Yep. China is coming after your silver.Shit. They're coming after our silver, for sure.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Funny you say that because I 100% believe the only reason China encourages their citizens to buy gold and silver is to confiscate it down the track.Yep. China is coming after your silver.

In the name of national security and/or a climate catastrophe, the western world will have no issues squeezing it's citizens.

This looks interesting

Yeah, that happened back in August. Silver was added to the list. Rob Gottlieb (ex-JPM bullion desk) has been talking ad nauseum that silver is currently subject to a 232 investigation to determine tariff policy (ie. that the USA might impose tariffs) now that it is designated as a critical mineral, but best I can tell, that is not the case. In the last few days though, FT et al reported that the USA is going to direct the Defense Logistics Agency (DLA) to stockpile critical minerals/metals with an initial $1B outlay. Silver was not specifically mentioned in any of the reports, but it's possible the DLA might start a new stockpile for silver - they used to manage one in years past but it ran dry in FY21.

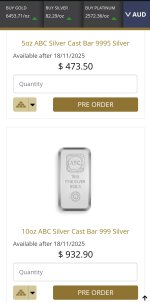

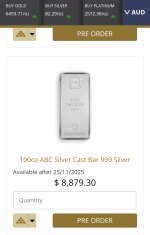

This has been going on at my source for months...They wont even bother to pick up the phone...People are starting to panic... This from a QLD dealer:

Today was absolutely wild. I have a tonne of missed calls, messages, and emails from first time customers scrambling for anything they could get.

Not the $5 days I was hoping for... But if it goes to $22 I'll be ready!...and now its falling like a rock...back to $22

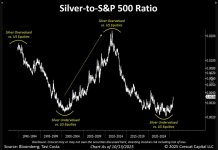

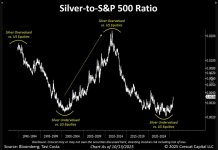

David's Commentary — 14th October 2025The Market Still Doesn’t Understand What’s UnfoldingAs I mentioned just days ago, the market continues to act foolishly — dancing around either side of US$50 as though this is a normal price zone. It isn’t. It’s a gift from the heavens . Silver is heading much, much higher.Now, with prices trading near US$53 , the usual chorus begins:“Overdone!” “Needs a correction!” “When do I take profits?” “Could be topping!”They simply don’t get it . Analysts, traders, and investors are still trapped in old paradigms — thinking in “norms” that no longer apply. The reality is that the world has changed , and silver is in the midst of a structural repricing unlike anything we’ve seen in modern times.My assessment is clear: what’s about to unfold — and soon — is a powerful emergence into a new price reality , one far above current levels. Silver will lead this move. And the economic, political, and institutional currents now in motion will only add fuel to this monetary fire.Prices will remain highly volatile, yet every dip is likely to be met with intense real-world physical demand , as buyers eagerly step in to accumulate on any weakness.Metal Supply Shortages Are ComingWe are now receiving increasing reports from across the globe — bullion dealers, refineries, and mints are turning clients away amid unprecedented demand and rapidly vanishing physical supply .The coming weeks are set to be decisive. The ongoing collapse in silver lease contracts , combined with panic buying from industrial users and i nvestors finally waking from their long coma induced slumber , is creating the conditions for severe product shortages ahead. The repercussions will be felt across the entire supply chain.At the same time, the Silver-to-S&P 500 ratio is flashing a powerful signal as I have updated many times over the years — the early phase of a major cycle shift , where silver begins to outperform U.S. equities. This is the hallmark of a Fourth Turning moment in global markets.While many investors remain conditioned to expect the opposite, this ratio tells a different story — one of capital quietly rotating into hard assets . When silver starts outperforming equities, it marks a deeper psychological pivot: investors are beginning to value tangible wealth over speculative paper promises.It’s still early — but these asset rotations are measured in years , not weeks, and we’re only just witnessing the first act.

We are now receiving increasing reports from across the globe — bullion dealers, refineries, and mints are turning clients away amid unprecedented demand and rapidly vanishing physical supply .The coming weeks are set to be decisive. The ongoing collapse in silver lease contracts , combined with panic buying from industrial users and investors finally waking from their long coma induced slumber , is creating the conditions for severe product shortages ahead. The repercussions will be felt across the entire supply chain.At the same time, the Silver-to-S&P 500 ratio is flashing a powerful signal as I have updated many times over the years — the early phase of a major cycle shift , where silver begins to outperform U.S. equities. This is the hallmark of a Fourth Turning moment in global markets.While many investors remain conditioned to expect the opposite, this ratio tells a different story — one of capital quietly rotating into hard assets . When silver starts outperforming equities, it marks a deeper psychological pivot: investors are beginning to value tangible wealth over speculative paper promises.It’s still early — but these asset rotations are measured in years , not weeks, and we’re only just witnessing the first act.

