JP Morgan Gold Traders Go To Jail, While JP Morgan Exits DoJ "Sin Bin"

Submitted by Ronan Manly, BullionStar.us

There have been some interesting developments in the long running saga of criminal prosecutions by the US Department of Justice (DoJ) against J.P. Morgan and its lawbreaking traders for precious metals price manipulation and fraud.

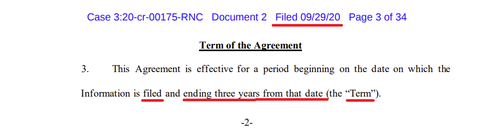

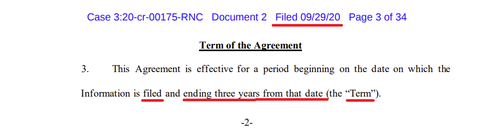

While three of JP Morgan’s top former gold traders were sentenced to jail in late August and September 2023, JP Morgan itself walks free after now having exited its 3 year-long Deferred Prosecution Agreement (DFA) with the US Department of Justice (DoJ) – an agreement which was signed in late September 2019, but began on September 29, 2020 and which expired in late September 2023.

[URL='https://www.justice.gov/criminal-fraud/file/1323586/download']Source[/URL]

This Deferred Prosecution Agreement relates to the September 2019 deal where JP Morgan paid US$ 920 million “in a criminal monetary penalty, criminal disgorgement, and victim compensation" to buy a ‘Get out of Jail Free card“, and avoided prosecution by the DoJ while admitting criminal wrongdoing.

With the expiry of this Agreement, JP Morgan now effectively gets out of the DoJ penalty ‘sin bin’, and will no longer have the DoJ looking over its shoulder, and will no longer have to submit annual compliance reviews to the DoJ.

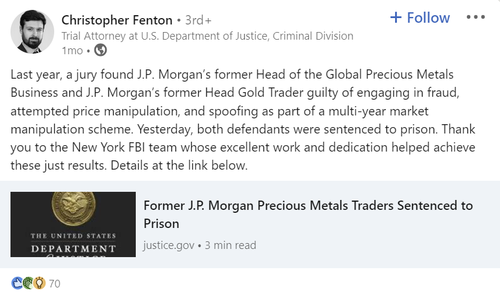

On August 22, 2023, Michael Nowak, J.P. Morgan’s former Head of Global Precious Metals, and Gregg Smith, J.P. Morgan’s former New York head gold trader, were sentenced to prison “for engaging in fraud, attempted price manipulation, and spoofing as part of a market manipulation scheme that spanned over eight years…and resulted in over $10 million in losses to market participants.”

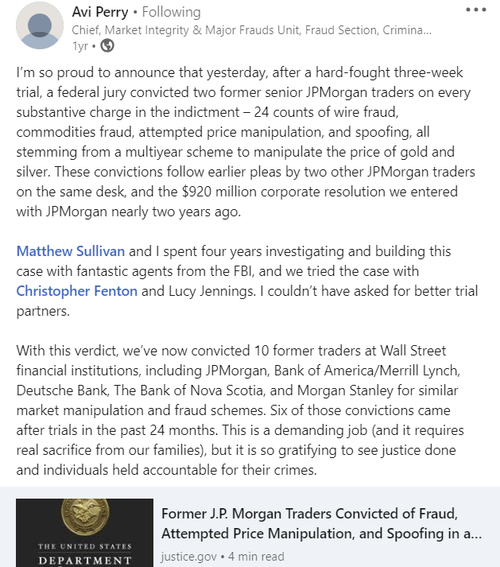

Nowak and Smith had been convicted a year earlier on 10 August 2022 after a jury trial in Chicago found them guilty of “wire fraud affecting a financial institution, commodities fraud, attempted price manipulation, and spoofing”, with Smith being described by the DoJ’s US Assistant Attorney as “the most prolific spoofer that the government has prosecuted to date.”

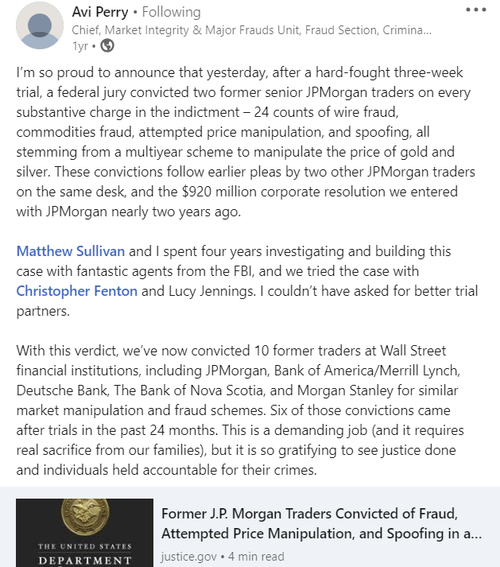

The case had been investigated by the FBI New York Field Office, assisted by the Commodity Futures Trading Commission (CFTC) Division of Enforcement, overseen by the DoJ “Market Integrity & Major Frauds Unit” led by Avi Perry, and prosecuted by DoJ trial attorneys Christopher Fenton, Matthew F. Sullivan, and Lucy B. Jennings, of the DoJ’s Criminal Division’s Fraud Section.

At sentencing in August, Gregg Smith was sentenced to 2 years in prison and a $50,000 fine, with US District Judge Edmond Chang saying to Smith, “You told many lies to the market. For many years, you injected fraud into the market.”

