Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

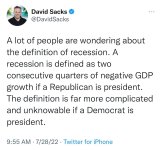

None dare call it a recession

- Thread starter Aurora et Luna

- Start date

the media saying the US isnt in recession reminds me of the time a CNN reporter stood in front of an entire block that was completely on fire, while saying the BLM protests were peaceful lol

these people are fucken idiots, if your going to make up bullshit, at least try and make it believable

these people are fucken idiots, if your going to make up bullshit, at least try and make it believable

US enters recession and the stock market goes up ahahaha. I feel like we are living in bizarro world

maybe some of us accidentally crossed over into some weird alternate universe in 2020 lol would explain why some people seem to wondering wtf and the others arent questioning anything ahaha if that is the case, please send me back to that other realm, it was better than this one lol

maybe some of us accidentally crossed over into some weird alternate universe in 2020 lol would explain why some people seem to wondering wtf and the others arent questioning anything ahaha if that is the case, please send me back to that other realm, it was better than this one lol

A Literal Depression Is Already Here

By Jeffrey Tucker

It?s been amusing, or tragic, to see the White House this week doing its dance. They?ve been preparing the way to deny, deny, deny the recession that today?s second-quarter GDP numbers indicated.

Doesn?t matter that our conditions will likely qualify by any definition of the term you read in a textbook. These people are shameless. They invent their own reality, in accord with post-structuralist thinking.

Or I could put it in plainer terms: They are lying.

The White House says that even with two consecutive quarters of negative output, we are not in recession. That?s because the labor markets look strong. But that is pretty twisted because it only looks at the unemployment rate, which doesn?t count those who are out of the workforce.

In labor participation, right now millions have gone missing, just having given up on life and personal ambition. That?s the truly chilling part of all of this.

We are not just in recession but depression and this is not just about economics. It?s about the human spirit itself. Hope has been drained away, and you can see it in the data or you can see it in the faces of those around you.

The lockdowns were catastrophic enough but they were followed by brutal mandates, educational losses, cultural destruction plus an enormous devaluation of the currency that has already drained away 14% of the purchasing power of the dollar.

Let us have a look at consumer confidence surveys as measured by the Organization for Economic Co-operation and Development (OECD), which has been tracking it since the 1960s. It has fallen off a cliff. I can?t even see how the line could be more vertical.

Confidence has never been this low in anyone?s record. But let?s zoom in a bit closer to see how things went. It crashed after lockdowns and then made some effort toward restoration. Do you remember those days? You remember thinking: Maybe these people are not utterly and completely sadistically insane?

Maybe the Biden administration will see the light and restore basic social and market functioning?

That did not happen. It got worse. Much worse. Now our present times give new meaning to the word ?worse.?

So yes, there is every reason to reject the term ?recession.? Let?s bring back the word ?depression.? That was the common term for a fall in economic conditions before World War II. It was changed only after the war to make the word less ugly as if to say we will never go back to that.

The word-game thing has been going on for a very long time.

A drill down into the labor market problem produces some terrifying realities. Hotels cannot find workers. Restaurants are cutting hours because they cannot find servers. Airline flights are being canceled because many pilots and flight attendants just left.

We?ve never seen this odd combination of high consumer demand, resources available to spend yet physical bodies in grave shortage actually to do what is necessary.

What these times have unearthed is an already existing corruption in the American labor markets. There are far too many people out there with high educational credentials and absolutely no skills and no market for those skills. And yet these people have set their reservation wage so high that they are unwilling to do anything that someone is willing to pay for.

This worked out well for many people for a very long time as corporations fattened up their administrative apparatus and every company built out a massive back office, dedicated mainly to compliance and paper pushing.

As technology improved and their jobs became ever easier, they worked less and less. After a while, it just seemed like money would flow forever even if millions only pretended to work.

My prediction is that these back-office jobs will be gradually gutted over the coming several years. And these people will have a very difficult time being repurposed in a labor market that wants actual workers rather than PJ-clad zoomers.

They will not downgrade their expectations. It will come as a devastating shock to millions of people who had come to believe that they could get money for nothing forever.

Be clear on the following. The labor shortage is not in administration or management or people who have learned to be in the right place at the right time and watch the money flow in. The labor shortage is for people willing to cook the food, change the sheets, transport the goods, make the software, fix the code, stack the dishes and so on.

In other words, people who actually do stuff will be in high demand but at low prices.

Looking back, the widespread appearance of books on bullshit jobs, boss hatred, work dissatisfaction and an overall explosion in labor-related litigation were all signs of a coming crisis. All they needed to explode was some one thing to introduce an element of chaos.

The same could be said of government debt, congressional spending, Federal Reserve money creation and so on. The U.S. as a country has lived off its capital accumulated in the 1980s for a very long time, while president after president has squandered it on wars, welfare and wild sprees of payoffs to special interests.

After decades of this nonsense, it truly seemed like nothing could break the system. Crazy theories began to circulate, such as ?Modern Monetary Theory,? which speculated that the central bank could print all the money it wanted without any real consequences on the value of money or the stability of the economy. That has turned out not to be true, as the devaluation is taking place at a record pace right now.

