I think it's about time we see $80 silver. Mexico is currently the top producer but many of their mines are set to go offline due to depletion over the next few years. We will inevitably see a decrease in mine supply, and with the introduction of Samsung's solid-state batteries, along with a continued increase in demand for solar panels, we should see a significant widening of the deficit - likely to the tune of 300+ Million Oz's.

Heres some cool figures for investment demand:

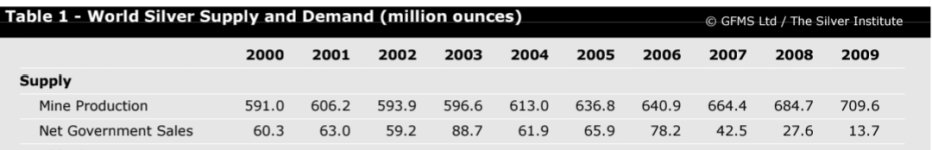

Between 2000-2005 - total investment demand was a meager 170 Million Oz's. The biggest year was in 2005 at 42 Million Oz's.

Between 2019-2024 - total investment demand was a whopping 1.26 Billion ozs. The biggest year was in 2022 at 338 Million Oz's (almost 2x the investment of 2000-2005 combined in one year and 40% of mine supply going to just minting coins and bars!).

The 2008-2011 bull run was the beginning of silver becoming more recognised by the people of the world, and it has remained at a steady average of 200+ Mozs a year.

Although silver has seen a nice flow of investment demand since 2008, investment demand was extremely low all the years prior. Some years only saw 15-20 million Oz's, and anything over 40 million Oz's was extremely uncommon.

The moment silver begins it's next journey to $50 and beyond, the increase in investment demand could easily exceed 400 Mozs, which will further exacerbate the deficit and put considerable stress on the physical market. We will likely see parabolic moves in silver that will surprise us all.