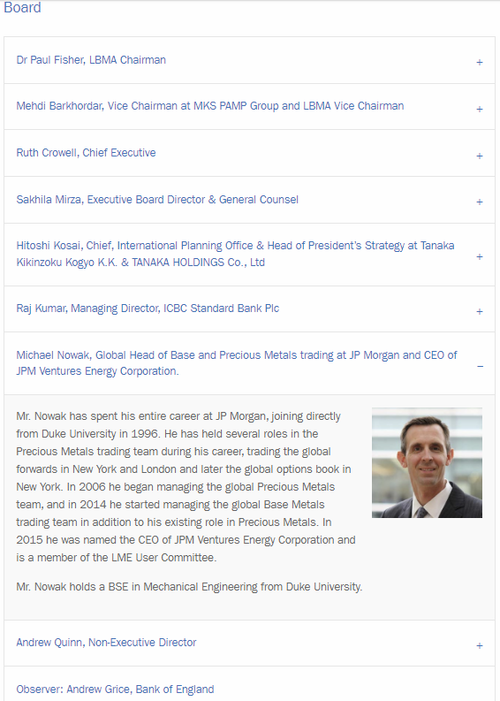

Michael Nowak (who was also on the board of the London Bullion Market Association (LBMA) when arrested by the US Government in September 2019) was sentenced to 1 year in prison and a $35,000 fine.

Specifically, according to the successfully prosecuted DoJ case, a group of JP Morgan precious metals traders, over an 8 year period, rigged the prices of not only gold and silver on COMEX, but of platinum and palladium on NYMEX as well:

The scheme involved the JP Morgan criminals injecting fake orders for precious metals futures contracts (that they intended to cancel before execution). These fake orders created “false and misleading information about the genuine supply and demand for precious metals futures contracts” which then drove “prices in a direction more favorable to orders they intended to execute on the opposite side of the market.”

Indeed, according to the New York Post, “prosecutors alleged the [JP Morgan] precious metals desk made as many as 50,000 spoof trades under Nowak’s watch” and that the global precious metals desk operated as an organized criminal enterprise.

Separately, Nowak and Smith’s precious metals trading desk colleague Christopher Jordan appeared for sentencing on September 15, 2023 (also in front of US District Judge Edmond Chang), charged with fraud in connection with a spoofing scheme in the gold and silver futures markets. Jordan was sentenced to jail for 6 months for wire fraud as part of a “scheme to rig gold and silver markets in his favor”.

Specifically, Jordan had been a trader on JPMorgan’s precious metals desk in New York from 2006 to 2009 where he “engaged in a deceptive spoofing strategy while trading gold and silver futures contracts on the Commodity Exchange (COMEX)” injecting “thousands of spoof orders…. to move so he could then to execute orders on the opposite side of the market.” Jordan was fired from JP Morgan in 2009 after an internal JP Morgan investigation.

Although Jordan had been charged by the DoJ on the same indictment as Nowak and Smith in September 2019, Jordan’s lawyers had managed to get him a separate trial, arguing that he would not get a fair trial if tried jointly with Nowak and Smith. Unfortunately for Jordan, that tactic made no difference, since he too was convicted and has now been sentenced – to 6 months in jail.

Like the futures fake orders of Nowak and Smith, Jordan’s fake orders created “false and misleading information about the genuine supply and demand for gold and silver futures contracts into the markets.”

So not only is the COMEX futures market a structurally fake market where physical supply and demand for precious metals never influences price because more than 99.5% of trading volume is cash-settled, but the cash-settled market itself can’t be trusted to represent real entered orders of longs and shorts, because bullion banks even fake the demand and supply intentions of these cash-settled trades.

Described by the Department of Justice’s assistant attorney general as “some of the most powerful traders in the worldwide precious metals markets”, Nowak, Smith and Jordan “used their positions” to “engage in an egregious effort to manipulate prices for their benefit” that “undermines the investing public’s trust in the integrity of our commodities markets.”

“They had the power to move the market, the power to manipulate the worldwide price of gold,” said DoJ prosecutor Avi Perry during his closing arguments.

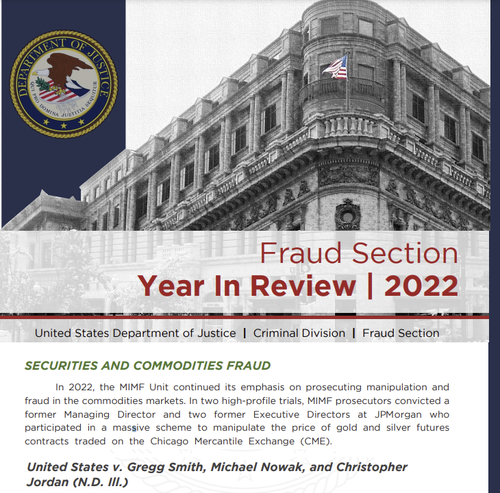

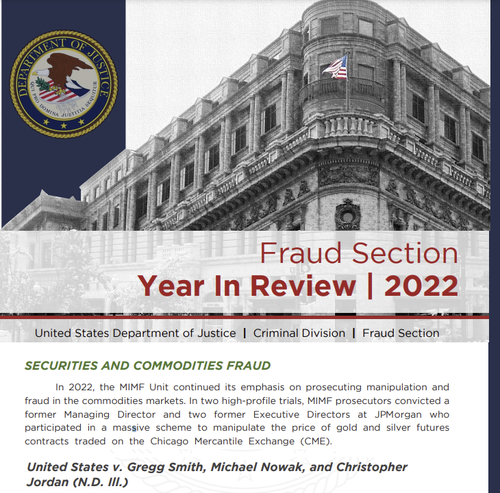

The Department of Justice conviction against the three JP Morgan gold traders was so significant, that the DoJ even made it a feature spread in the DoJ’s “Fraud Section Year in Review 2022” report.