What remarkable times! The experts are left sputtering. The ruling class lies with impunity. Everyone contradicts everyone else. And everyone seems to be out of ideas on how to fix things or even cover it up anymore.

This is the whole reason for the wild political drama on Capitol Hill today: The only way to distract people from the national catastrophe is political persecution. They have a convenient voodoo doll in the person of Donald Trump, who often seems like he was sent by central casting to be their preferred enemy.

For years now, we kept thinking things would get better, that someone would save us from the emerging hell, that cooler heads would prevail and that someone in charge would rediscover wisdom and truth. That is not happening.

We?ve got a population today that is drowning its troubles in substances while the way of life we once knew is being stolen from us piece by piece.

A temporary recession may be the least of our worries.

Regards,

Jeffrey Tucker

for The Daily Reckoning

By Jeffrey Tucker

It?s been amusing, or tragic, to see the White House this week doing its dance. They?ve been preparing the way to deny, deny, deny the recession that today?s second-quarter GDP numbers indicated.

Doesn?t matter that our conditions will likely qualify by any definition of the term you read in a textbook. These people are shameless. They invent their own reality, in accord with post-structuralist thinking.

Or I could put it in plainer terms: They are lying.

The White House says that even with two consecutive quarters of negative output, we are not in recession. That?s because the labor markets look strong. But that is pretty twisted because it only looks at the unemployment rate, which doesn?t count those who are out of the workforce.

In labor participation, right now millions have gone missing, just having given up on life and personal ambition. That?s the truly chilling part of all of this.

We are not just in recession but depression and this is not just about economics. It?s about the human spirit itself. Hope has been drained away, and you can see it in the data or you can see it in the faces of those around you.

The lockdowns were catastrophic enough but they were followed by brutal mandates, educational losses, cultural destruction plus an enormous devaluation of the currency that has already drained away 14% of the purchasing power of the dollar.

Let us have a look at consumer confidence surveys as measured by the Organization for Economic Co-operation and Development (OECD), which has been tracking it since the 1960s. It has fallen off a cliff. I can?t even see how the line could be more vertical.

Confidence has never been this low in anyone?s record. But let?s zoom in a bit closer to see how things went. It crashed after lockdowns and then made some effort toward restoration. Do you remember those days? You remember thinking: Maybe these people are not utterly and completely sadistically insane?

Maybe the Biden administration will see the light and restore basic social and market functioning?

That did not happen. It got worse. Much worse. Now our present times give new meaning to the word ?worse.?

So yes, there is every reason to reject the term ?recession.? Let?s bring back the word ?depression.? That was the common term for a fall in economic conditions before World War II. It was changed only after the war to make the word less ugly as if to say we will never go back to that.

The word-game thing has been going on for a very long time.

A drill down into the labor market problem produces some terrifying realities. Hotels cannot find workers. Restaurants are cutting hours because they cannot find servers. Airline flights are being canceled because many pilots and flight attendants just left.

We?ve never seen this odd combination of high consumer demand, resources available to spend yet physical bodies in grave shortage actually to do what is necessary.

What these times have unearthed is an already existing corruption in the American labor markets. There are far too many people out there with high educational credentials and absolutely no skills and no market for those skills. And yet these people have set their reservation wage so high that they are unwilling to do anything that someone is willing to pay for.

This worked out well for many people for a very long time as corporations fattened up their administrative apparatus and every company built out a massive back office, dedicated mainly to compliance and paper pushing.

As technology improved and their jobs became ever easier, they worked less and less. After a while, it just seemed like money would flow forever even if millions only pretended to work.

My prediction is that these back-office jobs will be gradually gutted over the coming several years. And these people will have a very difficult time being repurposed in a labor market that wants actual workers rather than PJ-clad zoomers.

They will not downgrade their expectations. It will come as a devastating shock to millions of people who had come to believe that they could get money for nothing forever.

Be clear on the following. The labor shortage is not in administration or management or people who have learned to be in the right place at the right time and watch the money flow in. The labor shortage is for people willing to cook the food, change the sheets, transport the goods, make the software, fix the code, stack the dishes and so on.

In other words, people who actually do stuff will be in high demand but at low prices.

Looking back, the widespread appearance of books on bullshit jobs, boss hatred, work dissatisfaction and an overall explosion in labor-related litigation were all signs of a coming crisis. All they needed to explode was some one thing to introduce an element of chaos.

The same could be said of government debt, congressional spending, Federal Reserve money creation and so on. The U.S. as a country has lived off its capital accumulated in the 1980s for a very long time, while president after president has squandered it on wars, welfare and wild sprees of payoffs to special interests.

After decades of this nonsense, it truly seemed like nothing could break the system. Crazy theories began to circulate, such as ?Modern Monetary Theory,? which speculated that the central bank could print all the money it wanted without any real consequences on the value of money or the stability of the economy. That has turned out not to be true, as the devaluation is taking place at a record pace right now.

What remarkable times! The experts are left sputtering. The ruling class lies with impunity. Everyone contradicts everyone else. And everyone seems to be out of ideas on how to fix things or even cover it up anymore.

