While Short-Term Rates Flatline, Long-Term Ocean Freight Rates Are Soaring...

Shippers looking to lock-in long term contracts for ocean freight are in for some serious sticker shock this month, according to shipping data consultancy Xeneta.

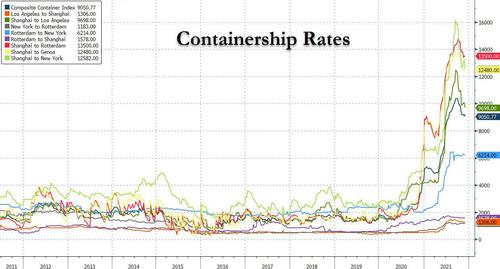

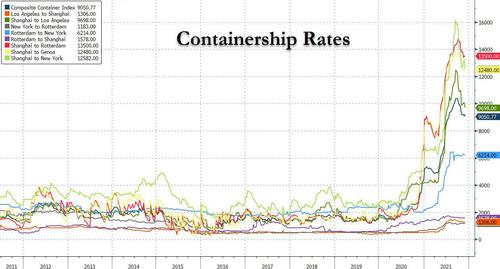

While some adherents to the now discredited "transitory" inflation camp point to the recent flatlining in short-term containership rates - or even decline in the case of core transpacific trades...

... long-term contract rates are still going up. According to Xeneta's statistics compiled by the Maritime Executive website, global average long-term contracted ocean freight rates went up by 16% in November alone, for a cumulative rise of 121% year-on-year. This follows after a record-setting increase of 28% in July, when all of the major shipping corridors saw significant long-term rate hikes.

"The continued perfect storm of high demand, maxed-out capacity, port congestion, changing consumer habits, and general supply chain disruption is fueling a rates explosion that, quite frankly, we?ve never seen the like of," said Patrik Berglund, the CEO of Xeneta. "What?s more, it?s difficult to see a change of course ahead, with the fundamentals stacked very much in favor of the carrier community. In short, they?ve never had it so good, while many shippers, unfortunately, are well and truly on the ropes."

The long-term rate hikes are most pronounced for routes to and from the United States. Xeneta calculated the increase for long-term import rates for the U.S. market at 39% for November, up 122 percent year-on-year. U.S. export rates also rose 9% for the month.

The soaring rates are driving tremendous profitability at the top container lines, many of which have doubled (or even tripled) their revenue year-on-year. Analysts with Blue Alpha Capital estimate that container lines took in a cumulative $48 billion in profit in the third quarter alone, and more than $100 billion over the first nine months of the year. This is more than the combined earnings of the last five years for the entire industry. According to third-ranked carrier CMA CGM, the fourth quarter may be even more profitable, and the first half of 2022 is looking strong as well.

"2021 will be a year to remember for carriers and one to forget, if that?s possible, for the shipper community," said Berglund. "What lies ahead is unclear, but we can see there?s action planned to try and ease congestion at major US ports . . . while newbuilds, potential new players and the growing trend of shippers chartering their own vessels might [have an effect]."

Shippers looking to lock-in long term contracts for ocean freight are in for some serious sticker shock this month, according to shipping data consultancy Xeneta.

While some adherents to the now discredited "transitory" inflation camp point to the recent flatlining in short-term containership rates - or even decline in the case of core transpacific trades...

... long-term contract rates are still going up. According to Xeneta's statistics compiled by the Maritime Executive website, global average long-term contracted ocean freight rates went up by 16% in November alone, for a cumulative rise of 121% year-on-year. This follows after a record-setting increase of 28% in July, when all of the major shipping corridors saw significant long-term rate hikes.

"The continued perfect storm of high demand, maxed-out capacity, port congestion, changing consumer habits, and general supply chain disruption is fueling a rates explosion that, quite frankly, we?ve never seen the like of," said Patrik Berglund, the CEO of Xeneta. "What?s more, it?s difficult to see a change of course ahead, with the fundamentals stacked very much in favor of the carrier community. In short, they?ve never had it so good, while many shippers, unfortunately, are well and truly on the ropes."

The long-term rate hikes are most pronounced for routes to and from the United States. Xeneta calculated the increase for long-term import rates for the U.S. market at 39% for November, up 122 percent year-on-year. U.S. export rates also rose 9% for the month.

The soaring rates are driving tremendous profitability at the top container lines, many of which have doubled (or even tripled) their revenue year-on-year. Analysts with Blue Alpha Capital estimate that container lines took in a cumulative $48 billion in profit in the third quarter alone, and more than $100 billion over the first nine months of the year. This is more than the combined earnings of the last five years for the entire industry. According to third-ranked carrier CMA CGM, the fourth quarter may be even more profitable, and the first half of 2022 is looking strong as well.

"2021 will be a year to remember for carriers and one to forget, if that?s possible, for the shipper community," said Berglund. "What lies ahead is unclear, but we can see there?s action planned to try and ease congestion at major US ports . . . while newbuilds, potential new players and the growing trend of shippers chartering their own vessels might [have an effect]."