US Department of Justice – “Fraud Section Year in Review 2022". [URL='https://www.justice.gov/criminal-fraud/file/1568606/download']Source [/URL]

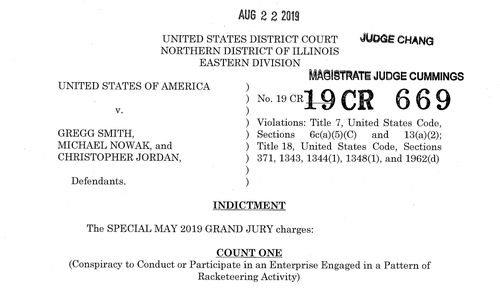

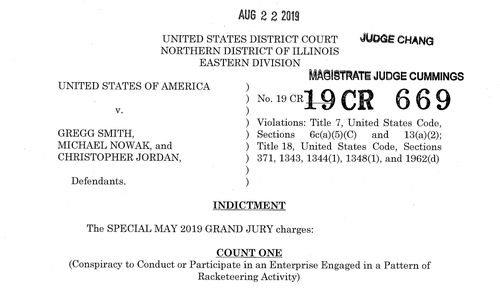

As a reminder, it is now just over 4 years ago on September 16, 2019 when the DoJ ‘unsealed’ the indictment against JP Morgan’s Nowak, Smith, and Jordan charging the three with “a Multi-Year Market Manipulation Racketeering Conspiracy”.

The charges were so serious that the DoJ rolled out the “Racketeer Influenced and Corrupt Organizations Act” (RICO Act) to charge the three with a RICO Conspiracy, legislation which is normally only used to bring down organized criminals in the Mafia.

The DoJ also charged Nowak, Smith and Jordan with a “Conspiracy to defraud the United States“, which is known as a “371 Conspiracy” with the name based on the US general conspiracy statute (18 U.S.C. § 371), which describes a conspiracy as where “two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose.

The DOJ also then in a superseding indictment during November 2019 charged JP Morgan precious metals desk salesman Geffery Ruffo (a colleague of Nowak, Smith and Jordan) with the RICO and 371 Conspiracy counts.

Specifically, the first two charges against Nowak, Smith and Jordan (and Ruffo) were all about “Conspiracy" i.e. plotting together:

COUNT ONE was “Conspiracy to Conduct or Participate in an Enterprise Engaged in a Pattern of Racketeering Activity“.

COUNT TWO was “Conspiracy to Commit Price Manipulation, Bank Fraud, Wire Fraud Affecting a Financial Institution, Commodities Fraud, and Spoofing".

On the RICO count, the DoJ charged Nowak, Smith and Jordan “and their co-conspirators” of being “members of an enterprise – namely, the precious metals desk of JP Morgan” where they ”conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.”

The DoJ had good reason to think that there had been a conspiracy for it had conducted a 4 year long investigation into the ‘global’ JP Morgan precious metals trading desk, and was 100% confident that the global JP Morgan precious metals desk was being run as a criminal enterprise.

A secret Grand Jury of May 2019 had also handed down the verdict that the JP Morgan traders should be investigated for racketeering and conspiracy.

That is why the DoJ charged Nowak and Smith with a racketeering conspiracy in violation of the Racketeer Influenced and Corrupt Organisations Act (RICO Act) and with a 371 Conspiracy.

The DoJ was essentially saying that over the 8 years from 2008 – 2016 specified on the DoJ’s indictment, it viewed the JP Morgan precious metals desk (a group of associated individuals) as an organized crime gang, who operated as a criminal enterprise. ‘Racketeering’ means making money through fraudulent dishonest or illegal activities in a coordinated scheme.

That it was definitely a “pattern of racketeering activity" – which requires at least two acts of racketeering activity committed within ten years of each other – should be obvious, as in the case of the JP Morgan scheme, this consisted of a pattern of racketeering acts “tens of thousands of times”. And there was definitely “continuity" to the scheme as it spanned at least the 8 year period that the DoJ indictment specified. It was also “coordinated", as you will see below.

It was also a “global in scale" criminal enterprise. Even JP Morgan the Company admitted as much in it’s Deferred Prosecution Agreement announcement saying that:

“According to admissions and court documents … numerous traders and sales personnel on JPMorgan’s precious metals desk located in New York, London, and Singapore engaged in a Scheme to Defraud in connection with the purchase and sale of gold, silver, platinum, and palladium futures contracts (collectively, precious metals futures contracts) that traded on NYMEX and COMEX."

Given that the sheer number of JP Morgan precious metals traders that have been involved in this DoJ investigation is a bit mind-boggling, a summary is helpful here. The Mafia would be jealous.

JP Morgan’s Michael Nowak – center

Apart from the JP Morgan traders Nowak, Smith and Jordan (and the salesman Ruffo), there were two other ‘named’ JP traders involved, John Edmonds and Christian Trunz. That makes a gang of six. But there were also 4 other JP Morgan traders ‘identified‘ in JP Morgan’s Deferred Prosecution Agreement (DPA) without being named (as you’ll see below). That overall makes at least 10 JP Morgan traders involved. Yes 10!

