Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

Silver saw an 8% rise in 24 hours. It's been lagging behind Gold for so long that a rapid move to $50US and beyond wouldn't be off the table. Do we have a correction this week or do we go parabolic?

One important thing to note is the deficits for previous years were 200 Moz's+ while the POS has fallen. Now, with the breakout through $30US bringing a new wave of excitement and interest, what will the deficits be when Bullion demand doubles? Physical investment demand could be the straw that breaks the camels back, leading to greater deficits, which lead to higher prices, which leads to higher demand.... And greater deficits. It's a viscous death spiral. Remember, the bull run of 2008-11 saw a 5x in physical Bullion demand!

The best thing about silver is the supply and demand fundamentals are still favourable without the need for physical investment demand. The market couldn't handle Australia's population buying 10 Oz's each... And what is that? $500 per person, or 240 Moz's? There does appear to be a 400 Moz cap on production capacity for mints around the world though. This production capacity will result in silver being unobtainable through dealers, and a new 'private sales market' will form with inflated premiums running rampant. For all those interested in GSR trades, Golden opportunities would exist in these times.

One important thing to note is the deficits for previous years were 200 Moz's+ while the POS has fallen. Now, with the breakout through $30US bringing a new wave of excitement and interest, what will the deficits be when Bullion demand doubles? Physical investment demand could be the straw that breaks the camels back, leading to greater deficits, which lead to higher prices, which leads to higher demand.... And greater deficits. It's a viscous death spiral. Remember, the bull run of 2008-11 saw a 5x in physical Bullion demand!

The best thing about silver is the supply and demand fundamentals are still favourable without the need for physical investment demand. The market couldn't handle Australia's population buying 10 Oz's each... And what is that? $500 per person, or 240 Moz's? There does appear to be a 400 Moz cap on production capacity for mints around the world though. This production capacity will result in silver being unobtainable through dealers, and a new 'private sales market' will form with inflated premiums running rampant. For all those interested in GSR trades, Golden opportunities would exist in these times.

We just hit $47 AUD

Finally! I purchased some silver back in 2011 for $45.

Your an excellent source of relevant information and have educated my ignorant self on several matters thankyou. Its great to see some momentum and stackers excited again bout AG im "weighted" towards gold and lately platinum more so then silver and prefer condensed portable metals but when silver has its day and hopefully it grows and revalues then those who've kept the faith and the weight will benefit the mostSilver saw an 8% rise in 24 hours. It's been lagging behind Gold for so long that a rapid move to $50US and beyond wouldn't be off the table. Do we have a correction this week or do we go parabolic?

One important thing to note is the deficits for previous years were 200 Moz's+ while the POS has fallen. Now, with the breakout through $30US bringing a new wave of excitement and interest, what will the deficits be when Bullion demand doubles? Physical investment demand could be the straw that breaks the camels back, leading to greater deficits, which lead to higher prices, which leads to higher demand.... And greater deficits. It's a viscous death spiral. Remember, the bull run of 2008-11 saw a 5x in physical Bullion demand!

The best thing about silver is the supply and demand fundamentals are still favourable without the need for physical investment demand. The market couldn't handle Australia's population buying 10 Oz's each... And what is that? $500 per person, or 240 Moz's? There does appear to be a 400 Moz cap on production capacity for mints around the world though. This production capacity will result in silver being unobtainable through dealers, and a new 'private sales market' will form with inflated premiums running rampant. For all those interested in GSR trades, Golden opportunities would exist in these times.

^^^ Silver boffins will have their day in the sun. I recently have moved to platinum too over Silver due to recent articles about the metal for green energy needs, and because my Silver coffers are full. Looking forward to next week to were the traders want to take Silver. Let's see a 1980s run would be great

I'm interested to understand where in the green energy sector platinum will be used? I'm not well researched in that area at all but I do know that it's used as a catalyst in hydrogen powered vehicles. If that was the main area that demand would come from, one would think that it would need to be more than what's used in catalytic converters in combustion engines today to see an increase in overall demand.

Demand Drivers - Supply & Demand - World Platinum Investment Council – WPIC®

Platinum is one of the rarest metals in the world, with unique physical and catalytic properties making it highly valued across a number of diverse demand segments, including key technologies that make it a critical mineral for the energy transition.

General information but probably not directly answering your ? While not as much industrial demand as silver imo (very amateur one) over time much room to grow and given was once twice price of gold, its rarity,etc im liking it as an outlier for metals and contarian play

... Do we have a correction this week or do we go parabolic?

Are we voting on this? I choose door number 2.

... The market couldn't handle Australia's population buying 10 Oz's each...

Could you explain what you mean by this?

Are we voting on this? I choose door number 2.

Could you explain what you mean by this?

I was referring to the overall silver market already being in a deficit, and how an increase of physical investment demand of 200+ Moz's would really put some pressure on an already over-pressured market. The amount of money that would have to go into silver would be so small (compared to other markets) to add 200+ Moz's. It's the equivalent of Australia's population putting in $500 each for a 10oz bar. Given that Australia only accounts for 0.33% of the worlds population, it wouldn't take much on a global scale.

