Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

So there are all of these physical silver buyers, and yet these guys that are always railing cocaine, that are so coked up that are saying, ‘Let’s just keep selling it short and taking the price down.’ And you said to me, ‘This just isn’t going to work.’”

Nomi Prins: “Yeah, I think they are living in that former world. We are so not 2011. And the idea that you can manipulate for any long period of time, and by long I mean a couple of days. Silver prices today are insane as you said, to use your word. I would never (laughter) want to be caught shorting physical silver, which is basically what they are doing if any delivery was to be taken into those contracts.

And so what’s happening now is that the short sellers are at the end, really, of the manipulation game. Which means that throughout this game you are shorting, you’re rolling into the next short, you are basically able to extend shorts while there is still silver buying, while there is still a silver deficit. But you are able to extend it because there is not enough buying pressure in the overall market, so you can kind of fiddle around the edges of the market. That’s no longer the case. It’s becoming the end of the possibility of thinking it can be the case.

And so these guys are going to get caught short having to deliver a lot of silver. And the reality about silver right now is we are in a global structural deficit for silver that is not going away. And it’s over 100 million ounces per year. It’s growing each year, the demand in stockpiling is growing. The knowledge that silver is a good hard asset to be held in long-term portfolios is growing. And the demand for silver from everything from solar to defense weaponry is growing. And so when you have this 110 million ounce deficit per year that’s growing, but this is the important thing for everybody listening to know: there are not enough mines that are in the almost permit or just getting permit stage between now and 2027, that if you brought even those mines online would be able to close the current 100+ million ounce structural deficit in silver. And between now and 2027, the demand for silver is only going to increase.

And so what we are seeing now with this kind of recent surge toward $50, it went up and then came back down — I think we are going to be in the $50s next week. But that surge is the real market, the physical market, not the financial manipulation of the market participants. … We talked about silver getting to $50 back in January on this show earlier this year, and it has. And now we are looking at silver going very quickly once it hits $52-53 up to $60-$65 this year or at the turn of the year because there is a lot of recognition that the overall market still has to note that these short sellers vs where they are going to get the supply to basically close those contracts because you can’t roll them forever anymore.

Link: https://kingworldnews.com/nomi-prin...e-50s-next-week-as-short-sellers-get-overrun/

Nomi Prins: “Yeah, I think they are living in that former world. We are so not 2011. And the idea that you can manipulate for any long period of time, and by long I mean a couple of days. Silver prices today are insane as you said, to use your word. I would never (laughter) want to be caught shorting physical silver, which is basically what they are doing if any delivery was to be taken into those contracts.

And so what’s happening now is that the short sellers are at the end, really, of the manipulation game. Which means that throughout this game you are shorting, you’re rolling into the next short, you are basically able to extend shorts while there is still silver buying, while there is still a silver deficit. But you are able to extend it because there is not enough buying pressure in the overall market, so you can kind of fiddle around the edges of the market. That’s no longer the case. It’s becoming the end of the possibility of thinking it can be the case.

And so these guys are going to get caught short having to deliver a lot of silver. And the reality about silver right now is we are in a global structural deficit for silver that is not going away. And it’s over 100 million ounces per year. It’s growing each year, the demand in stockpiling is growing. The knowledge that silver is a good hard asset to be held in long-term portfolios is growing. And the demand for silver from everything from solar to defense weaponry is growing. And so when you have this 110 million ounce deficit per year that’s growing, but this is the important thing for everybody listening to know: there are not enough mines that are in the almost permit or just getting permit stage between now and 2027, that if you brought even those mines online would be able to close the current 100+ million ounce structural deficit in silver. And between now and 2027, the demand for silver is only going to increase.

And so what we are seeing now with this kind of recent surge toward $50, it went up and then came back down — I think we are going to be in the $50s next week. But that surge is the real market, the physical market, not the financial manipulation of the market participants. … We talked about silver getting to $50 back in January on this show earlier this year, and it has. And now we are looking at silver going very quickly once it hits $52-53 up to $60-$65 this year or at the turn of the year because there is a lot of recognition that the overall market still has to note that these short sellers vs where they are going to get the supply to basically close those contracts because you can’t roll them forever anymore.

