Silver ON SALE SIGN is up again

www.bullionstar.com

aud is A$40.48

www.bullionstar.com

aud is A$40.48

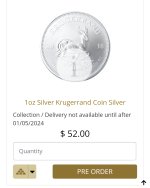

Buy 1 oz South African Silver Krugerrand Bullion Coin

Minted by the world-famous Rand Refinery of South Africa, this silver bullion Krugerrand coin is fabricated in 99.9% pure silver. Like its famous counterpart the Gold Krugerrand, the Silver Krugerrand features imagery of South Africa’s national symbol, the Springbok, along with a portrait of...