They have been playing a Shell Game for the last 7 yrs ( some say 5 yrs, but the 1'st 2 yrs was covered by ETF outflows ) shuffling Silver around markets, Leasing & Rehypothecating Silver that not really available

But Physical demand is finally catching up with the Paper Market. Buyers aren't wanting the promise of future Silver, they have their hands out & demanding Physical Delivery.

Problem is that the warehouses are getting VERY LOW on inventory & there is no coming extra mine supply anywhere into the future. That means some will miss out on Silver unless they are prepared to Bid Up the price.

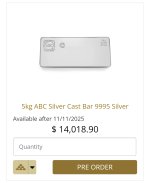

The BIG Plus for the future price is that Industrial Demand ( reported as 70% of the market ) must have their Silver or they go out of Business. If your Business/Profit is reliant on the Silver manufactured into your product, how much are you prepared to pay up to secure your supply of SILVER