web.telegram.org

web.telegram.org

We are now receiving increasing reports from across the globe — bullion dealers, refineries, and mints are turning clients away amid unprecedented demand and rapidly vanishing physical supply .The coming weeks are set to be decisive. The ongoing collapse in silver lease contracts , combined with panic buying from industrial users and investors finally waking from their long coma induced slumber , is creating the conditions for severe product shortages ahead. The repercussions will be felt across the entire supply chain.At the same time, the Silver-to-S&P 500 ratio is flashing a powerful signal as I have updated many times over the years — the early phase of a major cycle shift , where silver begins to outperform U.S. equities. This is the hallmark of a Fourth Turning moment in global markets.While many investors remain conditioned to expect the opposite, this ratio tells a different story — one of capital quietly rotating into hard assets . When silver starts outperforming equities, it marks a deeper psychological pivot: investors are beginning to value tangible wealth over speculative paper promises.It’s still early — but these asset rotations are measured in years , not weeks, and we’re only just witnessing the first act.

Telegram Web

Telegram is a cloud-based mobile and desktop messaging app with a focus on security and speed.

AI Slop & poorly written slop at that.David's Commentary — 14th October 2025The Market Still Doesn’t Understand What’s UnfoldingAs I mentioned just days ago, the market continues to act foolishly — dancing around either side of US$50 as though this is a normal price zone. It isn’t. It’s a gift from the heavens . Silver is heading much, much higher.Now, with prices trading near US$53 , the usual chorus begins:“Overdone!” “Needs a correction!” “When do I take profits?” “Could be topping!”They simply don’t get it . Analysts, traders, and investors are still trapped in old paradigms — thinking in “norms” that no longer apply. The reality is that the world has changed , and silver is in the midst of a structural repricing unlike anything we’ve seen in modern times.My assessment is clear: what’s about to unfold — and soon — is a powerful emergence into a new price reality , one far above current levels. Silver will lead this move. And the economic, political, and institutional currents now in motion will only add fuel to this monetary fire.Prices will remain highly volatile, yet every dip is likely to be met with intense real-world physical demand , as buyers eagerly step in to accumulate on any weakness.Metal Supply Shortages Are ComingWe are now receiving increasing reports from across the globe — bullion dealers, refineries, and mints are turning clients away amid unprecedented demand and rapidly vanishing physical supply .The coming weeks are set to be decisive. The ongoing collapse in silver lease contracts , combined with panic buying from industrial users and i nvestors finally waking from their long coma induced slumber , is creating the conditions for severe product shortages ahead. The repercussions will be felt across the entire supply chain.At the same time, the Silver-to-S&P 500 ratio is flashing a powerful signal as I have updated many times over the years — the early phase of a major cycle shift , where silver begins to outperform U.S. equities. This is the hallmark of a Fourth Turning moment in global markets.While many investors remain conditioned to expect the opposite, this ratio tells a different story — one of capital quietly rotating into hard assets . When silver starts outperforming equities, it marks a deeper psychological pivot: investors are beginning to value tangible wealth over speculative paper promises.It’s still early — but these asset rotations are measured in years , not weeks, and we’re only just witnessing the first act.

View attachment 15086

We are now receiving increasing reports from across the globe — bullion dealers, refineries, and mints are turning clients away amid unprecedented demand and rapidly vanishing physical supply .The coming weeks are set to be decisive. The ongoing collapse in silver lease contracts , combined with panic buying from industrial users and investors finally waking from their long coma induced slumber , is creating the conditions for severe product shortages ahead. The repercussions will be felt across the entire supply chain.At the same time, the Silver-to-S&P 500 ratio is flashing a powerful signal as I have updated many times over the years — the early phase of a major cycle shift , where silver begins to outperform U.S. equities. This is the hallmark of a Fourth Turning moment in global markets.While many investors remain conditioned to expect the opposite, this ratio tells a different story — one of capital quietly rotating into hard assets . When silver starts outperforming equities, it marks a deeper psychological pivot: investors are beginning to value tangible wealth over speculative paper promises.It’s still early — but these asset rotations are measured in years , not weeks, and we’re only just witnessing the first act.

Telegram Web

Telegram is a cloud-based mobile and desktop messaging app with a focus on security and speed.web.telegram.org

Yeah, take a bit of heat out of the engine driving thisThe pullback was very healthy. It was the pullback we had to have!