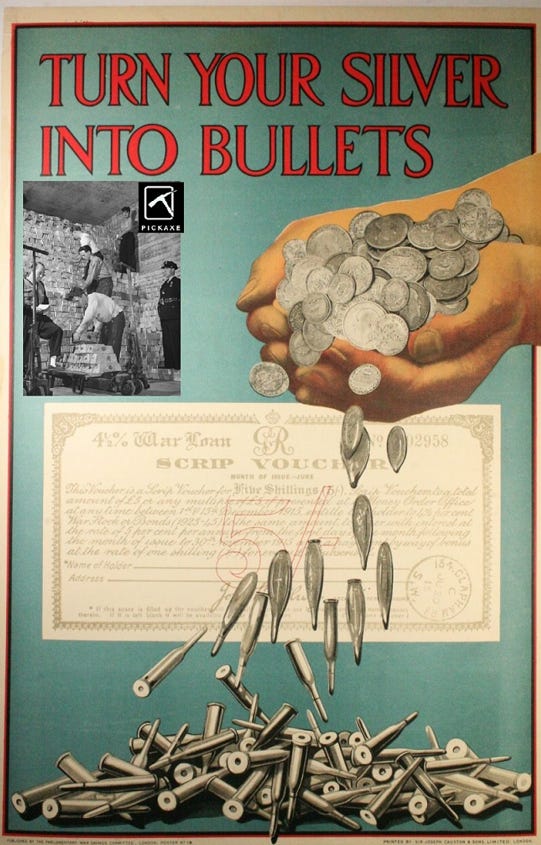

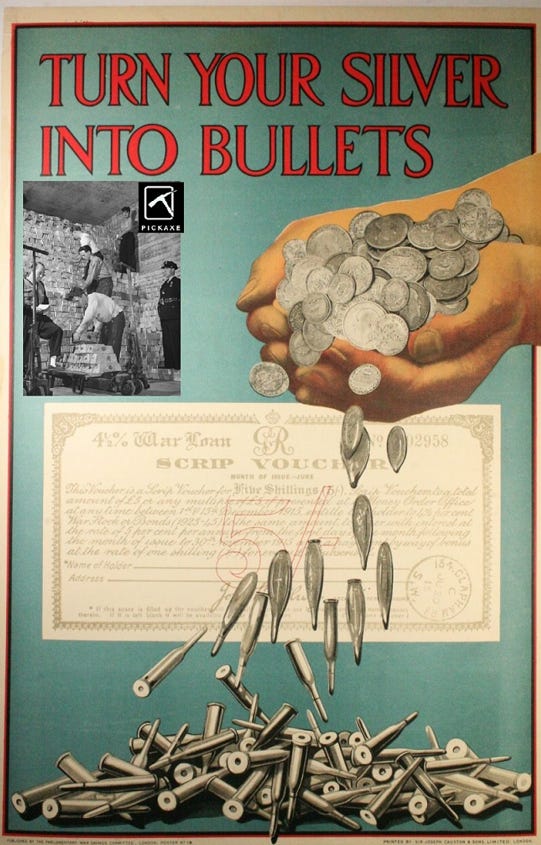

I was watching this interview and it got me thinking about Silvers necessity for a green energy future. There aren't any Silver confiscation laws in place in Australia (unlike Gold) but that could change in a moment. A real silver shortage is quite threatening to stackers IMO because of how critical it is to the green agenda and military industrial complex. There's probably 4-5 Billion Oz's in Bullion form that the system will eventually come after. The easiest way to access this "available" silver is to make private ownership illegal and commence some sort of buy-back scheme.

I must admit, I was quite naive in my assessment of silver. I never considered this when I took a deep dive into evaluating Silver's potential all those years ago. I saw the military uses for silver and the green energy agenda as benefits only, and barely considered how that could threaten the goals I have for stacking long-term.

I think, and it's going to be difficult to time it perfectly, that we will be presented with a short window of opportunity to maximise our wealth and transfer it into another form of value. If silver really took off and gained mainstream attention, that Influx of demand alone could shock the world completely. At least enough to pose a threat to stackers around the world as silver becomes classed as a metal of significance for all nations and a potential confiscation-like regime follows suit.

This is the interview with Bix Weir and Andy Schectman:

This is the article Andy was referring to when discussing Military uses for silver:

silverseek.com

silverseek.com

I must admit, I was quite naive in my assessment of silver. I never considered this when I took a deep dive into evaluating Silver's potential all those years ago. I saw the military uses for silver and the green energy agenda as benefits only, and barely considered how that could threaten the goals I have for stacking long-term.

I think, and it's going to be difficult to time it perfectly, that we will be presented with a short window of opportunity to maximise our wealth and transfer it into another form of value. If silver really took off and gained mainstream attention, that Influx of demand alone could shock the world completely. At least enough to pose a threat to stackers around the world as silver becomes classed as a metal of significance for all nations and a potential confiscation-like regime follows suit.

This is the interview with Bix Weir and Andy Schectman:

This is the article Andy was referring to when discussing Military uses for silver:

Military Heist Foiled: Authorities Recover Stolen Silver and Arrest Suspects...

US silver stockpile was raided by the Defense Department. Banks and defense contractors were accused of suppressing silver prices.