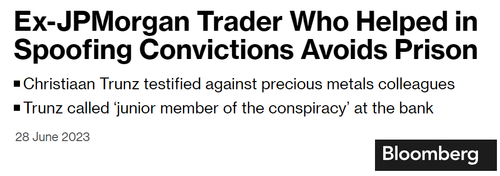

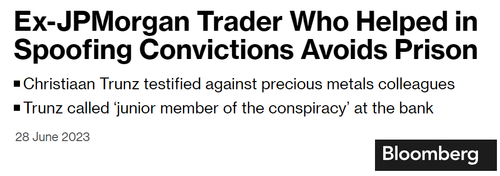

Anyone following this case will be familiar with the names John Edmonds and Christian Trunz. During the DoJ investigation, both Edmonds and Trunz (colleagues of Nowak, Smith and Jordan) turned state’s evidence and pleaded guilty to DOJ charges and then became witnesses for the DoJ testifying in the trials about the market manipulation carried out by Nowak, Smith and Jordan.

[Note – In July 2021, the DoJ had planned to call 34 witnesses to the trial of Nowak, Smith, Jordan and Ruffo, at least 12 of whom were from JP Morgan or formerly of JP Morgan.]

In October 2018, John Edmonds pleaded guilty to one count of commodities fraud and one count of conspiracy to commit wire fraud, commodities fraud, price manipulation, and spoofing.

In August 2019, Christian Trunz pleaded guilty to one count of conspiracy to engage in spoofing and one count of spoofing. From their testimony, it was definitely obvious that their was a conspiracy and collusion, and that JP Morgan’s global precious metals desk was run as a criminal enterprise.

For example, Trunz, when testifying during the trial of Nowak and Smith said that Smith was so fast at placing and cancelling bogus spoofing orders that the other traders on JP Morgan’s precious metals the trading desk joked that he needed to put ice on his fingers to cool them down, or that Smith must be double-jointed. The entire JP Morgan trading desk knew about the spoofing trades and that it was a topic for discussion.

Trunz worked on the JP Morgan precious metals trading desks in New York, Singapore and London between 2008 and 2019, and worked closely with Smith and Nowak.

“This was an open strategy on the desk,” said Trunz, “It wasn’t hidden.” Trunz said he “learnt how to spoof from Smith and others after joining Bear Stearns out of college in 2007, shortly before the bank was acquired by JPMorgan.”

“We all traded that way” Trunz said. “We utilized that strategy on the desk to make money for ourselves and for our clients.” Let that sink in. They all traded that way. This was racketeering and conspiracy. This was a criminal enterprise.

JP Morgan’s Gregg Smith leaving court

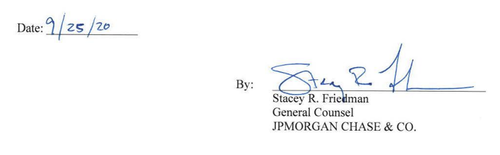

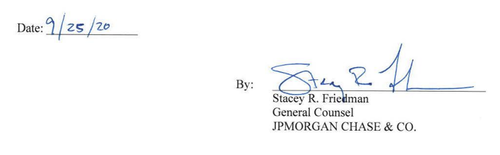

The existence of price manipulation in a coordinated and conspiratorial scheme was even admitted to by JP Morgan in its Deferred Prosecution Agreement (DPA) with the US Department of Justice which was published on September 29, 2019, and which was actually signed by JP Morgan on September 25, 2019. You can see that document here.

The signing party on behalf of JP Morgan (the ‘Company’) was Stacey R Friedman, JP Morgan Chase General Counsel, who signed on behalf of all three JP Morgan entities that were prosecuted – JPMorgan Chase & Co, JPMorgan Chase Bank, N.A., and J.P. Morgan Securities LLC and admitted everything you’ll see below.

Signature of JP Morgan Chase General Counsel, [URL='https://www.jpmorganchase.com/about/our-leadership/stacey-friedman']Stacey R Friedman[/URL]

Point 4 (a) on pages 3 and 4 states that:

“The nature and seriousness of the offense conduct, which involved tens of thousands of instances of unlawful trading in gold, silver, platinum, and palladium (“precious metals”) futures contracts by ten former traders on the precious metals desk of the Company and the Related Entities resulting in at least $205,992,102 of loss to other precious metals futures market participants between March 2008 and August 2016."

This is JP Morgan admitting that there was a Conspiracy ‘by ten former traders‘. Not 3. Not 5, but 10. JP Morgan admitted to the Conspiracy just a few days after Nowak and Smith had been arrested.

The global structure of the criminal enterprise was even laid out in this same document – “the Company, together with its subsidiaries including JPMC and its affiliates, ran one of the world’s largest precious metals businesses through its Global Commodities Group with precious metals traders that worked in offices in New York, Singapore, and London, England, and that operated as part of a single, cohesive global unit or “desk” (the ‘Precious Metals Desk’)."

We can see the identities of these 10 as follows:

Page A5 of the DPA states:

Unlawful Precious Metals Trading

Precious Metals Relevant Period here refers to “from at least March 2008 until August 2016".

Pages A3 – A5 of the DPA list the 10 individuals:

section 7. Gregg Smith

section 8. Michael Nowak

section 9. Jeffrey Ruffo

section 10. Christopher Jordan

section 11. John Edmonds

section 12. Christian Trunz

Then sections 13 – 16 ‘identify’ the other four traders without naming them.

section “13: Trader 1 was employed as a precious metals trader at Bear Stearns from May 2007 until its acquisition by the Company in May 2008. Trader 1 was employed as a Managing Director and trader on the Precious Metals Desk in New York until he left JPMC in July 2014."

section “14: Trader 2 joined JPMC in 2003. He was employed as a trader on the Precious Metals Desk in London as an Executive Director at the beginning of the Precious Metals Relevant Period. Trader 2 became a Managing Director in May 2014 and ultimately supervised the precious metals traders in London until he left JPMC in July 2017."

section “15: Trader 3 joined JPMC in July 2005….Trader 3 became an Executive Director in November 2014 and remained in that position through the end of the Precious Metals Relevant Relevant Period, he worked in New York and London. Trader 3 left JPMC in October 2019 and was a Managing Director and the Global Head of Precious Metals Trading at the time of his departure.“

section “16: Trader 4 joined JPMC in 2004. …Trader 4 became a Vice President in 2010 and an Executive Director in February 2014. Trader 4 was terminated from JPMC in June 2014 in connection with an inquiry into his trading activity."

