Is now a good time to get bullish on platinum?

I’ve written a lot about the fact that silver appears to be underpriced given both technical factors and the supply and demand dynamics.

Platinum may be even more undervalued.

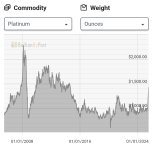

The current platinum price is hovering around $1,000 an ounce. To put that into perspective, platinum hit an all-time high of $2,213 an ounce in March 2008. This was higher than the record price gold hit in 2011.

One of the factors driving that 2008 record was a severe supply shortage due to a power crisis and labor strikes in South Africa, the world’s leading platinum producer.

Before 2011, platinum was generally more expensive than gold. In 2015, this historical trend reversed with the spread between gold and platinum growing wider.

But over the last two years, platinum has shown signs of life. In 2023, the platinum price was up a healthy 12.5 percent. So far this year, the metal has charted modest gains of about 3.8 percent.

Platinum has a long way to go to regain its historic parity with gold, but supply and demand dynamics indicate there is plenty of room for platinum to push higher.

Like silver, we’re seeing significant supply deficits in the platinum market. In 2023, there was a market deficit of over 100 million ounces, according to the World Platinum Investment Council. This was due to a combination of increasing demand and lagging mine output.

The supply shortfall continued into the first quarter of 2024.

According to the WPIC, total platinum supply in Q1 was the second lowest since the organization started tracking data.

As a result, the market deficit in Q1 came in at 369,000 ounces.

Platinum is an important component in automobile catalytic converters. Auto demand for the metal hit a 7-year high in Q1 and that pace is expected to continue through the rest of the year.

A rotation from electric vehicles to hybrids is boosting demand for platinum in the auto sector, according to the WPIC.

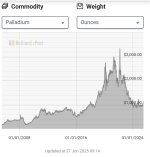

“Platinum demand is bolstered by stricter emissions legislation, increased hybrid vehicles that contain an internal combustion engine, and growth in the substitution of platinum for palladium. It is important to note that once platinum is substituted for palladium in specific vehicle platforms, this demand for platinum is likely to remain constant throughout the platform's seven-year lifecycle, even if platinum prices rise to, or exceed, those of palladium for an extended period.”

Platinum jewelry demand also saw a healthy increase in the first quarter, rising by 5 percent year-on-year, driven by a 53 percent increase in Indian jewelry buying.

Overall industrial demand fell slightly from a record in 2023 but remained 17 percent above the pre-COVID average.

Investment demand is also on a positive track upward this year, supported by coin and bar purchases in China.

According to the WPIC, China's retail investment in platinum is forecast to exhibit double-digit growth this year, driven by perceptions of the metal being undervalued relative to gold.

There is also a growing demand for platinum in the fast-growing hydrogen power sector.

“We are now seeing signs that platinum’s role in the hydrogen economy is gaining momentum, with our forecast for 2024 indicating a significant increase in demand to meaningful levels. This year will also witness the allocation and deployment of over US$300 billion in tax incentives and subsidies from various governments around the world, potentially further accelerating hydrogen's demand for platinum,” WPIC CEO Trevor Raymond said.

Looking ahead, the WPIC projects supply will remain flat even with the weak levels seen last year. Mine supply is expected to fall by about 3 percent offset somewhat by a rebound in recycling. But with demand expected to come in at a “robust” 7.6 million ounces, the WPIC projects a 476,000-ounce market deficit.

“For the second consecutive year, the platinum market will post a meaningful deficit underscored by platinum's sustained demand and supply vulnerability amidst global economic challenges. While we currently forecast a deficit of 476 koz, it is worth mentioning that a revision to the bar and coin investment series, based on new field research and information, could mean this deficit is potentially deeper,” Raymond said.

Above-ground stocks are forecast to decline for the second straight year, falling another 12 percent. This would mark a 4-year low in above-ground platinum supply.

Meanwhile, China is set to launch its first platinum futures contracts.

According to the South China Morning Post, the Guangzhou Futures Exchange (GFEX) “will be the first exchange to allow delivery against its contracts of platinum and palladium in a form used by the main consumers, including carmakers and other industrial sectors, and the contracts may also support platinum investment demand in China.”

According to the report, investors will be able to take delivery of platinum in both ingots and “sponge” – pure metal in powder form.

“The ability to take delivery of sponge could be transformative for industrial users of PGMs, as well as carmakers, as this is the main form typically used for their manufacturing purposes,” the WPIC said.

According to a WPIC statement, the GFEX futures will allow platinum jewelry and investment product fabricators to hedge price risk. This could reduce premiums and reduce the discount on platinum buyback, making platinum a more attractive investment.

It remains to be seen whether platinum will regain the price parity with gold we saw before the mid-2010s, but given the supply and demand dynamics, it is reasonable to be bullish on platinum in the near to mid-term. Given the price disparity with gold, this may signal a buying opportunity.

Mike Maharrey

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.

