It kinda looks like the AUD/USD is topping out may be set to fall over the next few weeks, which will be good for metals priced in AUD. The overall trend is down and it's been consolidating for a little while now but It's yet to show signs of a breakout on the upside. We're at a determining price point but it's struggling to move past it. If we don't break out here, then I expect it to make it's way down to .64c over the next month or so from its current 0.67c level.

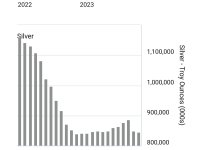

Silver has begun it's long overdue pullback. A correction down to $31 would be considered normal but it could turn around at the $31.60 mark if buying resumes. The weekly charts don't indicate that it's done with it's push to higher highs and we're still very much in an uptrend.

Silver has begun it's long overdue pullback. A correction down to $31 would be considered normal but it could turn around at the $31.60 mark if buying resumes. The weekly charts don't indicate that it's done with it's push to higher highs and we're still very much in an uptrend.

Last edited: