Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

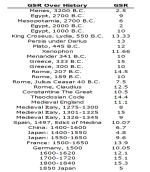

Historical Gold to Silver Ratio

- Thread starter Administrator

- Start date

I personally have given up on silver, it’s an industrial metal and as such needs the economy to be good for its consumption and price to appreciate. Uncertainty in years ahead will see a flight to safety to gold rather than silver. Yes silver will go up because of gold’s move higher but gold will still outperform silver.

But for all the silver heavy stackers I hope for your sake silver gains on gold

But for all the silver heavy stackers I hope for your sake silver gains on gold

If we mine it out of the ground at 7:1 and scrap metal refining is never be enough to offset the discrepancy between mine supply and overall demand, then it's just a waiting game for aboveground stockpiles to deplete before we see 12:1 or lower.I can't see it ever going below 30:1. But I hope I'm wrong.

Silver has some of the best supply and demand fundamentals of any other asset or commodity, coming second only to oil as far as I'm concerned. The biggest challenge when analysing silvers supply is the unknown stockpiles available to continuously meet market demand. We have incredible deficits of 200+ Mozs, which will become a serious feature to the market once these undisclosed stockpiles are depleted. Until that happens, silver could go to 200:1 in these controlled markets.

I personally have given up on silver, it’s an industrial metal and as such needs the economy to be good for its consumption and price to appreciate. Uncertainty in years ahead will see a flight to safety to gold rather than silver. Yes silver will go up because of gold’s move higher but gold will still outperform silver.

But for all the silver heavy stackers I hope for your sake silver gains on gold

I have absolutely no doubt silver is the real winner in the long-term. I have a 20-30 year outlook though and poor performance over the decades doesn't concern me one bit. I wouldn't even come near precious metals if it were purely just for investment over a 2-5 year period.

It's my view that silvers industrial application is what makes it such a good buy. Sure, it has economic dependency for continuous growth but it has so many uses that It's not like palladium or platinum where demand is dominated by one industry.

You may have a 20-30 yr timeframe, it’s been 40ish years since the 1980s top while gold has already blown past its all time highI have absolutely no doubt silver is the real winner in the long-term. I have a 20-30 year outlook though and poor performance over the decades doesn't concern me one bit. I wouldn't even come near precious metals if it were purely just for investment over a 2-5 year period.

It's my view that silvers industrial application is what makes it such a good buy. Sure, it has economic dependency for continuous growth but it has so many uses that It's not like palladium or platinum where demand is dominated by one industry.

Inflation adjusted, even if silver hits the nominal ~$50/oz price you’re still behind when compared to the 1980s top, when accounting for inflation (and even worse when accounting for “actual” inflation and not “official” CPI inflation)

if inflations remain high, it is very hard for low pay workers to catch up in the next 6 years

gold is not affordable for most workers, if we consider saving an ounce a month or bi-montly.

GSR has long waves, so for the next bottom, when the ratio is lower (30)

now gold at 3,556 aud, by year end it can be 4,000+ etc, there is just not enuff time for new buyers,

hard working salary man to catch up it a hurry.

may be it is just easier to get the silver first, then give them up for gold.

gold is not affordable for most workers, if we consider saving an ounce a month or bi-montly.

GSR has long waves, so for the next bottom, when the ratio is lower (30)

now gold at 3,556 aud, by year end it can be 4,000+ etc, there is just not enuff time for new buyers,

hard working salary man to catch up it a hurry.

may be it is just easier to get the silver first, then give them up for gold.

You may have a 20-30 yr timeframe, it’s been 40ish years since the 1980s top while gold has already blown past its all time high

Inflation adjusted, even if silver hits the nominal ~$50/oz price you’re still behind when compared to the 1980s top, when accounting for inflation (and even worse when accounting for “actual” inflation and not “official” CPI inflation)

I find it unhelpful to assess silvers future by looking into the past. Silver can stand on it's own

But 1980 wasn't a typical moment in history. It was a time where the majority of the population still understood silver and gold to be money. People were acutely aware of the gold standard and that it was recently abandoned. Inflation fears saw a run to precious metals during that time and subsequently a rise in the price of all metals.

