Submitted by QTR's Fringe Finance

Judging by the action in gold over the last two days, one might assume that rate hikes have been implemented (and worked) and that Russia and Ukraine have declared a cease-fire.

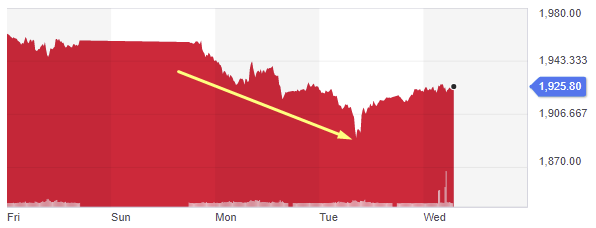

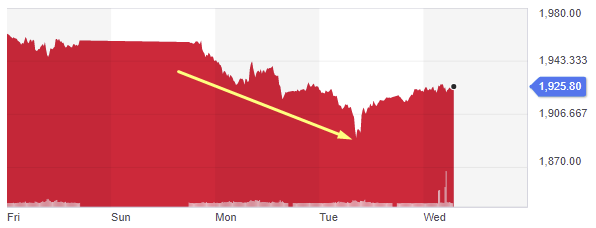

Neither of those things have happened and so (it?ll come as zero surprise to my readers) that I found the nearly $70 peak-to-trough sell off in gold over the last two days to be misguided.

I added exposure to gold with some GLD calls yesterday (yes, I know it is paper gold and a claim to physical that may not exist, I just wanted speculative options exposure) with the equity trading at about $177.75.

The slams lower in gold are as predictable as they are irrational.

Following a melt up/short squeeze in the equity markets over the last two days, ostensibly due to positive sounding cease-fire talks that I am still skeptical of and wrote about this week and last (here and here), gold sold off by about $70 within the course of less than two trading sessions.

The combination of the Fed finally embracing rate hikes and the Russia/Ukraine conflict potentially slowing down has the market thinking that safe havens may not be necessary going forward.

This perception that gold is trading on is far from the reality of the situation. As we just learned this morning, Russia has said ?nothing very promising? has taken place in peace talks so far, and the Fed hasn?t even begun to approach the problem of inflation yet.

Regardless of whether or not there is eventually a cease-fire or Russia decides to back off the gas in Ukraine, it doesn?t mean that the economic sanctions that have been put in place against the country are going to be withdrawn. These sanctions have forced Russia and China to cross the Rubicon, in my opinion, where it appears to me that Russia and China may challenge the U.S. dollar and that Russia is trying to back the ruble with gold.

This isn?t going to change anytime soon, regardless of whether or not the physical conflict in Ukraine continues.

And there was a lot of bluster yesterday from Philadelphia Fed President Patrick Harker, who said that he was ?open to the idea of more aggressive rate hikes? and that the ?U.S. can avoid a recession?. It was the usual line of bullshit from someone at the Fed: lots of confident-sounding lip on how to quell inflation, but little action.

The truth is we have only seen one 25 bps hike (which should have been a 50 bps hike). Real rates are still drifting between -6% and -8%. This is about as bullish of a scenario for gold as you can possibly get, and it isn?t going away anytime soon. Real rates are going to remain negative for the foreseeable future. If they don?t, it means that the Fed has raised rates so high that we?re going to have a massive debt crisis, which will then eventually become systemic, forcing people back into gold as a sovereign debt crisis safe haven, after they first sell it in a rush to deleverage.

The truth is that I think the gold rush has only just begun.

Watching one major selloff like we saw on Monday was fine with me ? I chalked it up to regular market gyrations. But once gold made a $70 dive in the course of less than two trading sessions, I had to pull the trigger on some speculation.

I?m not sure what the gold market is perceiving when it comes to the world of macro, but whatever it is, it certainly stands at odds with my analysis that both key outstanding risks - Russia and inflation - lead back to gold moving higher.

In the case of Russia, I expect permanent changes to the way the country conducts business globally (i.e. sells oil and natural gas) that will be bullish for gold.

With regard to inflation, I think the Fed will hike until the market crashes at some point this year. It?ll then be forced to retake a dovish stance on monetary policy, while hoping that CPI starts to turn slightly lower so that they can claim victory in the face of perversely negative real rates. A situation like this, in my opinion, isn?t just the likeliest outcome for how the inflation problem will be dealt with, it is also the most bullish scenario for gold.