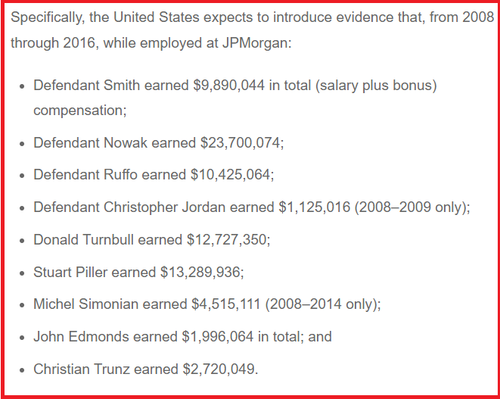

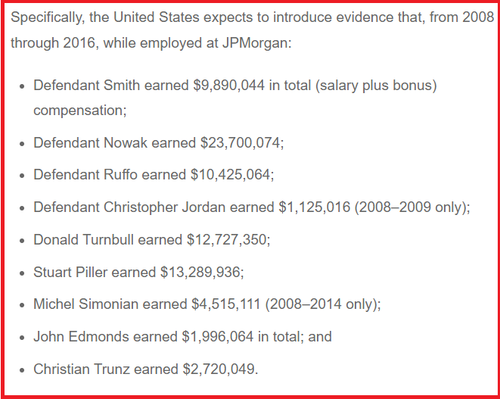

It’s actually easy enough to name 75% of these additional 4 traders by cross-referencing media sources, and not least because the DoJ stated the names of most of them in July 2021 when it moved to introduce “the salary and bonus information for the defendants and their co- conspirators.“

Details of the eye-watering compensation (in US dollars) of the JP Morgan precious metals trader defendants and their co-conspirators between 2008 – 2016. [URL='https://fxnewsgroup.com/forex-news/institutional/court-allows-doj-to-present-bonus-salary-info-about-jpmorgan-traders-in-spoofing-trial/']Source[/URL]

In addition to Nowak, Smith, Jordan, Ruffo, Trunz, and Edmonds, this salary and bonus information was revealed for Donald Turnbull, Stuart Piller and Michel Simonian (in the case of Simonian between 2008 – 2014).

From this article here, we see that:

Trader 4 was Michel Simonian.

An article here from September 13, 2019 states that:

Trader 2 was Stu Piller.

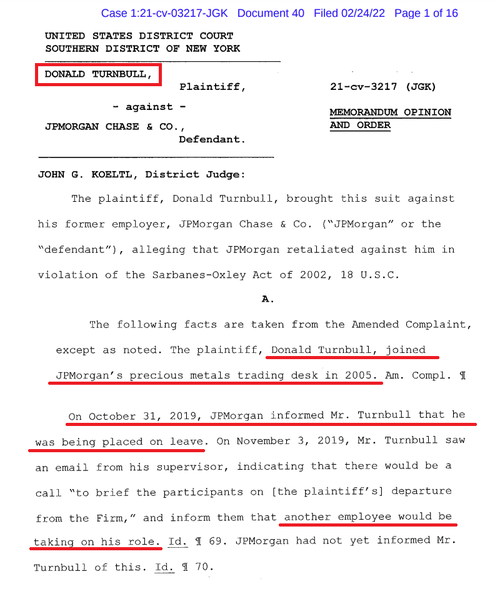

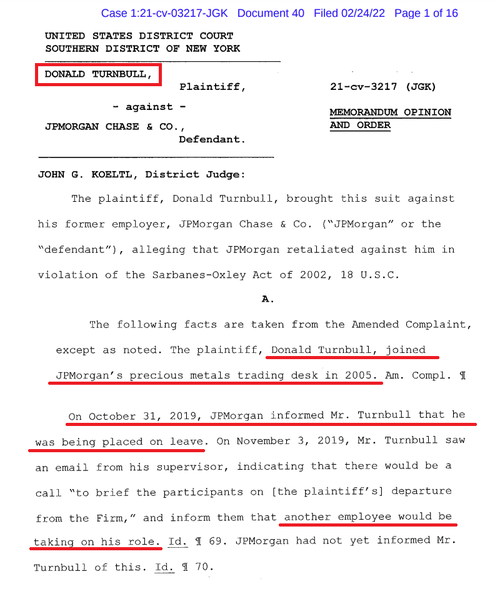

JP Morgan precious metals trader Donald Turnbull took a case against JP Morgan in 2022 saying that he was illegally terminated by JP Morgan in October 2019 after cooperating with the DoJ into the JP Morgan precious metals desk manipulation. Turnbull had “joined JPMorgan’s precious metals trading desk in 2005" and he left JP Morgan in October 2019 and was a Managing Director and the Global Head of Precious Metals Trading at the time of his departure." The legal document for that case makes it clear that…Trader 3 was Donald Turnbull.