This is the whole reason for the wild political drama on Capitol Hill today: The only way to distract people from the national catastrophe is political persecution. They have a convenient voodoo doll in the person of Donald Trump, who often seems like he was sent by central casting to be their preferred enemy.

For years now, we kept thinking things would get better, that someone would save us from the emerging hell, that cooler heads would prevail and that someone in charge would rediscover wisdom and truth. That is not happening.

We?ve got a population today that is drowning its troubles in substances while the way of life we once knew is being stolen from us piece by piece.

A temporary recession may be the least of our worries.

Regards,

Jeffrey Tucker

for The Daily Reckoning

A Downturn by Any Other Name?

Friday, 29 July 2022 ? Burradoo, New South Wales, Australia

By Brian Chu

Editor, The Daily Reckoning Australia

[6 min read]

? Downturn, recession, depression?it?s all a game

? The cause of the illness came from the treatment

? On the precipice of a debt bloodbath

Dear Reader,

Oh recession, recession, wherefore art thou recession?

Would a recession (or depression) be less distasteful if called by any other name?

2022 continues to take the world down a strange journey, with surprises around every corner.

What we?ve seen is the increasing failure of those at the helm, aka the central planners, to steer the proverbial ship away from disaster.

Not only that, but there are clear signs that these individuals may well have been the reason why society keeps experiencing problems.

Economic downturns?

Increasing wealth inequality?

Social unrests?

International conflicts?

Divided societies?

Breakdown of moral and family values?

I could go on for hours on each topic.

But today, I want to focus on the state of the global economy. The powers that be have driven society into an insurmountable level of debt, and their biggest concern now is not how to get us out of the debt pile?

Instead, they want to bring us a new definition for ?recession?.

I kid you not. They want to gaslight people, right in front of our eyes.

Downturn, recession, depression?it?s all a game

The US is officially in a recession. Two quarters of a decline in GDP. The first quarter saw GDP decline 1.2% and last quarter it fell 0.9%.

But watch the mainstream media channels tell you this isn?t a recession.

Recession is an economic term that commands more attention than it deserves. It belongs to the halls of parliament, inside a lecture theatre, or in a press conference.

You have to go through six months of this and then wait another month to find out that you?re in it!

It?s backward looking, much like a PCR or rapid antigen tests to confirm you have some flu-like virus when you have a fever, sore throat, aching joints, and a congested cough.

I?ve never understood the obsession over reporting who?s sick. Focus on the solutions, and ones that work!

People aren?t stupid. They feel it.

Households have been tightening their belts for several months as food, housing, petrol, and heating bills have risen rapidly. I doubt there?s anyone who hasn?t found it more difficult to make ends meet in the past year.

Those who?ve lost their jobs and see their mortgage repayments rise don?t need someone to tell them it?s a recession!

If it?s been painful up until now, things could get much tougher moving forward.

Even in Australia, we?re a bit behind with interest rate rises. But we?ll catch up real soon. There?s another meeting next Tuesday.

The cause of the illness came from the treatment

The very reason for our boom-bust cycle is because we have a small group of people making decisions to dictate how the economy should work.

And they get it wrong over again.

Yesterday morning we woke up to the announcement by the Federal Reserve Open Market Committee that it would raise the Federal funds rate by 0.75%. This was in line with market consensus.

The markets rallied strongly after this announcement was made public. Our ASX 200 Index [ASX:XJO] closed almost 1% higher. It was mild compared to other markets ? the NASDAQ Index rose more than 4% and the S&P 500 Index rose 2.6%.

Gold managed to rally nicely as well ? trading almost US$30 higher to sit at US$1,740 an ounce (AU$2,490) within an hour after the rate rise.

And not surprisingly, cryptocurrencies led the pack. Ethereum [ETH] managed to rally more than 15%.

Contrast this with early June when the Federal Reserve raised rates by the same amount, but the market was unprepared for it.

What we?re seeing is the markets hanging onto the words of the central planners. They end up taking a wilder roller coaster ride than needed.

But who can blame them? Years of literally zero interest rates have meant it?s harder to make an honest living relying on your salary or wages. The game is in investing and speculating in some asset.

You name your poison ? stocks, properties, commodities, cryptos, or derivatives.

So the central banks shift society into allocating more into speculating on capital rather than real productivity. And when speculations fail, they paper over it with bailouts, handouts, and creating new debt to keep the game going.

Now that the central banks are reducing the currency supply and calling time earlier than many expect, you?re seeing the global economy implode on itself.

All this is happening as these central bankers take turns telling the people that this rate hike cycle is to stabilise the economy and ensure there is full employment and low inflation. All while people are losing jobs, and inflation (which they claimed to be ?transitory?) is at 40-year highs.

On the precipice of a debt bloodbath

Many Australian borrowers are now in a dreadful predicament. They were lured by cheap loans and bullish forecasts on property prices to secure their dream of owning their home.

It seemed so right at the time. After all, as recently as last November, the RBA assured us that the first rate rise would come in 2024.

If only people remembered these economists? track record about never seeing a recession or a market crash in their lifetime! They would?ve spared themselves a world of hurt.

So the media is now echoing the anger of the people who felt duped by the RBA Board of Governors, which has left them deeply indebted. Things could get worse as the rate rises continue.

