You can see the CFTC's Commitment of Traders (COT) report here:

CFTC Commitments of Traders Long Report - Other (Combined)

This is the viewable version of the most recent release of the Other disaggregated long form futures only commitments report.www.cftc.gov

Scroll down a little bit to find the Silver data. In the table, you can see the long and short positions for Swap dealers. I see 80,128 short and 27,804 long for a net short position of 52,324. Each contract represents 5,000 troy ounces, so the net short position is 261,620,000 troy ounces.

Thank you. I am aware of the COT reports, I was more referring to it being translated to the amount of $$ it made the shorts go underwater. It seems significant but it really isn't when you consider the trillions of dollars being printed (or even missing). This was a recent topic of interest to me because I recall all the claims of "buy silver, crash JPM" and the more recent arise of WallStreetBets and WSS. It would appear the paper markets weren't of any interest (except PSLV and others alike) and the physical market was where the real damage would be done.

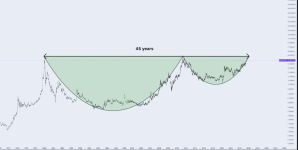

When I first began looking at the COT reports and uncovering how the COMEX and CFTC operated, I realised that eventually the fundamentals would overwhelm the paper markets and it would all become irrelevant. That's why I've put more interest on the aboveground stockpiles side of things to try to gauge how long we have left. overall, I'm far more dedicated to understanding vaulting data than anything related to the paper markets but it is interesting to gauge market sentiment and get an insight to the desperation of the shorts as time progresses.