Link: https://kingworldnews.com/nomi-prin...e-50s-next-week-as-short-sellers-get-overrun/

... Traders described a market where liquidity has almost entirely dried up, leaving anyone short spot silver struggling to source metal and forced to pay crippling borrowing costs to roll their positions to a later date.

And the squeeze has become so dramatic that some traders have rushed to book slots in the cargo holds of transatlantic flights for bulky silver bars — an expensive mode of transport typically reserved for more valuable gold — to profit off the massive premiums in London.

...

More:

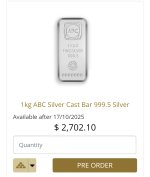

Alrighty then. We're starting see cracks in supply. ABC Bullion have their 1kg bars on pre-order for the first time in a few years. And these days, they'll set you back a cool $2700.

I remember having to pre-order their 1kg bars back in 2011.

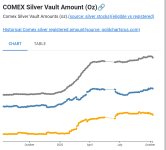

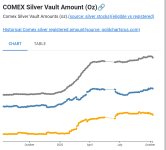

This website tracks the COMEX vault data, broken down into Registered and Eligible categories. Not all silver held at the COMEX is available for delivery. There were 8,000 tonnes of silver moved from the LBMA to COMEX vaults earlier this year - That's around 250 Million Oz's.

Of the total 520 Million Oz's held at the COMEX, only 180 Million Oz's is available for delivery in the registered category. It's still a huge bump up from previous years due to the LBMA transfer, but to me it indicates the remainder of what's available to fulfil physical market demand. 180 Million Oz's doesn't even cover a year of deficits. The LBMA might look like they have a lot of silver but most of their stock is owned by third parties like SLV. Estimated free float is a mere 140 Million Oz's.

So between the COMEX registered category and LBMA free float, there's about 320 Million Oz's that could be seen as "immediately available". With the rise of coin and bar demand this year, it's highly likely annual consumption will be somewhere in the 300 Million Oz category, which means the COMEX and LBMA barely have enough silver to satisfy physical investment demand for a year.

Now, I've been suspecting for a long time there's undisclosed stockpiles out there specifically being used to manage the physical market; to allow management of the paper markets, but we're seeing cracks in the system and I'm doubtful they can hold it together for much longer.

Of the total 520 Million Oz's held at the COMEX, only 180 Million Oz's is available for delivery in the registered category. It's still a huge bump up from previous years due to the LBMA transfer, but to me it indicates the remainder of what's available to fulfil physical market demand. 180 Million Oz's doesn't even cover a year of deficits. The LBMA might look like they have a lot of silver but most of their stock is owned by third parties like SLV. Estimated free float is a mere 140 Million Oz's.

So between the COMEX registered category and LBMA free float, there's about 320 Million Oz's that could be seen as "immediately available". With the rise of coin and bar demand this year, it's highly likely annual consumption will be somewhere in the 300 Million Oz category, which means the COMEX and LBMA barely have enough silver to satisfy physical investment demand for a year.

Now, I've been suspecting for a long time there's undisclosed stockpiles out there specifically being used to manage the physical market; to allow management of the paper markets, but we're seeing cracks in the system and I'm doubtful they can hold it together for much longer.

Silverback Snakes

SilverbackSnakes.io has free online multiplayer games and inflation-related financial metrics

silverbacksnakes.io

Buy Precious Metal & Bullion in Singapore | LPM

Shop gold, silver & platinum bullion with trusted precious metal dealers in Singapore. Discover top brands, secure storage, and fast delivery with LPM.

No trouble with Metals DailyWhat's up with silver spot not updating.

Trading view isn't showing anything, Kitco showed bit of movement then stopped reporting.

MetalDaily.com | Live Gold Prices, Gold Charts and Gold Headlines

MetalsDaily.com aims to bring you the latest gold news, live gold prices and gold charts and will soon be an online shop for buying gold bars and gold coins.

No trouble with Metals Daily

MetalDaily.com | Live Gold Prices, Gold Charts and Gold Headlines

MetalsDaily.com aims to bring you the latest gold news, live gold prices and gold charts and will soon be an online shop for buying gold bars and gold coins.www.metalsdaily.com

Something going on !

Silver price moved & then froze again ??As soon as I posted Silver price froze ?

Something going on !

Gold is trading so it's not the site.

Maybe the " Squeeze " in London is having an effect ?