With defaults likely to become more common, could the central banks power forward to normalise the economy and then leave it to the governments to placate the masses who literally lose everything?

Or will we see them walk back from their deadly waltz and cut rates?

Or could there be a financial system collapse that we?ve never seen before?

A plague on these central planners? houses, though many will lose theirs because of them.

I hope you?re not among the victims. If that?s the case, follow me here for an opportunity to take advantage of the imminent destruction of the fiat currency system.

God bless,

Friday, 29 July 2022 ? Burradoo, New South Wales, Australia

By Brian Chu

Editor, The Daily Reckoning Australia

[6 min read]

? Downturn, recession, depression?it?s all a game

? The cause of the illness came from the treatment

? On the precipice of a debt bloodbath

Dear Reader,

Oh recession, recession, wherefore art thou recession?

Would a recession (or depression) be less distasteful if called by any other name?

2022 continues to take the world down a strange journey, with surprises around every corner.

What we?ve seen is the increasing failure of those at the helm, aka the central planners, to steer the proverbial ship away from disaster.

Not only that, but there are clear signs that these individuals may well have been the reason why society keeps experiencing problems.

Economic downturns?

Increasing wealth inequality?

Social unrests?

International conflicts?

Divided societies?

Breakdown of moral and family values?

I could go on for hours on each topic.

But today, I want to focus on the state of the global economy. The powers that be have driven society into an insurmountable level of debt, and their biggest concern now is not how to get us out of the debt pile?

Instead, they want to bring us a new definition for ?recession?.

I kid you not. They want to gaslight people, right in front of our eyes.

Downturn, recession, depression?it?s all a game

The US is officially in a recession. Two quarters of a decline in GDP. The first quarter saw GDP decline 1.2% and last quarter it fell 0.9%.

But watch the mainstream media channels tell you this isn?t a recession.

Recession is an economic term that commands more attention than it deserves. It belongs to the halls of parliament, inside a lecture theatre, or in a press conference.

You have to go through six months of this and then wait another month to find out that you?re in it!

It?s backward looking, much like a PCR or rapid antigen tests to confirm you have some flu-like virus when you have a fever, sore throat, aching joints, and a congested cough.

I?ve never understood the obsession over reporting who?s sick. Focus on the solutions, and ones that work!

People aren?t stupid. They feel it.

Households have been tightening their belts for several months as food, housing, petrol, and heating bills have risen rapidly. I doubt there?s anyone who hasn?t found it more difficult to make ends meet in the past year.

Those who?ve lost their jobs and see their mortgage repayments rise don?t need someone to tell them it?s a recession!

If it?s been painful up until now, things could get much tougher moving forward.

Even in Australia, we?re a bit behind with interest rate rises. But we?ll catch up real soon. There?s another meeting next Tuesday.

The cause of the illness came from the treatment

The very reason for our boom-bust cycle is because we have a small group of people making decisions to dictate how the economy should work.

And they get it wrong over again.

Yesterday morning we woke up to the announcement by the Federal Reserve Open Market Committee that it would raise the Federal funds rate by 0.75%. This was in line with market consensus.

The markets rallied strongly after this announcement was made public. Our ASX 200 Index [ASX:XJO] closed almost 1% higher. It was mild compared to other markets ? the NASDAQ Index rose more than 4% and the S&P 500 Index rose 2.6%.

Gold managed to rally nicely as well ? trading almost US$30 higher to sit at US$1,740 an ounce (AU$2,490) within an hour after the rate rise.

And not surprisingly, cryptocurrencies led the pack. Ethereum [ETH] managed to rally more than 15%.

Contrast this with early June when the Federal Reserve raised rates by the same amount, but the market was unprepared for it.

What we?re seeing is the markets hanging onto the words of the central planners. They end up taking a wilder roller coaster ride than needed.

But who can blame them? Years of literally zero interest rates have meant it?s harder to make an honest living relying on your salary or wages. The game is in investing and speculating in some asset.

You name your poison ? stocks, properties, commodities, cryptos, or derivatives.

So the central banks shift society into allocating more into speculating on capital rather than real productivity. And when speculations fail, they paper over it with bailouts, handouts, and creating new debt to keep the game going.

Now that the central banks are reducing the currency supply and calling time earlier than many expect, you?re seeing the global economy implode on itself.

All this is happening as these central bankers take turns telling the people that this rate hike cycle is to stabilise the economy and ensure there is full employment and low inflation. All while people are losing jobs, and inflation (which they claimed to be ?transitory?) is at 40-year highs.

On the precipice of a debt bloodbath

Many Australian borrowers are now in a dreadful predicament. They were lured by cheap loans and bullish forecasts on property prices to secure their dream of owning their home.

It seemed so right at the time. After all, as recently as last November, the RBA assured us that the first rate rise would come in 2024.

If only people remembered these economists? track record about never seeing a recession or a market crash in their lifetime! They would?ve spared themselves a world of hurt.

So the media is now echoing the anger of the people who felt duped by the RBA Board of Governors, which has left them deeply indebted. Things could get worse as the rate rises continue.

With defaults likely to become more common, could the central banks power forward to normalise the economy and then leave it to the governments to placate the masses who literally lose everything?