@pmbug

I was just checking out the most recent silver survey. Look at photovoltaic (solar panel) demand climb from 59 Moz's in 2015 to 193 Moz's in 2023. Silver's use in electronics has also climbed from 272 Moz's to 445 in the same time period ('15-'23). So in 8 years, demand for silver in solar panels has increased 3.5x and demand for electronics has risen by 170 Moz's. At the same time, mine supply has declined.

Between 2022-2023 there was a 440+ Moz deficit. Because we live in backwards world, the price of Silver actually fell during this period. For that to even be a reality, there must be undeclared stockpiles that were used to supply the markets that aren't/couldn't be accounted for in the surveys.

The forecast for 2024 for physical investment is 210 Moz's. These forecasts are rarely accurate, and they were done long before we broke through the $30 threshold. My forecast is 300+ Moz's.

This is what I'm referring to when I say the market cannot handle an increase in demand. With positive market sentiment in the stacking community, the most likely place a 200 Moz's increase in overall market demand would come from is physical investment.

Because we have no way to analyse just how much silver is available in aboveground stockpiles to tame the markets, we can only speculate. But the last two years are not an anomaly on the silver deficit front. We have a whole history of deficits where 'Government Sales' were listed and they would always come in and provide the markets with supply... Much like they didn't want the POS to ever go up?! I've spoken about this so many times before but this here is the real manipulation. The Comex manipulation is just a smoke and mirrors distraction, and a complimentary tool to the true physical market manipulation that takes place.

For speculation sake; let's say the stockpiles have already run dry. This would mean that all the major tech companies, all the manufacturers of electronics and solar panels, the medical industry, jewellery industry, photography industry, Bullion industry, and every Military in the world would be competing for supply. When such a time comes (and it could be sooner than we think), the scramble for silver will be insane.

I was just checking out the most recent silver survey. Look at photovoltaic (solar panel) demand climb from 59 Moz's in 2015 to 193 Moz's in 2023. Silver's use in electronics has also climbed from 272 Moz's to 445 in the same time period ('15-'23). So in 8 years, demand for silver in solar panels has increased 3.5x and demand for electronics has risen by 170 Moz's. At the same time, mine supply has declined.

Between 2022-2023 there was a 440+ Moz deficit. Because we live in backwards world, the price of Silver actually fell during this period. For that to even be a reality, there must be undeclared stockpiles that were used to supply the markets that aren't/couldn't be accounted for in the surveys.

The forecast for 2024 for physical investment is 210 Moz's. These forecasts are rarely accurate, and they were done long before we broke through the $30 threshold. My forecast is 300+ Moz's.

This is what I'm referring to when I say the market cannot handle an increase in demand. With positive market sentiment in the stacking community, the most likely place a 200 Moz's increase in overall market demand would come from is physical investment.

Because we have no way to analyse just how much silver is available in aboveground stockpiles to tame the markets, we can only speculate. But the last two years are not an anomaly on the silver deficit front. We have a whole history of deficits where 'Government Sales' were listed and they would always come in and provide the markets with supply... Much like they didn't want the POS to ever go up?! I've spoken about this so many times before but this here is the real manipulation. The Comex manipulation is just a smoke and mirrors distraction, and a complimentary tool to the true physical market manipulation that takes place.

For speculation sake; let's say the stockpiles have already run dry. This would mean that all the major tech companies, all the manufacturers of electronics and solar panels, the medical industry, jewellery industry, photography industry, Bullion industry, and every Military in the world would be competing for supply. When such a time comes (and it could be sooner than we think), the scramble for silver will be insane.

Listen to the first part of this video. This gentleman claims that a few weeks ago China has asked it's citizens to stop buying Gold and buy Silver instead. I did a search but can't find any information on this. 100 respect points for anyone who can find anything relating to this claim. If true, things are about to get crazy.

At the very least, the fact that conversations like this are expanding out to non silver related channels is a good sign of things to come.

Edit: ok, I found some articles about it:

www.numismaticnews.net

www.numismaticnews.net

And another one:

jensendavid.substack.com

jensendavid.substack.com

We have almost half the world's population in India and China and their citizens are very familiar with the concept of buying Gold and Silver at this time.

I'm not sure what you're all feeling about this but I've just realised that the Man-man Climate Catastrophe is real! And it's in the Precious Metals market right now about to stir some shit up!

At the very least, the fact that conversations like this are expanding out to non silver related channels is a good sign of things to come.

Edit: ok, I found some articles about it:

Chinese Investment Gold Demand Soars

People have been trying to determine why gold and silver prices have soared since Valentine's Day this year. Now we know...

