Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Hey Elon ! My perspective is a bit different to ur's

Elon. My Silver is for sale if you want to buy. It's just not for sale at the current prices

The Silver Market Just Nuked The Narrative

Silver rips faces clean off on Friday. It's a statement.

Quoth the RavenDec 27, 2025

The Silver Market Just Nuked The Narrative

Silver rips faces clean off on Friday. It's a statement.

Good article

I monitor inventory at Bullion Now and ABC Bullion (Boycott ABC Bullion) to get a gauge of the retail market.

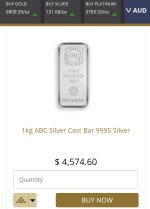

As you would all know by now, ABC is playing some spot price shenanigans. But Bullion Now is having their silver inventory drained at the same time. During the time when the huge lines outside ABC Bullion was making the news, Bullion Now had 80 silver products available on their website and that slipped down to 70. Recently, it recovered back to 80-82 products. Now they're at 48 and dropping...

These are the kind of signs we want to see to reveal a real physical shortage in the retail markets. This isn't just a supply bottleneck, this is the beginning of something rather magnificent in the silver space. We will start to see fractional silver become the new 1oz benchmark, and kilo bars priced beyond the reach for many newcomers to the scene.

As you would all know by now, ABC is playing some spot price shenanigans. But Bullion Now is having their silver inventory drained at the same time. During the time when the huge lines outside ABC Bullion was making the news, Bullion Now had 80 silver products available on their website and that slipped down to 70. Recently, it recovered back to 80-82 products. Now they're at 48 and dropping...

These are the kind of signs we want to see to reveal a real physical shortage in the retail markets. This isn't just a supply bottleneck, this is the beginning of something rather magnificent in the silver space. We will start to see fractional silver become the new 1oz benchmark, and kilo bars priced beyond the reach for many newcomers to the scene.

the bullion coin price is moving towards the collectable coin price.

currently 1kg silver price tracking 1oz Pt price, when Pt double the Au price again

then the track is truely broken

then the price of Ag 1kg would be 7k+

10oz bar would be 2,180

the new reality would set in, then we observed from then

currently 1kg silver price tracking 1oz Pt price, when Pt double the Au price again

then the track is truely broken

then the price of Ag 1kg would be 7k+

10oz bar would be 2,180

the new reality would set in, then we observed from then

the bullion coin price is moving towards the collectable coin price.

currently 1kg silver price tracking 1oz Pt price, when Pt double the Au price again

then the track is truely broken

then the price of Ag 1kg would be 7k+

10oz bar would be 2,180

the new reality would set in, then we observed from then

It's a cook up. I haven't been excited about silver for over a year until this moment. The hungry silver market has has a lot of mouths to feed and not enough silver spoons.

What is ABC Bullion anticipating? Their spot price is now almost $11.50 over actual spot. On a Sunday when the markets are closed.

A big jump up when the market opens.

Ive mentioned noticing spot going up on sat arvos and sundays on these sites before, but it doesnt budge on the charts. i cant remember why if anyone knew.

I wonder if ABC is allowed insight to market interest before markets open. If the markets jump to anywhere near ABC spot then I'll find that quote suspicious. I wonder how Bullion dealers hedge when markets are closed, and how risky that is for them with $10 daily moves.

Every single thing on guardian gold is preorder except for some generic sunshine mint rounds, and at 129 they are minimum order of 20, if you want any silver from them its 2.5+k

Bulk Bullion always seem to stock heaps so im gonna have a squiz there. (Not buying, just curious)

Should buy though!

Bulk Bullion always seem to stock heaps so im gonna have a squiz there. (Not buying, just curious)

Should buy though!