Extracts from the case by Donald Turnbull against JP Morgan

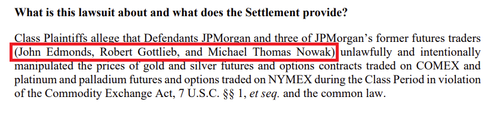

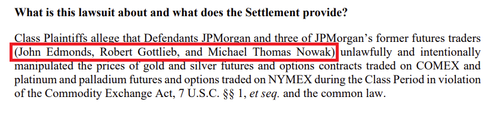

The identity of “Trader 1" may be Robert Gottlieb, who joined JP Morgan’s precious metals desk in 2008 from Bear Sterns alongside Gregg Smith and Christian Trunz. However Gottlieb had joined Bear Stearns in January 2006 from HSBC, and not in May 2007, as section 13 above states about Trader 1. Gottlieb had worked together with Christopher Jordan at HSBC and at Republic National Bank of New York before it was taken over by HSBC. See Amended Consolidated Class Action Complaint.

There is good reason to think that Gottlieb is Trader 1 as he also made an appearance in a 2015 civil case brought by three independent precious metals traders ) against JP Morgan and in which Goottlieb, Michael Nowak and John Edmonds were defendants. Gottlieb was described as controlling “the decision making for J. P. Morgan’s silver positions and took the primary role in trading JP Morgan’s silver spreads."

[URL='https://preciousmetalsfuturesclassactionsettlement.com/docs/Court%20Document%20Page/Class%20Plaintiffs%E2%80%99%20Motion%20for%20Preliminary%20Approval/7.pdf']Source[/URL]

Gottlieb had left JP Morgan and gone to work at Koch Industries. That civil suit was halted in 2018 when the DoJ was pursuing its criminal case against Nowak et al, but then this civil case was eventually settled by JP Morgan in 2020 for an undisclosed sum. Which was then revealed to be US$ 60 million. See here.

So overall, it was all very strange that the jury which heard the cases of Nowak and Smith and returned its verdict on August 10, 2022, did not find them guilty of conspiracy and racketeering, but only of breaking numerous laws individually, as follows:

See BullionStar article from August 22, 2022 here.

Full jury verdict (as per the Docket Entry of the Court Clerk):

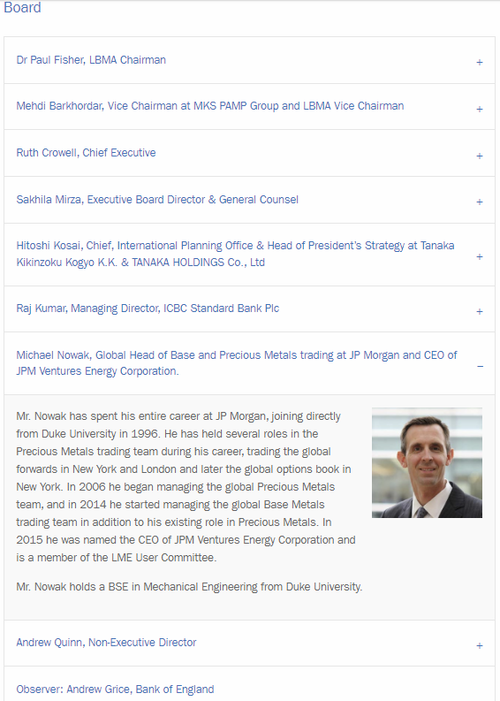

In all of the above, one question is baffling? Why did Michael Nowak, head of JP Morgan’s precious metals trading desk, join the board of the London Bullion Market Association (LBMA) in July 2019, if he, and people in the JP Morgan organization, as well as people in the DoJ, FBI and CFTC all knew that he and the JP Morgan precious metals desk was under criminal investigation?

Isn’t the LBMA supposed to be the ‘Global Authority on Gold’?

As a recap, Michael Nowak (known as Mike) joined the LBMA Board in July 2019, while he was under DoJ investigation, which was a month before he was put on leave by JP Morgan, and two months before be was arrested by the DoJ.

You can see the LBMA Board profile page here:

Mike Nowak’s profile listed alongside the other LBMA board members. [URL='https://web.archive.org/web/20190917072446/http://www.lbma.org.uk/committees']Source.[/URL]

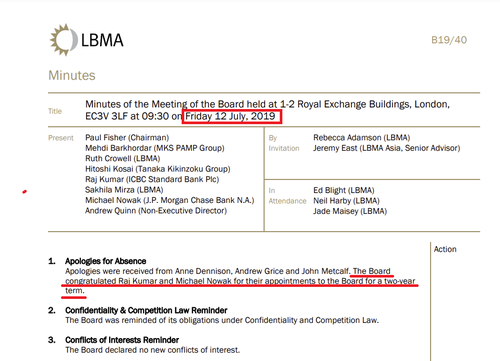

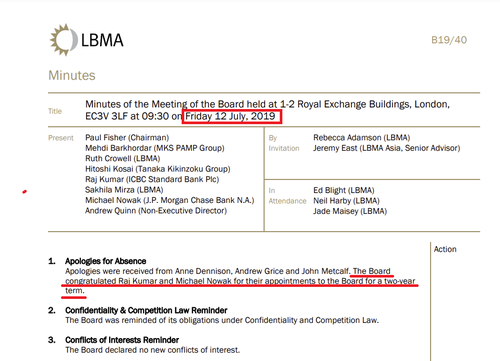

Nowak attended his first (and only) LBMA Board meeting on July 12, 2019, and the minutes of the meeting can be seen here and in archive here.

In this Board meeting, the LBMA Board congratulated Mike Nowak on his appointment to the Board for a 2 year term.