And another one:

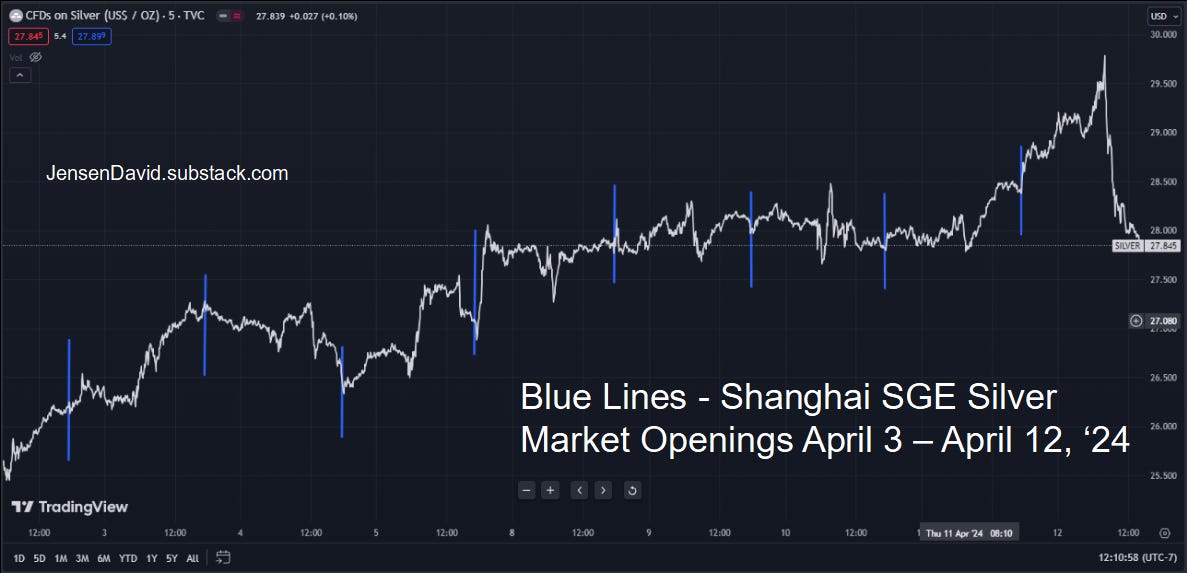

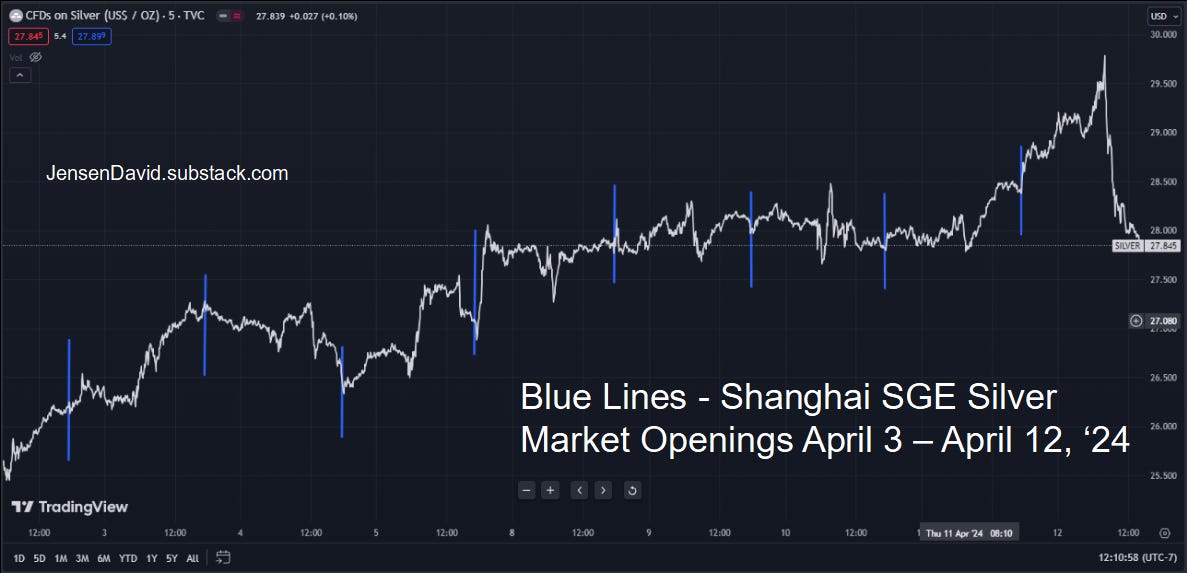

China's Media Recommends Buying Silver and Silver Starts to Surge on Open of Shanghai's SGE Exchange

This innocuous tweet, if correct, gives an interesting insight into a potential sea-change in the Chinese silver market.

We have almost half the world's population in India and China and their citizens are very familiar with the concept of buying Gold and Silver at this time.

I'm not sure what you're all feeling about this but I've just realised that the Man-man Climate Catastrophe is real! And it's in the Precious Metals market right now about to stir some shit up!

Last edited:

I'm really glad to be able to share these times with you and all other members. Big Cheers to @Administrator for the endless sacrifices and commitment to grow this forum. It went from being in the shadows to now being the best and fastest growing PM forum in Australia.Full-blown breakout and the hourly candles are indicating more to come

@Silver Soul you've been here from day dot supporting this project without ever looking back. Nurturing a forum from its infancy isn't possible without members like you, and I have a lot of respect for that. You saw what this forum could become and we're prepared to stay loyal to the cause, no matter how long it took. And look at where we are now!

Cheers to all you Roos! And cheers to good times to come

Predicting

The

Silver

Downfall

Haha that's awesome