Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

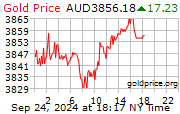

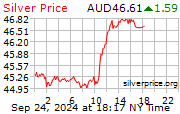

Silver Price Watch

- Thread starter STKR

- Start date

I'm expecting explosive price actionPatience is needed at this level. Let silver do its thing at the $31 it's health for POS in moving forward

Unless I buy it... Then we be back down to $25 for a few yearsAcquaintance of mine is thinking of selling some silver to buy gold. Silver should break through 35 on the way to 50 after he pulls the trigger.

Monthly charts look good. Current candle looks decent. Hoping for a push up to $33.50 then a pull back to $33 by the weekly close.

But If Silver was to be "managed", now would be the time to slam it back down. But I don't think they can get away with it for much longer. The more they keep Silver so undervalued, the more appealing it is to investors.

Who here remembers Scott Minerd's call for silver investment? He was right then and his call is even more relevant now.

Sadly, I've learnt when searching for his video that he was a member of the 'Died Suddenly' party in 2022. Conveniently after he called the stock market a Ponzi bubble and put the spotlight on silver. 63 years young