WHY OWN SILVER THIS DECADE?

[youtube]https://www.youtube.com/watch?v=jEtjVcqL2Bs&ab_channel=SDBullion[/youtube]

Silver bullion currently offers an asymmetric bet, a proven store of value with a limited downside yet very high potential upside valuation gains to come.

Full disclosure: we both privately buy and save silver bullion ourselves for the long term while also creating one of the United States' largest online silver bullion dealerships.

We have securely delivered silver bullion to hundreds of thousands of customers' doors and to their fully insured non-bank bullion depository accounts for nearly ten years.

Be it for private wealth preservation or an Individual Retirement Account, we are about to quickly cover some key reasons to own silver bullion this decade.

#1 Silver is Still A Store of Value Money

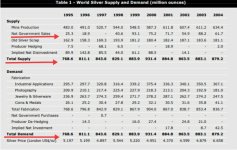

#2 Silver is Historically Cheap

#3 Increasing Industrial Applications for Silver Demand

#4 Silver is Critical in Technology and to Foster a Cleaner Environment

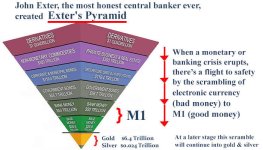

#5 Government Central Banks will Inflate Fiat Currencies Away

#6 Bubbles in Nearly Every Asset Class

#7 Silver Has Been Systematically Value Suppressed

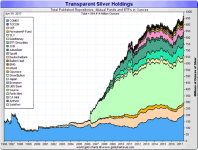

#8 Increasingly Silver is Being Bought as an Investment

#9 Fear of Loss Will Stampede Away All-Time Greed

#10 Silver Bullion offers Peace of Mind

It's a backtested proven fact that throughout this entire fiat currency era, owning a prudent bullion position along with stocks and bonds has been a successful strategy: https://www.linkedin.com/pulse/10-gol...

WHAT is TAKES to Be a SILVER WHALE: https://youtu.be/gPkMl1TFLiU

[youtube]https://www.youtube.com/watch?v=jEtjVcqL2Bs&ab_channel=SDBullion[/youtube]

Silver bullion currently offers an asymmetric bet, a proven store of value with a limited downside yet very high potential upside valuation gains to come.

Full disclosure: we both privately buy and save silver bullion ourselves for the long term while also creating one of the United States' largest online silver bullion dealerships.

We have securely delivered silver bullion to hundreds of thousands of customers' doors and to their fully insured non-bank bullion depository accounts for nearly ten years.

Be it for private wealth preservation or an Individual Retirement Account, we are about to quickly cover some key reasons to own silver bullion this decade.

#1 Silver is Still A Store of Value Money

#2 Silver is Historically Cheap

#3 Increasing Industrial Applications for Silver Demand

#4 Silver is Critical in Technology and to Foster a Cleaner Environment

#5 Government Central Banks will Inflate Fiat Currencies Away

#6 Bubbles in Nearly Every Asset Class

#7 Silver Has Been Systematically Value Suppressed

#8 Increasingly Silver is Being Bought as an Investment

#9 Fear of Loss Will Stampede Away All-Time Greed

#10 Silver Bullion offers Peace of Mind

It's a backtested proven fact that throughout this entire fiat currency era, owning a prudent bullion position along with stocks and bonds has been a successful strategy: https://www.linkedin.com/pulse/10-gol...

WHAT is TAKES to Be a SILVER WHALE: https://youtu.be/gPkMl1TFLiU