1980 only reveals to me what happens when enough people rush into metals from fear. 1980 wasn't even an economic crisis or collapse event... It was a fear and greed sandwich. Silver today is closer to facing a real physical shortage, and we've never been close to that throughout this monetary experiment. Supply and demand is the only thing that matters at this point. The case for silver has never been this strong in that regard.

everyday people buying an ounce here or there of silver aint gonna move the dial much, central banks buying gold hand over fist has a much larger impact on the price of gold, and this is another reason why I believe gold is still outperforming silverif inflations remain high, it is very hard for low pay workers to catch up in the next 6 years

gold is not affordable for most workers, if we consider saving an ounce a month or bi-montly.

GSR has long waves, so for the next bottom, when the ratio is lower (30)

now gold at 3,556 aud, by year end it can be 4,000+ etc, there is just not enuff time for new buyers,

hard working salary man to catch up it a hurry.

may be it is just easier to get the silver first, then give them up for gold.

While I agree past performance does not predict future price movements, however, I've been stacking since 2011, both gold and silver, and up until a few years in, was stacking both. since then I've only stacked gold. The whole time since 2011 when I began, GSR has been on an ever onward and upward march.I find it unhelpful to assess silvers future by looking into the past. Silver can stand on it's own

But 1980 wasn't a typical moment in history. It was a time where the majority of the population still understood silver and gold to be money. People were acutely aware of the gold standard and that it was recently abandoned. Inflation fears saw a run to precious metals during that time and subsequently a rise in the price of all metals.

1980 only reveals to me what happens when enough people rush into metals from fear. 1980 wasn't even an economic crisis or collapse event... It was a fear and greed sandwich. Silver today is closer to facing a real physical shortage, and we've never been close to that throughout this monetary experiment. Supply and demand is the only thing that matters at this point. The case for silver has never been this strong in that regard.

The spike in GSR was in Mar 2020, we all know what happened there. In times of crisis, gold > silver. What followed after Mar 2020 was massive monetary stimulus, and hence GSR began to drop until it bottomed in Feb 2021 and has been steadily increasing since.

The same arguments for why silver will outperform gold has been laid out for years. There have been heaps of such arguments, ranging from plausible to nonsensical, e.g. solar panel demand, poor man's gold, industrial use, a monster box worth of silver in each missile, silver gets used up and will eventually run out, etc, you name it, I've read about and heard them all - all have yet to produce the reversion to the lower GSR that have been called for, e.g. 7:1, 12:1, 30:1, etc. The last time GSR visited the 30s was in 2011 and it's been higher ever since.

Gold Silver Ratio| GoldSilver.com

Gold Silver Ratio charts with real time updates to give you the most accurate information. Explore historical Gold Silver Ratio information.

Yes, I've heard them all too. I don't care much for speculative nonsense, and supply and demand are the only thing that matters at the end of the day.

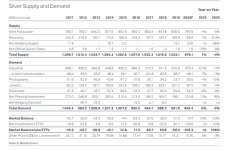

Almost everyone has failed to factor in aboveground stockpiles. You can see in the silver surveys that 'Government Sales' were listed up until 2014. Everytime there was a deficit, government sales would sweep in and fill the gap.

One thing I'm certain about is when the silver reserves dry up and the world solely depends on mine supply and scrap metal refining to supply the market, there will be nothing standing in the way of silver. The big question is: How much is left?

Almost everyone has failed to factor in aboveground stockpiles. You can see in the silver surveys that 'Government Sales' were listed up until 2014. Everytime there was a deficit, government sales would sweep in and fill the gap.

One thing I'm certain about is when the silver reserves dry up and the world solely depends on mine supply and scrap metal refining to supply the market, there will be nothing standing in the way of silver. The big question is: How much is left?

I think Silver has almost completely lost its role as a monetary metal - which it has enjoyed since the dawn of recorded history. That's why the GSR is so high in the modern fiat currency era. With almost all of its demand coming from industrial uses now I think a more useful ratio would be to look at the Copper : Silver ratio. Got a sexy chart for that one?

I think Silver has almost completely lost its role as a monetary metal - which it has enjoyed since the dawn of recorded history. That's why the GSR is so high in the modern fiat currency era. With almost all of its demand coming from industrial uses now I think a more useful ratio would be to look at the Copper : Silver ratio. Got a sexy chart for that one?

