I'm sure AI will find a way to supply endless amounts of Silver to build itself more & more MASSIVELY !It used to be, but with new tech and bot. It is much quicker now.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

The Silver Squeeze of 2025: CME Margin Hikes Trigger Flash Crash to $73.72 Amid 'Silver Thursday' Fears.

A reasonably well written article. Seems to have been written by a actual person

I think it's worth the read

TL;DW

AI can change coal that is already in production is what I get from the headline.

Can AI increase the production of Silver in the ground that hasn't been found yet ?

What is Palladium ?

Oh, industrial metal ?

Ok

View: https://youtu.be/YyMI965yA9I?si=4E02xqeLry-2uaky

EXTREME

It looks like CME is trying to kill the metals rally.

Another margin hike on gold, silver, platinum and palladium is hitting tomorrow.

View: https://x.com/WallStreetMav/status/2006192049620492409?s=20

Another margin hike on gold, silver, platinum and palladium is hitting tomorrow.

View: https://x.com/WallStreetMav/status/2006192049620492409?s=20

wowJanuary 1, 2026.

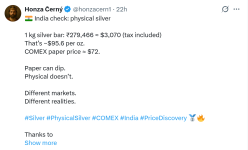

Silver trades at $130 in Tokyo.

Silver trades at $80 in Shanghai.

Silver trades at $71 in New York.

Same metal. Same day. Same ounce.

One of these prices is a lie.

HUGE mistake IMHO to have "shut down" A LOT of money has been made and lost in the Bullion market the last couple of days / weeks.BN has been off-line all day.

I wonder what's going on?

That's a long time to be down at such a pivotal moment.

They had bugger all silver for sale anyway, they had 400kg listed over the weekend and that's all gone now. Maybe it worked as a good time to update site because they had so little to sell?

I'm guessing it was supposed to be an hour or 2 at max and something went wrong. Hopefully they're back online and fully stocked soon.

I'm guessing it was supposed to be an hour or 2 at max and something went wrong. Hopefully they're back online and fully stocked soon.