Or will we see them walk back from their deadly waltz and cut rates?

Or could there be a financial system collapse that we?ve never seen before?

A plague on these central planners? houses, though many will lose theirs because of them.

I hope you?re not among the victims. If that?s the case, follow me here for an opportunity to take advantage of the imminent destruction of the fiat currency system.

God bless,

First to Go: The Money

By Bill Bonner

Editor, The Daily Reckoning Australia

Dear Reader,

Today, we turn our minds to the future, which may prove murkier still.

As we saw in China, during the 1930s and ?40s, the government printed money to pay its bills. It ran up debt it couldn?t pay. And then, the hyperinflation of the 1950s opened the door to Mao?s communists. After that, it was one disaster after another.

Americans think they can continue to borrow and spend forever. Investors are trained to believe that stocks always bounce back. They think that if they just hold on, soon they will be making money again.

And if they owe money, they think they?ll soon be able to refinance at even lower rates.

But all that has changed. Now that we have inflation, it?s a whole new ballgame. The Fed can still print money, but now it will cause consumer prices to rise even faster. Your stocks may go up, as they did from 1966?82, but inflation will wipe out your gains. And when you go to refinance your house, you will be hit by a double whammy. Falling house prices may have erased your ?equity??while rising mortgage interest increases your monthly payments.

The bubble epoch, RIP

Everybody knows you can?t just print money and expect to get rich. Every nation that tried it turned into a complete disaster. In Germany, Russia, and China, high inflation led to the rise of the Nazis, the Bolsheviks, and Mao?s communists. High inflation destroyed the economy of Argentina in the ?90s, of Zimbabwe in the ?00s, and Venezuela in the teens.

They could call it ?stimulus? or ?quantitative easing?, but it was nothing more than the old trick ? spending too much and trying to cover up the excess by printing more money.

Eventually, the bubble becomes a bust.

We?ve already seen nearly US$100 trillion in losses ? stocks, bonds, real estate, and private businesses ? worldwide.

And here?s the important thing: this is not just a typical market sell-off. Stocks will go up and down?but the bubble epoch won?t come back.

Already, inflation is the worst we?ve seen in 41 years?and with no relief in sight?

Gasoline went to US$6 a gallon?and then back down to US$4. Now, inventory levels are at multi-decade lows. And winter looms large. Natural gas bills this season are expected to be 28% higher than last year.

Meanwhile, mortgage interest is at a 20-year high. New house prices are already down 10%.

US total debt now stands at US$93 trillion?and the federal government?s portion of that, US$31 trillion, is growing at US$3.8 billion PER DAY.

A vicious ?culture war? rages at home?while overseas, a war with a nuclear-armed adversary spirals out of control. Who knows where they lead?

Down?down?down?

As for stocks, companies that led the charge higher have plunged since Jan. 3, 2022:

? Nvidia: down 45%

? Apple: down 17%

? Google: down 31%

? Microsoft: down 26%

? Facebook/Meta: down 67%

? Netflix: down 51%

Facebook?s Mark ?Meta? Zuckerberg has lost US$100 billion in the tech rout ? more than any human ever has. House buyers have seen their monthly payments double over the last six months. Millions of homeowners will probably lose their homes in the debacle ahead.

Over in the go-go digital world, cryptos, meme stocks, and many high-risk assets have been all but wiped out?many investors won?t get back a penny on the dollar.

The Wall Street Journal says it?s the ?worst bond market since 1842?. Remember, US Treasury bonds are the bricks and mortar of the entire US financial system. When they crack up, you may lose your pension, your savings, your insurance coverage, everything. Yes, even the Social Security system depends on US bonds. All are now in danger.

What we?ve lost so far is just a hint of what is coming?

Mark Mobius, CEO of Mobius Capital Partners says:

?We probably have another leg down as the Fed continues to raise rates, I expect rates to go much higher??

Billionaire investor Leon Cooperman told CNBC he thought the S&P 500 would fall 40% from its January peak in total?or another 25% from here.

JPMorgan CEO Jamie Dimon said stocks could fall ?another easy 20%? adding that the next drop will be ?much more painful than the first??.

And Stanley Druckenmiller warns, ?there?s a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this ?66 to ?82 time?.

The real (inflation-adjusted) story

But as we explained, stocks weren?t ?flat? during that 1966?82 period. During those 16 years, they lost 72% of their value in real terms (that is to say, thanks to inflation).

Yes, dear reader, dead ahead is a ?dark cluster decade?, when one crisis brings on another one. Prices shoot up. Shortages of food and fuel develop. Stocks crash. Recessions and or depressions begin.

Your savings?your retirement?your investments?your job?your house ? the whole shebang, is in danger.

There are not many things in life where age is an advantage. But some things take time. It takes time to figure things out. And it takes experience to put them in perspective.

Most people today have neither. But if you were born before 1960, you might remember?

?how you could work two jobs in the summer and finish college with no debt...

?how you had to get up at 4:00am to get in line to buy gasoline during the ?73 oil crisis...

?or how mortgage rates hit 16% in 1981.

Most people today can?t imagine it. Financially, most couldn?t survive it.

