Can't drive a silver bar on the beach or go camping on a sovereignThe mighty Triton. But a bit of a backwards step into a guaranteed depreciating asset.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

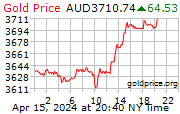

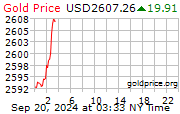

$̴3̴2̴0̴0̴ $̴3̴50̴0̴ $3̴90̴0̴ $400̴0̴ $410̴0̴ $4200 Gold!

- Thread starter ozcopper

- Start date

I hear ya. I love my triton and think they're the most underrated 4x4 out there. Life is definitely there to be lived and I've made a lot of sacrifices to preserve my stack at the expense of a more comfortable and fulfilling lifestyle.

To be honest... I have a fear of letting go. I've never been capable of saving long-term and metals became a vessel for me to do that. Each time I sell it's like I'm giving up a part of myself that I became proud of through such accomplishments. This line of thinking, although borderline unhealthy, has been a valuable tool in suppressing my temptations to liquidate.

Our short existance is certainly here to be taken advantage of. Living for the future often lends itself to neglecting the now... Something I'm often shamefully guilty of doing.

To be honest... I have a fear of letting go. I've never been capable of saving long-term and metals became a vessel for me to do that. Each time I sell it's like I'm giving up a part of myself that I became proud of through such accomplishments. This line of thinking, although borderline unhealthy, has been a valuable tool in suppressing my temptations to liquidate.

Our short existance is certainly here to be taken advantage of. Living for the future often lends itself to neglecting the now... Something I'm often shamefully guilty of doing.

I've made a lot of sacrifices to preserve my stack at the expense of a more comfortable and fulfilling lifestyle.

I'm just a hoarder.

You've got to love the smack downs! ...

I'm guessing that China and India will be very appreciative of cheap metals in the West. Quite a difference between spot and SGE closing prices right now.

That control is slipping through their fingers. I also feel that the "slap down " is not really an issue when the price is so much higher at closing than opening days earlierBrics don't need the west's futile control over metals. Let the US shatter. Texas will be the first to exit

Kinda evens out?

No, look at the maths. The two power houses India and China are consuming combined 1.658 tones I'm assuming per domestic supply for 2023. The rest of the countries given on the graph only equate to 623 tones equivalent consumed. How can that kinda evens out?