Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Physical Gold vs. Paper Gold

- Thread starter ozcopper

- Start date

Physical demand.

Most folk would know that bullion dealers are having trouble acquiring the allocation of coins and bars they require; indeed, some are importing from overseas.

Recently a well known dealer was allocating clients 1 to 3 coins of the very popular series 3 Lunar Rabbit silver bullion coin.

The Perth Mint have limits of 20 x 1oz, 20 x 1/2oz and 10 x 2oz. Normally the coin limits at Perth are dropped after a time period but the limits remain as at 01 November 2022 (release date was 17 October 2022).

Perth Mint 10 oz silver bars have not been available for years, same goes for 100 oz bars but Perth are flooding the silver coin market with 1oz silver Kangaroo coins. (13 million + in 2020, 11 million + in 2021 but, they have increased a large variety of low mintage coins like the "Swan" etc.

I'm not so sure there's a silver shortage, just that the mints like Perth only have a limited manufacturing capacity.

Demand is high.

Sales on the secondary market continue to hold good prices for coins and bars even though the price of silver has dropped from the March 2022 highs.

Keep stacking.

Most folk would know that bullion dealers are having trouble acquiring the allocation of coins and bars they require; indeed, some are importing from overseas.

Recently a well known dealer was allocating clients 1 to 3 coins of the very popular series 3 Lunar Rabbit silver bullion coin.

The Perth Mint have limits of 20 x 1oz, 20 x 1/2oz and 10 x 2oz. Normally the coin limits at Perth are dropped after a time period but the limits remain as at 01 November 2022 (release date was 17 October 2022).

Perth Mint 10 oz silver bars have not been available for years, same goes for 100 oz bars but Perth are flooding the silver coin market with 1oz silver Kangaroo coins. (13 million + in 2020, 11 million + in 2021 but, they have increased a large variety of low mintage coins like the "Swan" etc.

I'm not so sure there's a silver shortage, just that the mints like Perth only have a limited manufacturing capacity.

Demand is high.

Sales on the secondary market continue to hold good prices for coins and bars even though the price of silver has dropped from the March 2022 highs.

Keep stacking.

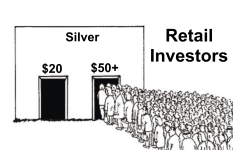

I'd say demand is about as high as it's ever been and still ?most folks? have no idea what even is a bullion? Once the price breaks 50, maybe 30 the masses will start to gain an interest and I wouldn't be surprised if there wasn't much to be had.

shinymetal said:I'd say demand is about as high as it's ever been and still ?most folks? have no idea what even is a bullion? Once the price breaks 50, maybe 30 the masses will start to gain an interest and I wouldn't be surprised if there wasn't much to be had.