Could we suffer another ?energy shock?? Yes, we could.

Could stocks go nowhere for the next 31 years? You bet they could.

Might you have to pay a 16% interest rate to refinance your house? Yep.

And it could be far worse...

Back in the ?70s, the US economy and its major institutions hadn?t yet been corrupted by four decades of ?funny money?. Federal debt was still under US$1 trillion until 1980. There was no bubble in the stock market back then. Or in the bond market. People still considered themselves either men or women. And not being a ?racist? was easy; all you had to do was to treat others with respect.

Democrats and Republicans were still talking to each other. We were not in a proxy war with Russia. China was still a ?third-world? nation. We didn?t have more than half the population relying on money from the government. And back then, if you had mentioned a ?new civil war? in the US, people would have thought you were nuts.

Today, it?s a very different situation?.and a much more dangerous one.

Regards,

Bill Bonner

By Bill Bonner

Editor, The Daily Reckoning Australia

Dear Reader,

Today, we turn our minds to the future, which may prove murkier still.

As we saw in China, during the 1930s and ?40s, the government printed money to pay its bills. It ran up debt it couldn?t pay. And then, the hyperinflation of the 1950s opened the door to Mao?s communists. After that, it was one disaster after another.

Americans think they can continue to borrow and spend forever. Investors are trained to believe that stocks always bounce back. They think that if they just hold on, soon they will be making money again.

And if they owe money, they think they?ll soon be able to refinance at even lower rates.

But all that has changed. Now that we have inflation, it?s a whole new ballgame. The Fed can still print money, but now it will cause consumer prices to rise even faster. Your stocks may go up, as they did from 1966?82, but inflation will wipe out your gains. And when you go to refinance your house, you will be hit by a double whammy. Falling house prices may have erased your ?equity??while rising mortgage interest increases your monthly payments.

The bubble epoch, RIP

Everybody knows you can?t just print money and expect to get rich. Every nation that tried it turned into a complete disaster. In Germany, Russia, and China, high inflation led to the rise of the Nazis, the Bolsheviks, and Mao?s communists. High inflation destroyed the economy of Argentina in the ?90s, of Zimbabwe in the ?00s, and Venezuela in the teens.

They could call it ?stimulus? or ?quantitative easing?, but it was nothing more than the old trick ? spending too much and trying to cover up the excess by printing more money.

Eventually, the bubble becomes a bust.

We?ve already seen nearly US$100 trillion in losses ? stocks, bonds, real estate, and private businesses ? worldwide.

And here?s the important thing: this is not just a typical market sell-off. Stocks will go up and down?but the bubble epoch won?t come back.

Already, inflation is the worst we?ve seen in 41 years?and with no relief in sight?

Gasoline went to US$6 a gallon?and then back down to US$4. Now, inventory levels are at multi-decade lows. And winter looms large. Natural gas bills this season are expected to be 28% higher than last year.

Meanwhile, mortgage interest is at a 20-year high. New house prices are already down 10%.

US total debt now stands at US$93 trillion?and the federal government?s portion of that, US$31 trillion, is growing at US$3.8 billion PER DAY.

A vicious ?culture war? rages at home?while overseas, a war with a nuclear-armed adversary spirals out of control. Who knows where they lead?

Down?down?down?

As for stocks, companies that led the charge higher have plunged since Jan. 3, 2022:

? Nvidia: down 45%

? Apple: down 17%

? Google: down 31%

? Microsoft: down 26%

? Facebook/Meta: down 67%

? Netflix: down 51%

Facebook?s Mark ?Meta? Zuckerberg has lost US$100 billion in the tech rout ? more than any human ever has. House buyers have seen their monthly payments double over the last six months. Millions of homeowners will probably lose their homes in the debacle ahead.

Over in the go-go digital world, cryptos, meme stocks, and many high-risk assets have been all but wiped out?many investors won?t get back a penny on the dollar.

The Wall Street Journal says it?s the ?worst bond market since 1842?. Remember, US Treasury bonds are the bricks and mortar of the entire US financial system. When they crack up, you may lose your pension, your savings, your insurance coverage, everything. Yes, even the Social Security system depends on US bonds. All are now in danger.

What we?ve lost so far is just a hint of what is coming?

Mark Mobius, CEO of Mobius Capital Partners says:

?We probably have another leg down as the Fed continues to raise rates, I expect rates to go much higher??

Billionaire investor Leon Cooperman told CNBC he thought the S&P 500 would fall 40% from its January peak in total?or another 25% from here.

JPMorgan CEO Jamie Dimon said stocks could fall ?another easy 20%? adding that the next drop will be ?much more painful than the first??.

And Stanley Druckenmiller warns, ?there?s a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this ?66 to ?82 time?.

The real (inflation-adjusted) story

But as we explained, stocks weren?t ?flat? during that 1966?82 period. During those 16 years, they lost 72% of their value in real terms (that is to say, thanks to inflation).

Yes, dear reader, dead ahead is a ?dark cluster decade?, when one crisis brings on another one. Prices shoot up. Shortages of food and fuel develop. Stocks crash. Recessions and or depressions begin.

Your savings?your retirement?your investments?your job?your house ? the whole shebang, is in danger.