Minutes of the LBMA Board meeting July 12, 2019

Then on August 20, 2019, Christian Trunz, part of Nowak’s precious metals desk, “pleaded guilty in the Eastern District of New York to an information charging him with one count of conspiracy to engage in spoofing and one count of spoofing“. Trunz then resigned from JP Morgan on the same day.

According to CNBC, Michael Nowak “was placed on leave around late August" [2019].

On September 16, 2019, Mike Nowak and Gregg Smith were arrested, and their indictment was unsealed. While this indictment was only “unsealed" on September 16, 2019, it has an original date stamped on it of August 22, 2019, and it refers to a “SPECIAL MAY 2019 GRAND JURY”.

The original indictment against Nowak, Smith and Jordan is dated 22 August 2019 [URL='https://www.justice.gov/opa/press-release/file/1202466/download']Source.[/URL]

This “SPECIAL MAY 2019 GRAND JURY” was a special court which had met since (or been selected during) May 2019 to hear evidence on the DoJ case against the JP Morgan manipulators. August 22 was the date on which the Grand Jury returned the sealed indictment.

The meaning of a ‘Grand Jury’ is as follows:

If the grand jury finds probable cause, then it will return a written statement of the charge called an indictment.

This “SPECIAL MAY 2019 GRAND JURY” then returned a 14-count sealed indictment on August 22, 2019 charging Nowak, Smith and Jordan with a racketeering conspiracy:

Which means that a lot of insiders in the DoJ and the CFTC, and the Illinois courts, and even JP Morgan senior executives, would have known about the existence of the Grand Jury back in May 2019 2 months before the LBMA added Nowak to the LBMA Board.

Why then did the LBMA only remove Nowak from the LBMA Board on September 20, 2019? See BullionStar article here.

Nowak and his precious metals traders also knew about the DoJ investigation months before he was appointed by the LBMA. Christian Trunz was interviewed by the FBI on August 19, 2019. See Footnote 8 page 20 – ”FBI 302 of Christian Trunz interview dated August 19, 2019”. A “302” is the form used by F.B.I. agents to summarize an interview.

That document talks about a period “after they [Trunz and Nowak] both had learned of the government’s investigation and were represented by counsel, but before either had been charged. In his interviews with the FBI and at trial, Trunz said that he and Mike spoke often about the investigation in this period, during Mike’s regular trips to the London office.”

Trunz pleaded guilty in court on August 20, 2019. So before Trunz was charged on August 20, 2019, Nowak knew about the DoJ investigation and was already represented by counsel. Before the Grand Jury returned a 14-count sealed indictment charging Nowak, Nowak knew of the government investigation. As Trunz told the FBI, they often spoke about the investigation, during Mike’s regular trips to London (not just one trip, trips in plural, regular trips).

This was the exact time that Mike Nowak joined the Board of Directors of the London Bullion Market Association (LBMA) on July 12, 2019. Nowak knew he was under investigation by the DoJ when he joined the LBMA Board of Directors in July 2019.

Why didn’t the LBMA not see it fit to ask Nowak (or any new Board member) a question such as: “Is there anything that might prevent you from being on the LBMA Board?" And why did Nowak not tell them?

In Additional, Nowak was already a defendant in a civil suit in New York concerning precious metals manipulation which was getting covering from 2015 up until 2018. See here and here.

And also see the JP Morgan quarterly reports which had to divulge this litigation. For example, see the JP Morgan first quarter 10-Q filing dated May 1, 2019:

Additionally, one of Nowak’s traders, John Edmonds, had pleaded guilty in November 2018 “to commodities fraud and a spoofing conspiracy in connection with …fraudulent and deceptive trading activity in the precious metals futures contracts markets.“

According to the DoJ at that time: “for years, John Edmonds engaged in a sophisticated scheme to manipulate the market for precious metals futures contracts". he “By conspiring with his trading partners to place spoof orders, he blatantly attempted to profit off of an unfair market that he helped create."

Why did the LBMA not know in 2018 about this prosecution of Nowak’s trader Edmonds?

Why did the LBMA not know in 2017 about this case and that Smith, one of Nowak’s chief traders, had been fined?

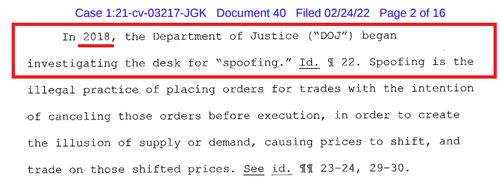

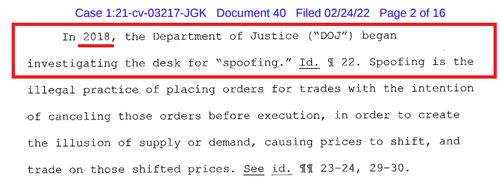

In fact, it was common knowledge across investment bank trading floors that the DoJ began to investigate the JP Morgan precious metals desk in 2018 for spoofing.

[URL='https://www.dol.gov/sites/dolgov/files/OALJ/PUBLIC/WHISTLEBLOWER/DECISIONS/COURT_DECISIONS/21-03217-Turnbull-SD-NY-02-24-2022.pdf']Source[/URL]

Why did the event organizers the LBMA not know this, or did they?

After Nowak was dropped from the LBMA Board, the LBMA Board had its next meeting on September 26, 2019, and the minutes did not mention Nowak’s ousting at all. Crickets. See here and in archive here.