No matter what, it feels to me like a new, bifurcated global economy waits in the wings and that it is only a matter of time before gold once again gets the starting nod to do what it does best: preserve wealth, store value and help act as sound money.

If you enjoyed today?s piece and have the means to support Fringe Finance, I?d be honored to have you as a subscriber: https://quoththeraven.substack.com/subscribe?utm_medium=web&utm_source=subscribe-widget&utm_content=51238594

Judging by the action in gold over the last two days, one might assume that rate hikes have been implemented (and worked) and that Russia and Ukraine have declared a cease-fire.

Neither of those things have happened and so (it?ll come as zero surprise to my readers) that I found the nearly $70 peak-to-trough sell off in gold over the last two days to be misguided.

I added exposure to gold with some GLD calls yesterday (yes, I know it is paper gold and a claim to physical that may not exist, I just wanted speculative options exposure) with the equity trading at about $177.75.

The slams lower in gold are as predictable as they are irrational.

Following a melt up/short squeeze in the equity markets over the last two days, ostensibly due to positive sounding cease-fire talks that I am still skeptical of and wrote about this week and last (here and here), gold sold off by about $70 within the course of less than two trading sessions.

The combination of the Fed finally embracing rate hikes and the Russia/Ukraine conflict potentially slowing down has the market thinking that safe havens may not be necessary going forward.

This perception that gold is trading on is far from the reality of the situation. As we just learned this morning, Russia has said ?nothing very promising? has taken place in peace talks so far, and the Fed hasn?t even begun to approach the problem of inflation yet.

Regardless of whether or not there is eventually a cease-fire or Russia decides to back off the gas in Ukraine, it doesn?t mean that the economic sanctions that have been put in place against the country are going to be withdrawn. These sanctions have forced Russia and China to cross the Rubicon, in my opinion, where it appears to me that Russia and China may challenge the U.S. dollar and that Russia is trying to back the ruble with gold.

This isn?t going to change anytime soon, regardless of whether or not the physical conflict in Ukraine continues.

And there was a lot of bluster yesterday from Philadelphia Fed President Patrick Harker, who said that he was ?open to the idea of more aggressive rate hikes? and that the ?U.S. can avoid a recession?. It was the usual line of bullshit from someone at the Fed: lots of confident-sounding lip on how to quell inflation, but little action.

The truth is we have only seen one 25 bps hike (which should have been a 50 bps hike). Real rates are still drifting between -6% and -8%. This is about as bullish of a scenario for gold as you can possibly get, and it isn?t going away anytime soon. Real rates are going to remain negative for the foreseeable future. If they don?t, it means that the Fed has raised rates so high that we?re going to have a massive debt crisis, which will then eventually become systemic, forcing people back into gold as a sovereign debt crisis safe haven, after they first sell it in a rush to deleverage.

The truth is that I think the gold rush has only just begun.

Watching one major selloff like we saw on Monday was fine with me ? I chalked it up to regular market gyrations. But once gold made a $70 dive in the course of less than two trading sessions, I had to pull the trigger on some speculation.

I?m not sure what the gold market is perceiving when it comes to the world of macro, but whatever it is, it certainly stands at odds with my analysis that both key outstanding risks - Russia and inflation - lead back to gold moving higher.

In the case of Russia, I expect permanent changes to the way the country conducts business globally (i.e. sells oil and natural gas) that will be bullish for gold.

With regard to inflation, I think the Fed will hike until the market crashes at some point this year. It?ll then be forced to retake a dovish stance on monetary policy, while hoping that CPI starts to turn slightly lower so that they can claim victory in the face of perversely negative real rates. A situation like this, in my opinion, isn?t just the likeliest outcome for how the inflation problem will be dealt with, it is also the most bullish scenario for gold.

No matter what, it feels to me like a new, bifurcated global economy waits in the wings and that it is only a matter of time before gold once again gets the starting nod to do what it does best: preserve wealth, store value and help act as sound money.

If you enjoyed today?s piece and have the means to support Fringe Finance, I?d be honored to have you as a subscriber: https://quoththeraven.substack.com/subscribe?utm_medium=web&utm_source=subscribe-widget&utm_content=51238594