There are not many things in life where age is an advantage. But some things take time. It takes time to figure things out. And it takes experience to put them in perspective.

Most people today have neither. But if you were born before 1960, you might remember?

?how you could work two jobs in the summer and finish college with no debt...

?how you had to get up at 4:00am to get in line to buy gasoline during the ?73 oil crisis...

?or how mortgage rates hit 16% in 1981.

Most people today can?t imagine it. Financially, most couldn?t survive it.

Could we suffer another ?energy shock?? Yes, we could.

Could stocks go nowhere for the next 31 years? You bet they could.

Might you have to pay a 16% interest rate to refinance your house? Yep.

And it could be far worse...

Back in the ?70s, the US economy and its major institutions hadn?t yet been corrupted by four decades of ?funny money?. Federal debt was still under US$1 trillion until 1980. There was no bubble in the stock market back then. Or in the bond market. People still considered themselves either men or women. And not being a ?racist? was easy; all you had to do was to treat others with respect.

Democrats and Republicans were still talking to each other. We were not in a proxy war with Russia. China was still a ?third-world? nation. We didn?t have more than half the population relying on money from the government. And back then, if you had mentioned a ?new civil war? in the US, people would have thought you were nuts.

Today, it?s a very different situation?.and a much more dangerous one.

Regards,

Bill Bonner

they call it "transitory" when the -0.1% gdp after a negative quarter.

last quarter there was supposed to be -gdp figure, but war spending in Ukraine, bail out the figure to +2%.

so this delay get 2 more quarters free till Mar 2023 before a new name can be called again

continue to kick the can down the slope

last quarter there was supposed to be -gdp figure, but war spending in Ukraine, bail out the figure to +2%.

so this delay get 2 more quarters free till Mar 2023 before a new name can be called again

continue to kick the can down the slope

Bye-Bye Bubble World

Dear Reader,

Stocks sold off again yesterday. From CNBC:

?The S&P 500 and Nasdaq Composite closed lower for a third straight session Tuesday as traders struggled to recover from sharp losses suffered in the previous session and looked ahead to more economic tea leaves coming later in the week.

?The Nasdaq Composite shed 0.59% to close at 10,983.78. The S&P 500 lost 0.16%, ending the day at 3,957.63. The Dow Jones Industrial Average notched a marginal gain, closing 3.07 points, or 0.01%, higher at 33,852.53.

?Investors are watching for data coming later this week, including JOLTS job openings on Wednesday and November payrolls Friday, for insight into how the economy is performing. They are also waiting for Federal Reserve Chair Jerome Powell?s scheduled speech at the Hutchins Center on Fiscal and Monetary Policy at Brookings on Wednesday for clues into whether the central bank will slow or stop interest rate hikes.?

We can?t be 100% sure that the rally is over?but it looks like it. And if that is so, we should expect the stock market to take out October?s low, bringing the Dow back down below 29,000 points. As for the final bottom, our guess is that it won?t come anytime soon.

Not your grandad?s market

This is not that steady, comfortable path of the last four decades, in which stocks would sell-off?but soon come bouncing back and then go on to new highs. This is a longer route. Slower. More difficult. This is the path that has been abandoned for the last 40 years. It?s a much more treacherous trail?with traps that catch-up unsuspecting investors.

By our reckoning, we left the well-trod ?buy-the-dip? trail in two steps. First, in July of 2020, the Primary Trend in bonds finally came to an end. Then, the 10-year T-Bond yielded less than six-tenths of 1%. That was it for the bond market. More than 38 years? of falling yields and rising bond prices had finally reversed. A new, long bear market in bonds had begun.

And it?s unlikely that yields will get anywhere close to those 2020 lows again ? not in our lifetimes. Currently, the yield on the 10-year is six times as high ? at 3.6%

In the stock market, the bubble top was finally reached 18 months later in December 2021. Then, the Primary Trend ? a bull market in stocks that had begun in August 1982 ? came to an end. It had taken the Dow from 900 to more than 36,000 in a 39-year period.

Since then, the averages have fallen, bounced, and fallen again. The big losses, naturally enough, came in the ?tech? sector. In 2021, no price for Apple, Google, Facebook, or Microsoft seemed too high. But as 2022 developed, trillions of dollars? worth of capital in these leading stocks just disappeared. Prices fell?far more than the Dow itself.

Leading losers

Facebook (now Meta) was trading at US$334 at the end of last year. Now it is only US$122.

Amazon, similarly, has been cut in half. Nvidia, ditto.

Even the mighty Tesla began the year around US$400 a share. Today?s price? US$179.

Meanwhile, over in the even fluffier crypto world, it?s hard to imagine that Bitcoin [BTC] was at more than US$50,000 a year ago. Now, it?s around US$17,000. But that loss is benign compared to the rest of the crypto scape. Many coins have vanished. Billion-dollar fortunes have gone ?poof? overnight. The second largest exchange ? FTX ? has gone bankrupt. And even coins thought to be ?stable?, by virtue of their links to other assets, have turned out to be worthless.

