Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

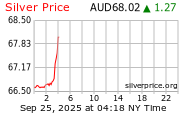

Silver Price Watch

- Thread starter STKR

- Start date

pmbug said:The silver FOMO bull will overrun the paper exchanges.

Global free float vault stock at the beginning of September was around 19,702.296 metric tons (see link below for details). There are indications that not all of that is liquid either (see second citation below).

Let's be conservative and assume that it is all liquid. Let's even round up to an even 20,000 metric tons to be super conservative with our math.

20,000 metric tons is 643,014,900 troy ounces. Let's assume an average cost of $60/ozt as buyers rotate capital from money market funds and other liquid investments into silver as FOMO takes hold.

In that scenario, 20k tons represents $38,580,894,000. Let's call it $38.6B. That represents just 0.193% of the $20T that is purportedly currently available capital (see third citation below). That's all it would take to wipe out every troy ounce of silver that is currently available in the world's major exchange vaults (LBMA, COMEX and SGE/SFE).

The silversqueeze is going to be epic.

This is the latest report that I could find on SILVER Short positions.

That's a lot of shorts that might be having visions of an approaching " Apocalypse "

COMEX Silver Combined Managed Money Short Positions (I:COMEXSNW)

14875.00 for Wk of Sep 16 2025That's a lot of shorts that might be having visions of an approaching " Apocalypse "

This is the latest report that I could find on SILVER Short positions.

COMEX Silver Combined Managed Money Short Positions (I:COMEXSNW)

14875.00 for Wk of Sep 16 2025

That's a lot of shorts that might be having visions of an approaching " Apocalypse "

There's speculation that the commercial banks' ongoing short positions are on behalf of "clients". Some believe a client is the US government. If the intention is to maintain faith in the system, it would be a small price to pay to keep eyes off silver. Nobody with half a brain would maintain long-term short positions for the second most useful commodity on the planet, with declining ore grades and multi-year deficit.

There was a time on Silver Stackers where a good portion of active members hated silver and convinced themselves it would never be anything more than a stagnant commodity. I hope they're enjoying the ride.

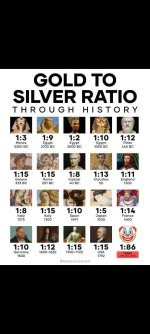

I took advantage of the induced Insanity of GSR 105:1

I swapped 3oz of Gold for 300oz of Silver ( 300 x Silver rounds )

When the GSR mean reverts ( mean revision does work if u give it enough time ) to 42:1, the Historical average ( last 120 yrs I believe ) I will take just 150oz of Silver & swap back for my 3oz of Gold

I will then have my 3oz of Gold & 150oz of Silver that will be worth a lot more than when I made the initial swap ( at the time of the swap the price of 1oz of Silver was AUD $56.56/oz including Premium )

I just saw that. Nice surge a moment ago. Blink and we're rounding another $$SILVER is on a run Again

Hi Ho Silver