supposedly!). But because there have been many decades since silver was in demand as a monetary metal, global exchange warehouses built up huge inventories of stock in the preceding decades. That huge stock has been covering the difference in global demand vs. production. When the free float of stock is finally depleted, we should finally see true market forces play out with industrial demand vs. production.

I posit that it is irrelevant as long as the demand vectors remain disjointed. Should silver revert to a monetary metal (ie. demand driven by the same channels that drive gold demand), I would expect the mining ratio to gain relevance as a determining factor rather than a simple observation.

A couple of further points on this topic:

I think it is possible that we might see demand for silver exceed demand for gold. They might be mined at a 12:1 ratio (more or less), but demand could be at a 100:1 ratio. We won't know until we know.

- Is gold currently in a structural deficit? Is global demand greater than global production? I'm honestly not sure about that. I haven't been watching stock inventory for the COMEX, LBMA and SGE/SFE on gold over the last year+ like I have for silver. I suspect that it might be, but I haven't seen any analysis on the subject.

- Silver *is* in a structural deficit going on five years now (supposedly!). But because there have been many decades since silver was in demand as a monetary metal, global exchange warehouses built up huge inventories of stock in the preceding decades. That huge stock has been covering the difference in global demand vs. production. When the free float of stock is finally depleted, we should finally see true market forces play out with industrial demand vs. production.

The only issue I take with any of that is the word "irrelevant". Beyond that, I agree with just about everything you say. I get that we're now comparing a T1 Asset Monetary Metal to a largely industrial metal, and the demand side isn't a direct comparison... But it never would be.

I think you would agree the mining ratio does hold significance. It's significant because it shows us how accessible both metals are when compared to each other, which they have been for millennia. It shows the ratio of new supply vs the price ratio of what aboveground stockpiles can influence. It shows us the potential of one metal when these stockpiles deplete. In this sense, I would turn the word "irrelevant" into "highly significant"... But that doesn't mean the points you've made are invalid.

Are we in for a breakout? We've barely made back the losses from the smackdown several weeks ago. It's amusing to watch months of gains be taken out in an instance, but each time they do it is one less time they can before they lose control. Their finite reserves are depleting by the day.

Does anyone actually know where the silver is coming from to continuously top up the COMEX and LBMA inventories, and meet market demand when we're in a deficit? It seems nobody knows. It would be nice if there was an investigation into this because someone, somewhere, there's a market played that has a lot of silver stored.

View: https://youtu.be/OQzNTFlVHDw?feature=shared

View: https://youtu.be/OQzNTFlVHDw?feature=shared

I remember having a bit of a debate with Bron Suchecki over at SS long ago (Bron was an analyst at ABC Bullion) and he claimed there is no silver held by governments anymore. From my understanding, the US held like 10 Billion Oz's when they signed the coinage Act in the 60's. President Johnson at the time said that treasury held a lot of silver and it would be used to keep the price inline with the value of the coins (in an attempt to deter people hoarding silver coins). So back in the 60's, using physical stockpiles was definitely on the table to manipulate the price. It would be fair to assume the US government, or at least entities in control of the US financial system, are the ones intervening in the market. I would expect there's a way such information like silver stockpiles/reserves would be obtainable through a FOI request to the right department.

