Try refreshing the worm between gold and silver, or other PM's on the site you are using. Or set the worm refesh every half hour if you are in worm mode and not candles . It's obvious you are not trading the metal so why stream in live. They probably have limits on you streaming aswell hence the flat line no data in hi traffic movements of the metal.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Are the silver god's finally on our side?

Deficits are unsustainable. There will come a time where the charts and comex pricing become redundant. Parabolic moves are almost guaranteed at some point in the future. All we need is a depletion of aboveground stockpiles.

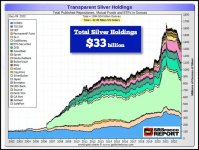

There's a claimed 1.6 Billion ozs of aboveground silver held by the LBMA, Comex and SLV, but there's also the issue with double counting. Much of the SLV holdings are held by JPM and are counted as Comex holdings. Much of the LBMA holdings are also Comex and SLV holdings. From my speculative estimates, there Probably only 800 million ounces left once you factor in the double counting.

With deficits of 250Mozs per year, and the silver used to feed the market to keep the price "stable" coming from these repositories, we probably only have 3 years of play left before the deficits really show their ugly face and result in the erosion of price controls. That is, of course, assuming there isn't any undisclosed stockpiles they can tap into. And that's also assuming they're willing to die on their own sword by continuing to maintain control of the price at the expense of their physical reserves.

London vaults have declined 330Mozs in the past 2 years, and it's claimed that 85% of their holdings are claimed by ETFs already, so as far as available silver is concerned, there really isn't much left. This is a prime "cooking the books" example - one that merely provides the illusion of aboveground reserves.

The chart below shows a 10moz decline in Comex holdings for the month of August alone, and the previous increase in holdings seem to coincide with the 'double counting/moving silver around' to keep up appearances that stockpiles aren't depleting at a rate that matches reality. Each month that passes is a month closer to the end game. Triple digit silver is in our sights and I wouldn't be surprised if we get there by 2027.

Vault totals through end of August:

www.pmbug.com

www.pmbug.com

Silver Demand Drivers (and vault totals)

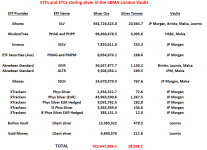

Update (see post #68 for last month):LBMA - As at end August 2024, ... There were also 26,245 tonnes of silver (a 1.4% decrease on previous month)... SLV report for 6 September claims 363.01 mtoz vaulted in London. That leaves a total of ~480.78 mtoz of silver in the London vaults not owned by...

Vault totals through end of August:

Silver Demand Drivers (and vault totals)

Update (see post #68 for last month):LBMA - As at end August 2024, ... There were also 26,245 tonnes of silver (a 1.4% decrease on previous month)... SLV report for 6 September claims 363.01 mtoz vaulted in London. That leaves a total of ~480.78 mtoz of silver in the London vaults not owned by...www.pmbug.com

Are you certain the remaining 480Mozs isn't owned by ANY ETFs? It looks like it's just a total holdings minus SLV reported holdings to get to that number. There's a lot of other ETFs and mutual funds that may hold their silver in London vaults, and I've seen reports/claims that 85% of the silver held at London is from ETFs alone.

I don't know how much might be owned by other ETFs. I only reported on numbers where I could find reported data. I listed my sources. If you can find some reports of vault totals for other ETFs, please let me know!

I don't know how much might be owned by other ETFs. I only reported on numbers where I could find reported data. I listed my sources. If you can find some reports of vault totals for other ETFs, please let me know!

It was just the wording that 480Mozs were NOT held by ETFs that made me ask. But all I have is speculative estimates, as far as I know. I'll do some digging and see what I can find.

Here's some data as of 2021:I don't know how much might be owned by other ETFs. I only reported on numbers where I could find reported data. I listed my sources. If you can find some reports of vault totals for other ETFs, please let me know!

85% of Silver in London Already Held by ETFs

In addition to SLV, another 13 ETFs store silver in LBMA vaults, holding 85% of all the silver in London.

@pmbug Based on the data presented above, and the data in your article, it would appear that SLV has been the main supplier of physical silver in the times of deficits.

I have a theory, which is purely from my assessment of SLV and Comex holdings, along with the data from the silver survey's and the timing of when 'Government Sales' stopped being recorded (or at least adding to the supply in a meaningful way), that the US treasury gave the remainder of their stockpiles to SLV and the Comex to continue the management of the silver price.