Taken as a whole, the crypto universe has lost about 75% of its value. That may seem like a lot. But what amazes us is not that so much has been lost, but that there is anything left. Everybody now knows that most cryptos had no value at all. And everybody now knows that some of the leading crypto celebrities ? such as Sam Bankman-Fried ? were either total frauds or total incompetents, maybe both. And nobody knows for sure where the next debacle will appear.

Under those conditions, why is anyone still holding cryptos? The whole idea of cryptos as a ?store of value? has been discredited. It turned out, there was no value to store. Earning ?interest? from your cryptos also turned out to be bogus. If you were lucky, you might participate in some of the speculative gains. But slow, sure, steady interest earnings? From cryptos? They never existed.

But the whole hullabaloo was fun while it lasted. Meme stocks?NFTs?buybacks?stimmy cheques?SPACs?business loans you didn?t have to repay ? whee!

Try to recall these things, dear reader. We?re unlikely to ever see them again.

The Bubble World is gone.

We?re going to miss it.

Regards,

Bill Bonner,

Dear Reader,

Stocks sold off again yesterday. From CNBC:

?The S&P 500 and Nasdaq Composite closed lower for a third straight session Tuesday as traders struggled to recover from sharp losses suffered in the previous session and looked ahead to more economic tea leaves coming later in the week.

?The Nasdaq Composite shed 0.59% to close at 10,983.78. The S&P 500 lost 0.16%, ending the day at 3,957.63. The Dow Jones Industrial Average notched a marginal gain, closing 3.07 points, or 0.01%, higher at 33,852.53.

?Investors are watching for data coming later this week, including JOLTS job openings on Wednesday and November payrolls Friday, for insight into how the economy is performing. They are also waiting for Federal Reserve Chair Jerome Powell?s scheduled speech at the Hutchins Center on Fiscal and Monetary Policy at Brookings on Wednesday for clues into whether the central bank will slow or stop interest rate hikes.?

We can?t be 100% sure that the rally is over?but it looks like it. And if that is so, we should expect the stock market to take out October?s low, bringing the Dow back down below 29,000 points. As for the final bottom, our guess is that it won?t come anytime soon.

Not your grandad?s market

This is not that steady, comfortable path of the last four decades, in which stocks would sell-off?but soon come bouncing back and then go on to new highs. This is a longer route. Slower. More difficult. This is the path that has been abandoned for the last 40 years. It?s a much more treacherous trail?with traps that catch-up unsuspecting investors.

By our reckoning, we left the well-trod ?buy-the-dip? trail in two steps. First, in July of 2020, the Primary Trend in bonds finally came to an end. Then, the 10-year T-Bond yielded less than six-tenths of 1%. That was it for the bond market. More than 38 years? of falling yields and rising bond prices had finally reversed. A new, long bear market in bonds had begun.

And it?s unlikely that yields will get anywhere close to those 2020 lows again ? not in our lifetimes. Currently, the yield on the 10-year is six times as high ? at 3.6%

In the stock market, the bubble top was finally reached 18 months later in December 2021. Then, the Primary Trend ? a bull market in stocks that had begun in August 1982 ? came to an end. It had taken the Dow from 900 to more than 36,000 in a 39-year period.

Since then, the averages have fallen, bounced, and fallen again. The big losses, naturally enough, came in the ?tech? sector. In 2021, no price for Apple, Google, Facebook, or Microsoft seemed too high. But as 2022 developed, trillions of dollars? worth of capital in these leading stocks just disappeared. Prices fell?far more than the Dow itself.

Leading losers

Facebook (now Meta) was trading at US$334 at the end of last year. Now it is only US$122.

Amazon, similarly, has been cut in half. Nvidia, ditto.

Even the mighty Tesla began the year around US$400 a share. Today?s price? US$179.

Meanwhile, over in the even fluffier crypto world, it?s hard to imagine that Bitcoin [BTC] was at more than US$50,000 a year ago. Now, it?s around US$17,000. But that loss is benign compared to the rest of the crypto scape. Many coins have vanished. Billion-dollar fortunes have gone ?poof? overnight. The second largest exchange ? FTX ? has gone bankrupt. And even coins thought to be ?stable?, by virtue of their links to other assets, have turned out to be worthless.

Taken as a whole, the crypto universe has lost about 75% of its value. That may seem like a lot. But what amazes us is not that so much has been lost, but that there is anything left. Everybody now knows that most cryptos had no value at all. And everybody now knows that some of the leading crypto celebrities ? such as Sam Bankman-Fried ? were either total frauds or total incompetents, maybe both. And nobody knows for sure where the next debacle will appear.

Under those conditions, why is anyone still holding cryptos? The whole idea of cryptos as a ?store of value? has been discredited. It turned out, there was no value to store. Earning ?interest? from your cryptos also turned out to be bogus. If you were lucky, you might participate in some of the speculative gains. But slow, sure, steady interest earnings? From cryptos? They never existed.

But the whole hullabaloo was fun while it lasted. Meme stocks?NFTs?buybacks?stimmy cheques?SPACs?business loans you didn?t have to repay ? whee!

Try to recall these things, dear reader. We?re unlikely to ever see them again.

The Bubble World is gone.

We?re going to miss it.

Regards,

Bill Bonner,