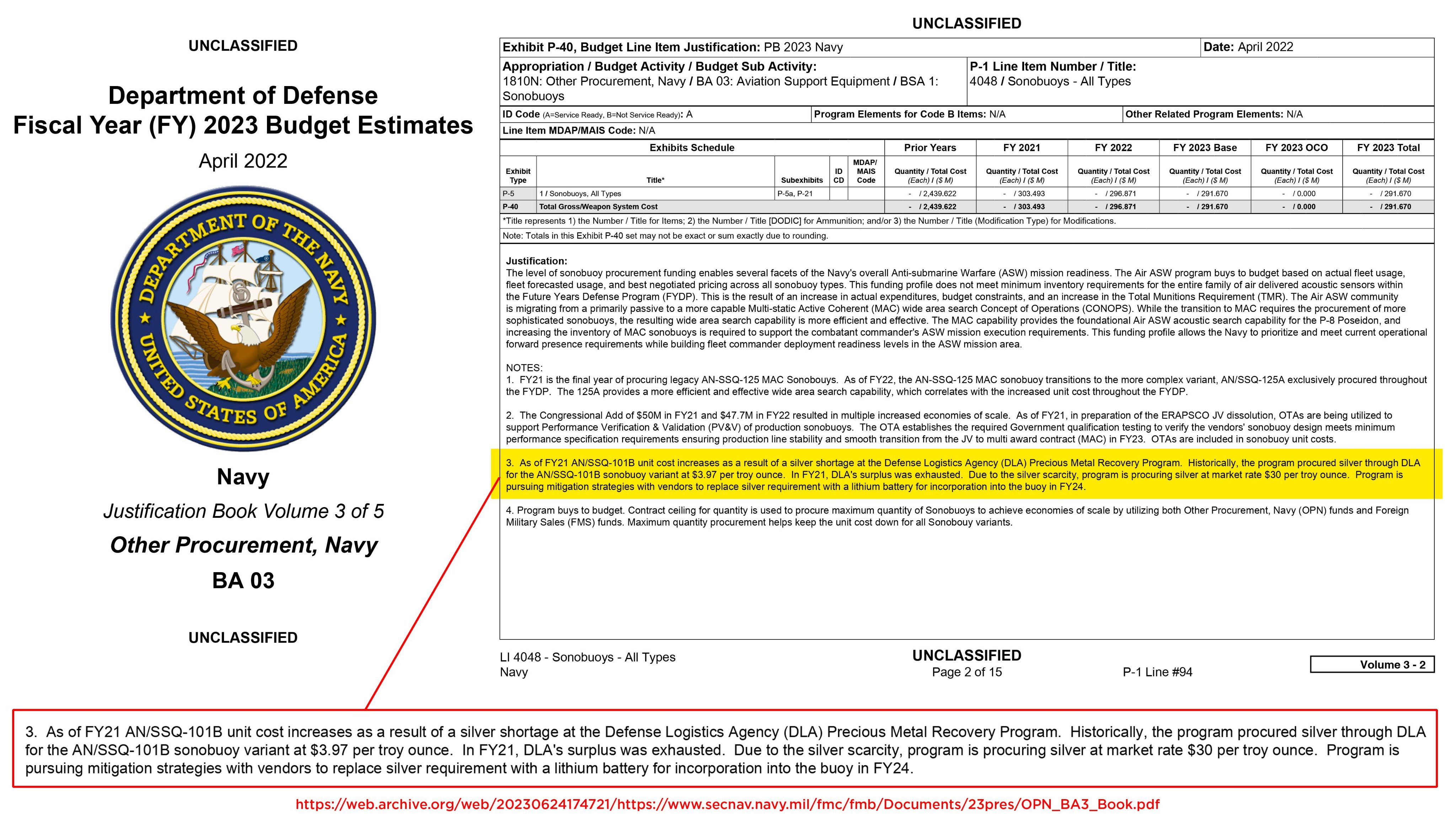

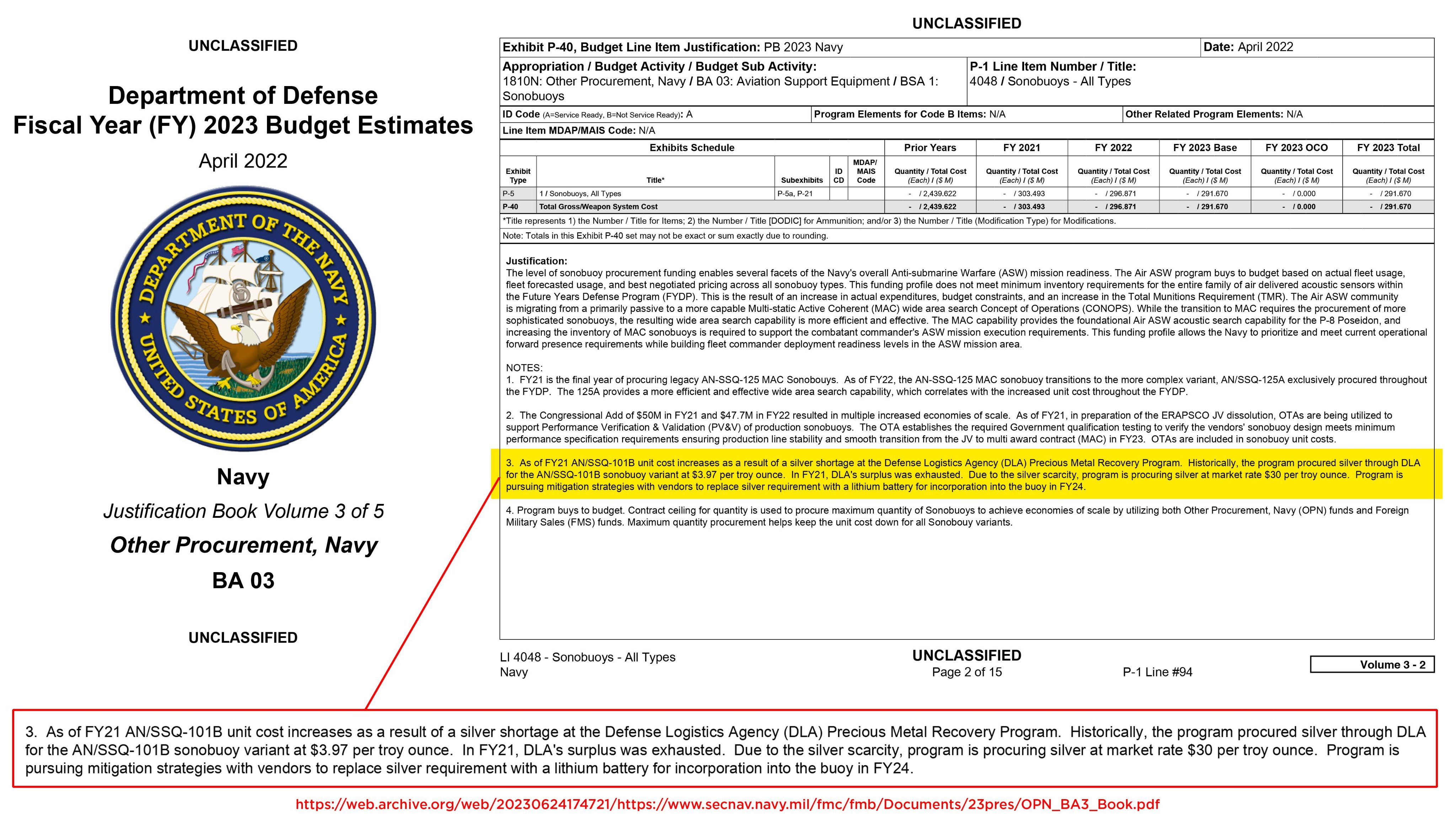

I am yet to encounter anyone who has any information on this. I recall seeing a letter relating to the US military buying silver, as their strategic reserves were non-existent. @pmbug was this you that brought this to our attention? Given you are an extremely good investigator when it comes to Silver related information, I would be grateful for your input on this. It would be so good if we could find data on silver stockpiles outside of the LMBA and COMEX to get a gauge of what we were working with.

I am yet to encounter anyone who has any information on this. I recall seeing a letter relating to the US military buying silver, as their strategic reserves were non-existent. @pmbug was this you that brought this to our attention? Given you are an extremely good investigator when it comes to Silver related information, I would be grateful for your input on this. It would be so good if we could find data on silver stockpiles outside of the LMBA and COMEX to get a gauge of what we were working with.

... I recall seeing a letter relating to the US military buying silver, as their strategic reserves were non-existent. @pmbug was this you that brought this to our attention? Given you are an extremely good investigator when it comes to Silver related information, I would be grateful for your input on this. ...

Silver might 10x within the next 3 years

Sounds crazy, right? Maybe it is. Maybe it isn't. I'll explain my thinking and you decide... Four Years of Structural Deficit Draining Vault Inventories Silver has been in a structural deficit for the last four years. Demand (mostly industrial, investment demand is fairly insignificant in...

Yes, thank you. I think uncovering the seemingly secret stockpiles would be a huge breakthrough for the serious stacker. We could then get an estimate of when we'd expect to see a real shortage. If there were a 20 Billion oz stockpile somewhere (which I'm sure there isn't), I would rethink the volume of my stack.

Silver might 10x within the next 3 years

Sounds crazy, right? Maybe it is. Maybe it isn't. I'll explain my thinking and you decide... Four Years of Structural Deficit Draining Vault Inventories Silver has been in a structural deficit for the last four years. Demand (mostly industrial, investment demand is fairly insignificant in...www.pmbug.com

I find it extremely fascinating that nobody has gone down this path to investigate where this silver is actually coming from. The numbers don't add up. The silver cannot be solely coming from transparent silver holdings like SLV, COMEX OR The LBMA.

Yes! I was just talking to my son about this.Something big is going on! WiFi is very slow over platforms? Anyone experiencing the same?