Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

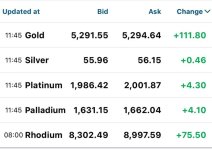

Silver Price Watch

- Thread starter STKR

- Start date

Almost no flight.I like solid ground. Thanks

US space dominance CRIPPLED by Trump-Musk feud

According to the Washington Post, NASA and the Pentagon are desperately begging SpaceX rivals to accelerate rocket development after Trump’s threats caused Musk to nearly halt all US flights to the ISS

If POS stays in the longer-term trend column, we could see $38.50ish soon.

It will be interesting when POS gets to this target, and what it does! We could see a major pullback to form a handle on the shorter term Cup before the next major run to infinity .... Or it could just blow right through the whole lot and go parabolic. The USA is not so United States anymore Europe is close to fullblown ww3. So much unrest around the world everywhere we have interesting times ahead.

It will be interesting when POS gets to this target, and what it does! We could see a major pullback to form a handle on the shorter term Cup before the next major run to infinity .... Or it could just blow right through the whole lot and go parabolic. The USA is not so United States anymore Europe is close to fullblown ww3. So much unrest around the world everywhere we have interesting times ahead.

Last edited:

I'm trying to curb my optimism here by reminding myself that one of the ways they manipulate the market is by manipulating market sentiment. Right when it looks like silver is about to let go and reach great new heights, we see market intervention. For as long as they still have physical silver to meet market demand, with the intent to intervene with the free-market forces that would otherwise drive the price to place of ultimate correction, they will continue to manage the price.

If they let silver go from here, we could see a flooding of physical investment that will significantly drive up the deficit, and drive a stake in the heart of price intervention.

All I'm saying is that if there were to be a time to slam the price back down, it would be now. Although I am hopeful, I am sceptical this is the time. It's quite likely they may need to make a concession on the price to new highs, but IMO we are far from Silver breaking free from it's bonds that've held it down for decades. I still think we're a few years away from that moment and if they concede too much too soon, they run the risk of losing control sooner than they needed to.

The only reason I'm cautious here is because it looks so good. Just my 2c.

If they let silver go from here, we could see a flooding of physical investment that will significantly drive up the deficit, and drive a stake in the heart of price intervention.

All I'm saying is that if there were to be a time to slam the price back down, it would be now. Although I am hopeful, I am sceptical this is the time. It's quite likely they may need to make a concession on the price to new highs, but IMO we are far from Silver breaking free from it's bonds that've held it down for decades. I still think we're a few years away from that moment and if they concede too much too soon, they run the risk of losing control sooner than they needed to.

The only reason I'm cautious here is because it looks so good. Just my 2c.