Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

I bet if I list silver 1oz here I could not get $10 premium

People only pay dealers premium then complain that its so high

From the early beginnings Silveroos has been a discussion-oriented forum, with most of it's members being in the scene for a decade or more. We're not looking to fomo into the market or just add an extra oz to the stack. Most of us are just happy to be holding and discussing. A few months ago I posted silver at spot here first as a courtesy to members and it didn't sell - It's like trying to sell a used car to a used car salesman. I added a premium and sold it on the FB groups within minutes. There's no shortage of buyers in the private market, In fact, there's an absolute frenzy taking place right now due to the delays from dealers.

I don't know how many members you've seen complaining about dealer premiums and stating they're buying right now? Most people are just amazed that the premiums are almost as high as the cost of bullion a few years back.

That is all I was doing. Just highlighting the Spread from a Dealer I had used. Haven't brought from them in a few years. Back then the spread was under $10 if memory serves me.From the early beginnings Silveroos has been a discussion-oriented forum, with most of it's members being in the scene for a decade or more. We're not looking to fomo into the market or just add an extra oz to the stack. Most of us are just happy to be holding and discussing. A few months ago I posted silver at spot here first as a courtesy to members and it didn't sell - It's like trying to sell a used car to a used car salesman. I added a premium and sold it on the FB groups within minutes. There's no shortage of buyers in the private market, In fact, there's an absolute frenzy taking place right now due to the delays from dealers.

I don't know how many members you've seen complaining about dealer premiums and stating they're buying right now? Most people are just amazed that the premiums are almost as high as the cost of bullion a few years back.

Only Silver I have brought is some Beautiful & Artistic pieces from " Smithys Bullion ", whom also supplies the 1/2 ounce Bars that I have purchased for the Treasure Hunt.

Smithy even holds the Bars & posts them out to the Winner. Very kind of him to support the Forum

I just had a thought... In 2020 when the price of silver dumped to $20 or so and we saw dealer shortages due to high demand and supply bottlenecks, the amount of $$ that had to flow into the market to drain dealer inventory was a minimum of 8x less than today. But that doesn't factor in the circumstances surrounding global lockdowns causing a significant issue with shipments. We could be seeing up to 20x the $$ pouring into the silver market right now than in previous years to create the low dealer supply we're seeing today.

I recall assessing the private bullion market a few years back and determined the world has a production/minting capacity of approx. 400 Million Oz's to satisfy global investment demand for new Bullion. Beyond that, significant investment would be required by government and private mints to ramp up production. 400 million Oz's is also half of global mine supply, so if industry is having a difficult time obtaining silver, and silver is now declared a strategic metal of significant importance, government mints are more likely to decrease production and increase premiums moving forward. The US Mint is a classic example of this and I believe we're going to see much of the same for other government mints in the near future.

I recall assessing the private bullion market a few years back and determined the world has a production/minting capacity of approx. 400 Million Oz's to satisfy global investment demand for new Bullion. Beyond that, significant investment would be required by government and private mints to ramp up production. 400 million Oz's is also half of global mine supply, so if industry is having a difficult time obtaining silver, and silver is now declared a strategic metal of significant importance, government mints are more likely to decrease production and increase premiums moving forward. The US Mint is a classic example of this and I believe we're going to see much of the same for other government mints in the near future.

Mate, there's an undeclared war. The war is strategic mineral reserves ( Silver is part of that ). The USA is going for South America/Greenland & the Chinese are going Africa & whatever else they can secure.I just had a thought... In 2020 when the price of silver dumped to $20 or so and we saw dealer shortages due to high demand and supply bottlenecks, the amount of $$ that had to flow into the market to drain dealer inventory was a minimum of 8x less than today. But that doesn't factor in the circumstances surrounding global lockdowns causing a significant issue with shipments. We could be seeing up to 20x the $$ pouring into the silver market right now than in previous years to create the low dealer supply we're seeing today.

I recall assessing the private bullion market a few years back and determined the world has a production/minting capacity of approx. 400 Million Oz's to satisfy global investment demand for new Bullion. Beyond that, significant investment would be required by government and private mints to ramp up production. 400 million Oz's is also half of global mine supply, so if industry is having a difficult time obtaining silver, and silver is now declared a strategic metal of significant importance, government mints are more likely to decrease production and increase premiums moving forward. The US Mint is a classic example of this and I believe we're going to see much of the same for other government mints in the near future.

Just saw a article that the USA is building it's 1'st Aluminum Smelter in 40 + yrs. The battle to secure minerals is ON !

At some stage the delivery side of Silver is going to CRASH ! & that might bring Gov intervention

We will see if that brings on a real SHTF moment

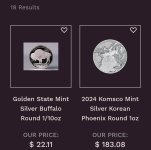

So ABC have repriced all of their Bullion products. 1oz coins are about $30 over spot. No wonder Bullion Now are selling out so quickly. They still have 1oz coins at $9 over spot.

I think the days of low premiums at Bullion Now are numbered. I think the days of available silver at Bullion Now are also numbered. The private market is about to lead the way in price discovery for a period of time.

I think the days of low premiums at Bullion Now are numbered. I think the days of available silver at Bullion Now are also numbered. The private market is about to lead the way in price discovery for a period of time.

Swan Bullion is getting smashed. Every time they list any silver it rapidly vanishes. Bullion Nows site is incredibly slow no doubt to all the business they're attracting.

TBH Bullion Now might like to just wear the online angst and only list stuff they can get out in a timely manner. I'd temporarily suspend the free storage so it's Order - Pay - Shipped.

TBH Bullion Now might like to just wear the online angst and only list stuff they can get out in a timely manner. I'd temporarily suspend the free storage so it's Order - Pay - Shipped.

They have to do something, upgrade servers for one.

They dribbled out the kg bars instead of putting 1 or 200 up at a time, most I saw up was 20, I assume to stop a whale buying it all.

I'm sure Michael isn't disappointed they sold out in hours.

They dribbled out the kg bars instead of putting 1 or 200 up at a time, most I saw up was 20, I assume to stop a whale buying it all.

I'm sure Michael isn't disappointed they sold out in hours.

I bet if I list silver 1oz here I could not get $10 premium

People only pay dealers premium then complain that its so high

I'm always interested in Kookaburra's. I have one complete set (awaiting Perth Mint to delivering this years)

To be fair though, at current spot prices I'd only be looking at maybe 3 at any one time tops.

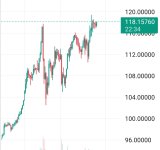

Dang, I woke up last night and checked Spot OVER $170. Wowsers. Woke up a bit above $155. Must have dreamed the $170. Checked again before having my morning shower $165. Log on to make sure the world hasn't fallen apart during the night as I eat my breakfast..... $163

What a Wild Ride Stable Silver has become!

What a Wild Ride Stable Silver has become!