Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Price Action

- Thread starter Kooka30

- Start date

Insanity. But chaos and drama can be exciting.

You weren't wrongTomorrow 29/12-25 is going to be wild

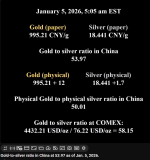

Silver Gates Have ClosedA Geostrategic Analysis of the Impact on Inflationby Jay MorseReality does not negotiate. There are decisive geostrategicconsequences of the two Gates of Silver closing at the same time.The first Gate of Silver that closed is that the world’s silver price isnow the price of physical silver, which is fixed largely in Shanghai andin Chinese Yuan (CNY), not US Dollars (USD).The second Gate of Silver that closed is that as of January 1st. Chinanot only dominates the world’s silver refining capacity no matter wheresilver is mined, it requires a permit to export silver, so Beijing decidesto whom silver can be exported. For example, Mexico leads the globalmining of silver but bans export of silver, except of ore to China forprocessing, so China decides who can buy silver refined from oremined in Mexico. Fully 70% of globally traded refined silver ultimatelycomes from China (World Population Review, 2025; Marketwatch,2026). The, US in contrast, produces as little as 20% of its total silverneed (MoneyMetalsExchange, 2025; Birch Gold Group, 2025).The salient consequence of both Silver Gates closing is that Chinadecides who gets silver and why, and when Beijing does permit theexport of silver it decides the currency of payment. Since January 1when silver export permitting took effect, Beijing has canceled theloading of scheduled shipments which until now had been paid for withUS Treasury Notes.

Did a " Hallucinating " AI slap this shit together ?

Silver Gates Have ClosedA Geostrategic Analysis of the Impact on Inflationby Jay MorseReality does not negotiate. There are decisive geostrategicconsequences of the two Gates of Silver closing at the same time.The first Gate of Silver that closed is that the world’s silver price isnow the price of physical silver, which is fixed largely in Shanghai andin Chinese Yuan (CNY), not US Dollars (USD).The second Gate of Silver that closed is that as of January 1st. Chinanot only dominates the world’s silver refining capacity no matter wheresilver is mined, it requires a permit to export silver, so Beijing decidesto whom silver can be exported. For example, Mexico leads the globalmining of silver but bans export of silver, except of ore to China forprocessing, so China decides who can buy silver refined from oremined in Mexico. Fully 70% of globally traded refined silver ultimatelycomes from China (World Population Review, 2025; Marketwatch,2026). The, US in contrast, produces as little as 20% of its total silverneed (MoneyMetalsExchange, 2025; Birch Gold Group, 2025).The salient consequence of both Silver Gates closing is that Chinadecides who gets silver and why, and when Beijing does permit theexport of silver it decides the currency of payment. Since January 1when silver export permitting took effect, Beijing has canceled theloading of scheduled shipments which until now had been paid for withUS Treasury Notes.

GATA has been around since the beginning of the gold bull runDid a " Hallucinating " AI slap this shit together ?

John Williams shadow stat is an old school way of calculations, been around for decades

You have become Jonny comes lately

I'm actually a subscriber to the GATA newsletter & read it every morning.GATA has been around since the beginning of the gold bull run

John Williams shadow stat is an old school way of calculations, been around for decades

You have become Jonny comes lately

The info may have come from GATA but that posting is someone's AI Slop

My criticism was of the presentation.

its posted on Gata web pageI'm actually a subscriber to the GATA newsletter & read it every morning.

The info may have come from GATA but that posting is someone's AI Slop

My criticism was of the presentation.

Mmm, I'm a little suspicious of this figure of $4.738 TRILLION

From what I have gathered/understand that figure is based upon all the Silver that is estimated to have been mined.

But unlike Gold, Silver in consumed in industrial processes. Most of the Gold ever mined is still available. A good portion of the Silver ever mined has been consumed/lost.

What percentage ? I have no idea. But say just 20% of all that Silver has been consumed/lost.

That figure of $4.738 TRILLION will be substantially lower.

So I have some doubt on that figure.