Only because in the 60's all the silver reserved for coinage was stockpiled. If you look at the silver surveys, silver's had a rough time supplying the market on mining output and scrap metal alone. If it weren't for these stockpiles and the clear intent to utilise them whenever a deficit occurs, silver would be hundreds of $$ per oz. The use of these stockpiles is the clearest example of market manipulation and price suppression around. It reveals to us there's a reason they don't want the price of Silver to let go. We can only speculate as to why but maybe it's because they don't want silver to be seen as a monetary metal? Maybe it represents financial freedom to the common man and undermines the fiat system?

I've spoken about this so many times I sound like a broken record, but there's a clear example of the intention to use aboveground stockpiles to suppress the price of Silver in the remarks made by President Johnson when signing the 1965 coinage act:

"If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content."

Remarks at the Signing of the Coinage Act | The American Presidency Project

And what we've seen in the almost 60 years since is market intervention by the US Government.

I've heard there was an estimated 10 Billion Oz's of available aboveground silver in the 60's. There was certainly enough silver that was no longer held by the military in strategic reserves. In fact, that's how the silver eagle program came about; to make use of the military's strategic silver reserves.

Once the aboveground stockpiles run out, everyone in the 1st world will know about silver and the global shortage that follows. We will consider ourselves fools for trading silver for gold at a ratio of 10:1. The world needs silver. Gold could disappear tomorrow and the economic cogs would keep moving along without a care. Take silver away and everything comes to a halt while innovation tries to catch up to replace it. Easier said than done.

The fact that silver is so unloved by even the most experienced stackers is one reason why I think it's the best thing our failing fiat currency can buy. But people need to be realistic and understand how long this silver can has been kicked, and how long it can continue to be kicked.

That's not what I see alor, I see a steady rise through a parallel channel, we're bouncing around near the bottom of the range, plenty of upside potentially, even if only to the midrange of the channel, you're looking at GSR of around 110+

Unless it breaks below the bottom of the channel, in which case I'd reconsider my view.

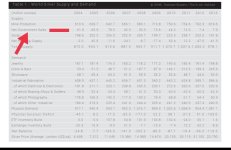

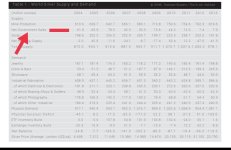

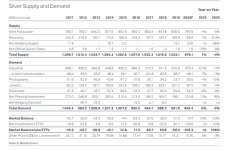

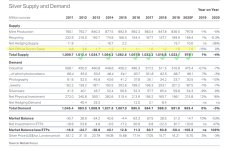

From what I can see, Net Official Sector Sales since 2011 only makes up less than 1% of total supply (e.g. 2011, 4.8/1009.7 = 0.475%, and in 7 out of 9 years in this table Total Supply was greater than Total Demand. From these numbers, I'm not seeing how there is a significant amount of government stockpile sales of silver.Yes, I've heard them all too. I don't care much for speculative nonsense, and supply and demand are the only thing that matters at the end of the day.

Almost everyone has failed to factor in aboveground stockpiles. You can see in the silver surveys that 'Government Sales' were listed up until 2014. Everytime there was a deficit, government sales would sweep in and fill the gap.

View attachment 12055

View attachment 12056

View attachment 12057

One thing I'm certain about is when the silver reserves dry up and the world solely depends on mine supply and scrap metal refining to supply the market, there will be nothing standing in the way of silver. The big question is: How much is left?

Green ticks means supply > demand for that year, even when omitting official sector sales (meaning mining and recycling more than covers total demand)

ETPs being exchange traded products, is paper market play money silver, which I've ignored.

From what I can see, Net Official Sector Sales since 2011 only makes up less than 1% of total supply (e.g. 2011, 4.8/1009.7 = 0.475%, and in 7 out of 9 years in this table Total Supply was greater than Total Demand. From these numbers, I'm not seeing how there is a significant amount of government stockpile sales of silver.

Green ticks means supply > demand for that year, even when omitting official sector sales (meaning mining and recycling more than covers total demand)

ETPs being exchange traded products, is paper market play money silver, which I've ignored.

View attachment 12062

You're looking at 2020 charts that don't have government sales listed. I only attached that survey to show that government sales had been removed. Prior to 2015, it was common for government sales to be up to 10% and sometimes 15% of supply for some years. Between 2000-2006 government sales accounted for over 470 Million Oz's of supply!

Look at total supply and total demand numbers during that period. They're identical. Net government sales swoop in and deliver the exact volume of silver needed to meet demand. Talk about market intervention!

Last edited: