Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

BN still have some coins now for 8.5 over, not bad at the moment.

Not ideal, but I reckon premiums next time any kgs come in will be close to, that, it would be better getting the coins now than waiting to see where premiums are when stock returns.

Not ideal, but I reckon premiums next time any kgs come in will be close to, that, it would be better getting the coins now than waiting to see where premiums are when stock returns.

Sometimes i wonder why noone moves coins at or just above spot on gumtree, then it dawned on me that the same four people (+ cashies ludicrous valuations) would just flip it anyhow. Gumtree used to be an oprion but last few years just short term flippers.

Gumtree is dead. Went downhill since eBay bought them out and FB marketplace took offSometimes i wonder why noone moves coins at or just above spot on gumtree, then it dawned on me that the same four people (+ cashies ludicrous valuations) would just flip it anyhow. Gumtree used to be an oprion but last few years just short term flippers.

Nah, I'm going with the Gremlins storyI think it was to do with the webserver outage yesterday.

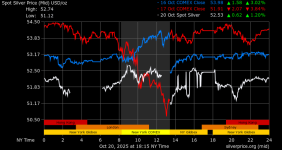

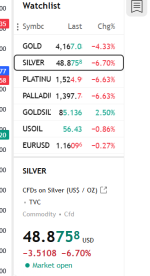

Bit of a healthy pullback.

...

SLV (and therefore LBMA OTC market) received 8.7M ozt of COMEX silver over the weekend apparently:

pmbug said:Today (10-20) in silver

Today saw silver spot bounced up and down between $52 and $52.50 for most of the day. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 1,574 ozt to the vault (which is about a bar and a half). PSLV has been very active of late, but took another rest day today. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Friday (COMEX reports activity for the previous working day) showed 300K ozt (~9.3 metric tons) withdrawn from the Asahi vaults, and ~4.2M ozt (~132 metric tons) withdrawn overall. The vault system was quite busy Friday as they also received 1.2M ozt (~39 metric tons). For the second working day in a row, Asahi had no silver move from registered to eligible. I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM reported no withdrawals or deposits, but moved 70K ozt (~2.2 metric tons) from registered to eligible. JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Loomis was the big loser on Friday with 3M ozt withdrawn and none deposited. Overall, 290.8K ozt (~9 metric tons) of silver was moved from registered to eligible on Friday.

SLV

My "canary in the silver mine" signalling slightly less supply stress in London. Today JPM reported adding 8.7M ozt (272.3 metric tons) to the silver stock while Blackrock reported adding 9.65M shares.

The number of shares available to borrow breached 1M today, so maybe that explains the difference between the new shares and new silver stock. The borrowing fee rose to a high of 20.33% before falling down to 16.23%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.11%.

SFE/SGE

The Oct 20 trading report from this morning indicated the SGE/SFE prices for silver moving up almost to par with the LBMA/COMEX. The SFE silver vault continues to bleed out inventory - shedding another 2M ozt (~64.2 metric tons) today. China is going to need to bid silver up higher if they want silver to flow in from the West.

View: https://x.com/pmbug/status/1980457573053497468

ITALPREZIOSI SILVER 5 OZ .999 SILVER BAR | eBay Australia

ITALPREZIOSI SILVER 5 OZ .999 SILVER BAR

ebay.us