- Research suggests the US government no longer holds significant silver stockpiles, likely depleted by 2002.

- It seems likely that historical interventions using silver reserves occurred in the 1960s, but current market influence appears driven by supply and demand.

- The evidence leans toward no active government intervention in the silver market today using physical stockpiles, though other entities may influence prices.

Historical Context

In the 1960s, the US government held around 10 billion ounces of silver, as noted by President Lyndon B. Johnson during the Coinage Act of 1965 signing. Johnson mentioned using these reserves to stabilize silver prices and deter hoarding, indicating active market intervention at the time.

Current Situation

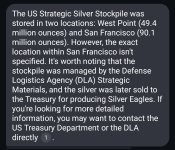

Today, the US Geological Survey (USGS) lists the government’s silver stockpile as “None,” suggesting no significant reserves remain. Historical records show the strategic stockpile, established in 1968 with 165 million ounces, was depleted by 2002 for minting Silver Eagles.

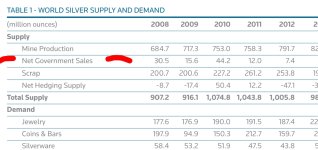

Market Dynamics

The silver market now seems driven by supply, demand, and trading on exchanges like COMEX and LBMA, with no evidence of government using physical stockpiles to influence prices. Industrial demand and investor sentiment play key roles.