Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

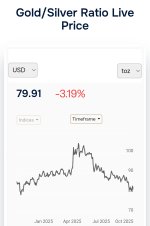

Silver Price Watch

- Thread starter STKR

- Start date

View attachment 15028

50 to 51 happened very quickly.

I was just about to post this. What a surge. ATH is among us. This moment will be referenced in the silver discussion for decades to come.

Silver’s falling , but not because new supply showed up.

What’s really happening is liquidity breaking before inventory does.

Dealers and funds are being forced to dump paper positions to meet margin calls. Futures are falling faster than spot, so the gap keeps widening even as both drop.

The link between COMEX and LBMA is jammed — credit’s pulling back and no one’s stepping in to arbitrage.

It looks like a price crash, but it’s actually a funding squeeze.

And the irony? This kind of flush only makes the next squeeze worse. When the selling stops and real metal bids return, there’ll be fewer shorts, less liquidity, and no buffer left to contain the move

View: https://x.com/SunilRe89392848/status/1976333864349192653

View: https://www.instagram.com/p/DPnRksgCeH2/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

The era of cheap silver is over.

The largest silver squeeze in modern history is unfolding. Overnight, silver lease rates exploded past 200% — a complete breakdown of the global silver leasing system. This isn’t a paper-market anomaly. It’s a true physical shortage.

Our CEO, David Mitchell expects prices to target US$60–65/oz, with potential for even higher levels as the structural shortage deepens.

I just wish I had money to buy more, but even if I had money to buy more, I'd wish I had more money to buy even more.

I bet even David Bateman, that guy who brought 1.5% of world mining supply sits around wishing he had brought more.

It's amazing how addictive silver can be, you don't consume it, it just sits in a safe spot. I'm addicted to putting shiny things in locked boxes that I rarely open.

I bet even David Bateman, that guy who brought 1.5% of world mining supply sits around wishing he had brought more.

It's amazing how addictive silver can be, you don't consume it, it just sits in a safe spot. I'm addicted to putting shiny things in locked boxes that I rarely open.