Source: https://www.moneymetals.com/news/2024/07/09/is-it-time-to-get-bullish-on-platinum-003305

I’ve written a lot about the fact that silver appears to be underpriced given both technical factors and the supply and demand dynamics.

Platinum may be even more undervalued.

The current platinum price is hovering around $1,000 an ounce. To put that into perspective, platinum hit an all-time high of $2,213 an ounce in March 2008. This was higher than the record price gold hit in 2011.

One of the factors driving that 2008 record was a severe supply shortage due to a power crisis and labor strikes in South Africa, the world’s leading platinum producer.

Before 2011, platinum was generally more expensive than gold. In 2015, this historical trend reversed with the spread between gold and platinum growing wider.

But over the last two years, platinum has shown signs of life. In 2023, the platinum price was up a healthy 12.5 percent. So far this year, the metal has charted modest gains of about 3.8 percent.

Platinum has a long way to go to regain its historic parity with gold, but supply and demand dynamics indicate there is plenty of room for platinum to push higher.

Like silver, we’re seeing significant supply deficits in the platinum market. In 2023, there was a market deficit of over 100 million ounces, according to the World Platinum Investment Council. This was due to a combination of increasing demand and lagging mine output.

The supply shortfall continued into the first quarter of 2024.

According to the WPIC, total platinum supply in Q1 was the second lowest since the organization started tracking data.

As a result, the market deficit in Q1 came in at 369,000 ounces.

Platinum is an important component in automobile catalytic converters. Auto demand for the metal hit a 7-year high in Q1 and that pace is expected to continue through the rest of the year.

A rotation from electric vehicles to hybrids is boosting demand for platinum in the auto sector, according to the WPIC.

“Platinum demand is bolstered by stricter emissions legislation, increased hybrid vehicles that contain an internal combustion engine, and growth in the substitution of platinum for palladium. It is important to note that once platinum is substituted for palladium in specific vehicle platforms, this demand for platinum is likely to remain constant throughout the platform's seven-year lifecycle, even if platinum prices rise to, or exceed, those of palladium for an extended period.”

Platinum jewelry demand also saw a healthy increase in the first quarter, rising by 5 percent year-on-year, driven by a 53 percent increase in Indian jewelry buying.

Overall industrial demand fell slightly from a record in 2023 but remained 17 percent above the pre-COVID average.

Investment demand is also on a positive track upward this year, supported by coin and bar purchases in China.

According to the WPIC, China's retail investment in platinum is forecast to exhibit double-digit growth this year, driven by perceptions of the metal being undervalued relative to gold.

There is also a growing demand for platinum in the fast-growing hydrogen power sector.

“We are now seeing signs that platinum’s role in the hydrogen economy is gaining momentum, with our forecast for 2024 indicating a significant increase in demand to meaningful levels. This year will also witness the allocation and deployment of over US$300 billion in tax incentives and subsidies from various governments around the world, potentially further accelerating hydrogen's demand for platinum,” WPIC CEO Trevor Raymond said.

Looking ahead, the WPIC projects supply will remain flat even with the weak levels seen last year. Mine supply is expected to fall by about 3 percent offset somewhat by a rebound in recycling. But with demand expected to come in at a “robust” 7.6 million ounces, the WPIC projects a 476,000-ounce market deficit.

“For the second consecutive year, the platinum market will post a meaningful deficit underscored by platinum's sustained demand and supply vulnerability amidst global economic challenges. While we currently forecast a deficit of 476 koz, it is worth mentioning that a revision to the bar and coin investment series, based on new field research and information, could mean this deficit is potentially deeper,” Raymond said.

Above-ground stocks are forecast to decline for the second straight year, falling another 12 percent. This would mark a 4-year low in above-ground platinum supply.

Meanwhile, China is set to launch its first platinum futures contracts.

According to the South China Morning Post, the Guangzhou Futures Exchange (GFEX) “will be the first exchange to allow delivery against its contracts of platinum and palladium in a form used by the main consumers, including carmakers and other industrial sectors, and the contracts may also support platinum investment demand in China.”

According to the report, investors will be able to take delivery of platinum in both ingots and “sponge” – pure metal in powder form.

“The ability to take delivery of sponge could be transformative for industrial users of PGMs, as well as carmakers, as this is the main form typically used for their manufacturing purposes,” the WPIC said.

According to a WPIC statement, the GFEX futures will allow platinum jewelry and investment product fabricators to hedge price risk. This could reduce premiums and reduce the discount on platinum buyback, making platinum a more attractive investment.

It remains to be seen whether platinum will regain the price parity with gold we saw before the mid-2010s, but given the supply and demand dynamics, it is reasonable to be bullish on platinum in the near to mid-term. Given the price disparity with gold, this may signal a buying opportunity.

Mike Maharrey

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.

Source: https://www.moneymetals.com/news/2024/07/09/is-it-time-to-get-bullish-on-platinum-003305