There's a connection with deficits and the reduction of SLV and Comex holdings. But I think the US treasury (up until recently) still had existing stockpiles that were being assigned to SLV and the Comex. It would also appear that any surplus from mine supply or scrap metal refining was being bought and utilised for future price controls.

I have a theory, which is purely from my assessment of SLV and Comex holdings, along with the data from the silver survey's and the timing of when 'Government Sales' stopped being recorded (or at least adding to the supply in a meaningful way), that the US treasury gave the remainder of their stockpiles to SLV and the Comex to continue the management of the silver price.

There's a connection with deficits and the reduction of SLV and Comex holdings. But I think the US treasury (up until recently) still had existing stockpiles that were being assigned to SLV and the Comex. It would also appear that any surplus from mine supply or scrap metal refining was being bought and utilised for future price controls.

Here's some data as of 2021: ...

Ronan Manly FTW. He included source links in that report. I'll have to do some digging for updated numbers. It might have to wait for the September update though as I'm dealing with some issues that are limiting my computer time right now.

Bix has done a great job uncovering the Silver Institutes miscounting of Silver demand for Solar panels and electric vehicles. Although I don't agree with much of what he talks about (or at least his conclusions), this would have to be one of his most researched areas. I don't particularly trust the Silver Institute and I think they've been captured and corrupted to report lower deficits to deter investors.

Check out this Nasdaq article about Samsung's solid state batteries. It's reported to double the range of Electric vehicles and reduce charge times. It's claimed to require approx. 1kg of silver per battery, and Samsung + Toyota have entered a production agreement to commence in 2027.

"The electric vehicle (EV) revolution is charging ahead, and a critical new player might soon steal the spotlight: solid-state batteries. Samsung's recent breakthrough in silver-based solid-state battery technology could not only transform the EV landscape, but also send shockwaves through thesilver market These batteries promise a 600-mile range on a single charge, a 20-year lifespan, and a mere 9-minute charging time. With an energy density of 500 Wh/kg, nearly double that of current mainstream EV batteries, this technology could revolutionize the industry."

"The electric vehicle (EV) revolution is charging ahead, and a critical new player might soon steal the spotlight: solid-state batteries. Samsung's recent breakthrough in silver-based solid-state battery technology could not only transform the EV landscape, but also send shockwaves through thesilver market These batteries promise a 600-mile range on a single charge, a 20-year lifespan, and a mere 9-minute charging time. With an energy density of 500 Wh/kg, nearly double that of current mainstream EV batteries, this technology could revolutionize the industry."

Loading…

www.nasdaq.com

Could also mean the end of personal ownership of silver. If you dont hand it over you are killing poor weeping gaia. Dont under estimate the climate death cult's ability to mobilise the mobs toward seizure of anything that might enable you to be independent of their welfare technate.

They already did it with the 'your killing grandma' spin on their latest depopulation effort. Obviously this sounds histrionic and an exageration however they really are going hard for 2030 depop.

We're on the same page with this. Making private ownership illegal and the depopulation agenda are two potential downsides to the long-term stacker. The consequence of which will extend far beyond our interest in the metal. But depopulation would result in a drastic decline in demand which will probably negate the need for making private ownership illegal.

Its a possibility but imo highly unlikely, confiscation of physical its been done with gold to those who actually handed theirs over but never silver,while getting rarer its still plentiful above ground in many forms...even silverware and jewellery among other things,still mined majority as a by-product and still has large untapped desposits under ground as yet unmined as its unprofitable to do so. A slow and steady appreciation due to its properties and hopefully lessening of manipulation of its small market is what i hope for. I worry sometimes on conversion-physical Gold/silver/platinum,etc for CBDC and the allowance to do so as levels of control now ridiculous and sickening. But if we cant have the benefits of insurance and $ outside the garbage system and we believe our metals will be confiscated and rendered worthless then whats the point? At times i see all the oppressive bullshit and the weight on us pressing down without escape as its impossible now to be free in most ways that can doubt even precious metals...but if have faith in nothing then any hope in shit is gone. Physical assets without 3rd party risk-without taxes and fees take that and then we truly own nothing, even fkd with thoughts in our headWe're on the same page with this. Making private ownership illegal and the depopulation agenda are two potential downsides to the long-term stacker. The consequence of which will extend far beyond our interest in the metal. But depopulation would result in a drastic decline in demand which will probably negate the need for making private ownership illegal.