Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

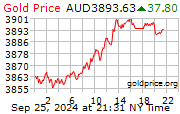

$̴3̴2̴0̴0̴ $̴3̴50̴0̴ $3̴90̴0̴ $400̴0̴ $410̴0̴ $4200 Gold!

- Thread starter ozcopper

- Start date

Cheapest ABC cast 1/2 oz is now just over 2k..... I bought one in earlier this year for just under $1600.

bullionstore.com.au

bullionstore.com.au

ABC Bullion 1/2 oz Gold Cast Bar Button

The 12 oz. abc bullion gold bar. cast bar is one of the most premium investment products for professional purchasers and private investors around the world.

bullionstore.com.au

bullionstore.com.au

We gave $3900 a quick kiss when the AUD/USD dumped briefly.

Gold is certainly taking the stage at the moment. It's reached the point where the liquidity of 1oz or more has taken a significant hit in the private market based on the price rises alone. I mainly gobbled up 1/10 Oz coins when I could get them close to spot or at a slight premium for this reason.

It's definitely the age of PM's right now and I don't think we've seen anything yet.

Gold is certainly taking the stage at the moment. It's reached the point where the liquidity of 1oz or more has taken a significant hit in the private market based on the price rises alone. I mainly gobbled up 1/10 Oz coins when I could get them close to spot or at a slight premium for this reason.

It's definitely the age of PM's right now and I don't think we've seen anything yet.

I remember the $250 an Oz Gold days. Gold has proven to be one of the best investments to date, and one of the few options with no counterparty risk. I bet if you told someone back in the $250 days that gold will reach $4000, it would be just as unfathomable as the claims today that gold will hit $70,000 in the coming decades.

Long live Gold!

Long live Gold!

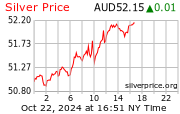

Because I'm so silver heavy, I sometimes forget I have Gold. But when you add it up at $4000 an Oz, it's a crazy amount of $$ to have in such a small package.

I bought silver because I saw more potential, and I liked the fractional liquidity options more than gold. But most of my purchases of Bullion were at the very bottom of the market in 2018,19 and 2020. The increase in both metals would be around the same from a ratio standpoint, so it's worked out pretty well.

Historically, we've seen Silver piggyback off Gold's surges but this time it's been lagging. I wonder if Gold will get a surge from Silver when silver takes off?

I bought silver because I saw more potential, and I liked the fractional liquidity options more than gold. But most of my purchases of Bullion were at the very bottom of the market in 2018,19 and 2020. The increase in both metals would be around the same from a ratio standpoint, so it's worked out pretty well.

Historically, we've seen Silver piggyback off Gold's surges but this time it's been lagging. I wonder if Gold will get a surge from Silver when silver takes off?

Don't remind me about $250 gold. I actually worked in some gold mines in the eighties and nineties when AU$400 an Oz was the price to make some mines financially viable.

My ancient aunty around 60 at the time used to talk about gold being real money and that I should buy some. I remember telling her that gold was just another commodity metal, because that was what I was reading. I am still ashamed about that.

My ancient aunty around 60 at the time used to talk about gold being real money and that I should buy some. I remember telling her that gold was just another commodity metal, because that was what I was reading. I am still ashamed about that.

Silver crashed back twice around the $20aud mark in the past 12 years or so while gold had a couple of correction but it only knows one way and that is up. I expect silver to crash again-you heard it here 1st

Silver crashed back twice around the $20aud mark in the past 12 years or so while gold had a couple of correction but it only knows one way and that is up. I expect silver to crash again-you heard it here 1st

Crash through the roof on it's way to the moon

better to know the background, its not likely for most people to be buying at the bottom, that bottom belongs to Mr Brown, who was a SELLERI remember the $250 an Oz Gold days. Gold has proven to be one of the best investments to date, and one of the few options with no counterparty risk. I bet if you told someone back in the $250 days that gold will reach $4000, it would be just as unfathomable as the claims today that gold will hit $70,000 in the coming decades.

Long live Gold!

why are people not buying at that time when price was $250, looking back...most people who own gold before that, they were in a 20 years of BEAR market.

so everyone you can ask about gold, they are bad investment, it is holding at a LOSS

looking back, gold peak out around 1980's at $850, interest rate was raised to 20.5%

what cased the gold run was the temporary suspension of dollar convertibility to gold in 1971

back to 2000, gold was still looked down...remember that bond still paying good yield and were in HOLD TO MATURITY basket

only in 2005, we are at 450, almost double and getting notice, the trend turn is confirmed and moving up to 2011 first all time high

if you buy at 850 for the right reason and holding to now, still in the money

if you bought it for 100 even after the first 3x, good money

if you bought it after 1000, now 2.5x, good money

gold only went to 1050 after the 2011 peak, most people would believe gold was in a bear market...until now the bear was wrong again

gold is in direct competition with the green back, after the Russian 300+billion got stolen, the trust in the dollar was completely lost

many governments will let their bonds converted to treasuries and let them matured and converted to GOLD, there is no need to sell their USD BONDs anymore lol, they just buy more gold

these buying keep the gold demand strong and keep the poor guys chance to buy the low impossible

think you missed the launch unless you are in the wild4032 as i poo...

Gold is BOOMING$4200 by saturday morning