Then on 7 November 2019, Nowak was suspended and prohibited from working in a bank by the US Senior Deputy Comptroller for Large Bank Supervision

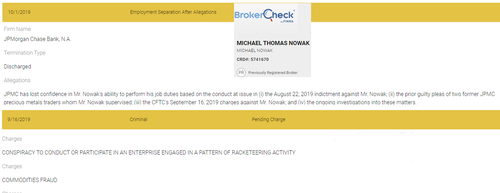

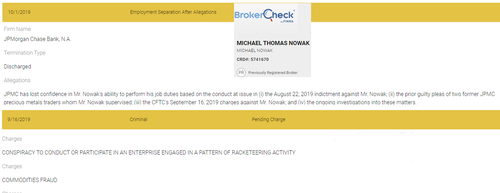

In FINRA BrokerCheck, Nowak’s status now says ‘Discharged’. See here.

[URL='https://brokercheck.finra.org/individual/summary/5741670']Source[/URL]

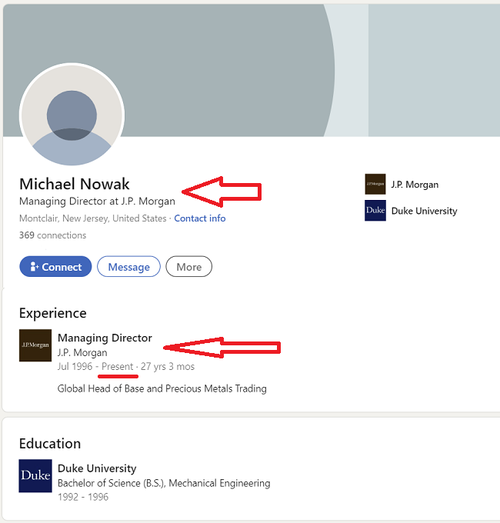

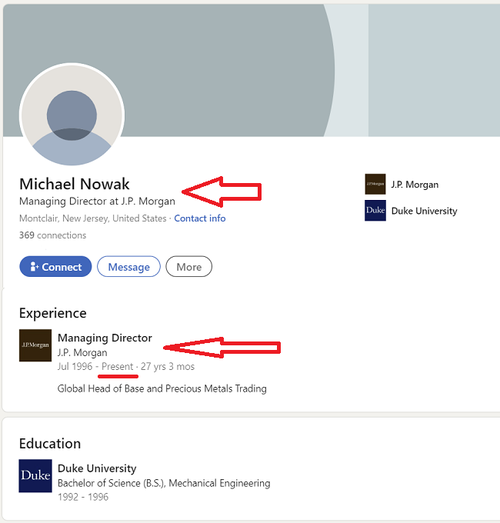

It’s therefore very strange then that after being prohibited from working in a bank by the US Government and after having been sentenced to jail, the Linkedin page of Micheal Nowak still now says that he works for JP Morgan as a Managing Director and as Global Head of Base and Precious Metals.

[URL='https://www.linkedin.com/in/michael-nowak-327137a2/']Source[/URL]

Despite years of precious metals manipulations by multiple JP Traders across gold, silver, platinum and palladium:

JP Morgan Securities is still a trading member of the COMEX and NYMEX.

JP Morgan Securities is still a clearing member firm of the CME for COMEX and NYMEX.

JP Morgan Chase Bank NA stills runs one the biggest COMEX gold depositories in New York.

JP Morgan Chase Bank is still one of the seven Full Market Makers of the London Bullion Market Association.

JP Morgan is still one of the 4 members of the London Precious Metals Clearing Limited (LPMCL).

JP Morgan is still one of the direct participants of the LBMA Gold Price and the LBMA Silver Price auctions.

JP Morgan runs one of the biggest gold and silver vaults in the LBMA vault network in London.

JP Morgan Chase Bank NA is now one of the two custodians of the SPDR Gold Trust (GLD) having only been appointed recently.

J.P. Morgan Securities LLC is still an Authorized Participant of the SPDR Gold Trust.

JP Morgan is still custodian of the iShares Silver Trust (SLV).

JP Morgan is still a Market Making member of the London Platinum and Palladium Market (LPPM), and other JP Morgan entities (J P Morgan SE and J P Morgan Securities plc) are still associate members of the LPPM.

How is any of this possible? Maybe ask the LBMA/LPPM at its annual 2023 conference which is on (as I write) in Barcelona, between 15-17 October.

I’ll tell you why it’s possible. It is possible because JP Morgan paid US$ 920 million to get out of jail free, while sacrificing a handful of traders.

As the Financial Times said on September 24, 2020 about JP Morgan’s settlement with the DoJ:

If you read the DPA, you’ll see that those conditions were just compliance guff about annual compliance review, compliance hiring, monitoring, compliance training, something which traders just throw in the trash can. Something which ChatGPT could spew out in a few seconds.

They say that a leopard never changes its spots. Now that JP Morgan has exited its Deferred Prosecution Agreement with the US Department of Justice, how long before it’s back to its old tricks? Roll up and take your bets.

As well as JP Morgan being embedded into every aspect of trading, clearing and vaulting in the New York and London precious metals markets, JP Morgan has also managed to get its tentacles on to nearly all the LBMA committees.

For there are JP Morgan representatives still on the LBMA Finance Committee, the LBMA Regulatory Affairs Committee, the LBMA Physical Committee, and the LBMA Vault Managers Working Group, and the LPMCL Board of Directors.

The question is whether there is a JP Morgan representative on the LBMA Financial Crime Working Group? Yes it exists.

JP Morgan’s ‘first hand’ input would indeed be valuable to this Financial Crime Working Group given that the JP Morgan precious metals trading desk, which operated as a criminal enterprise, was an ideal ‘working’ example of organized ‘Financial Crime’.

This article was originally published on the BullionStar.us website under the same title "JP Morgan Gold Traders go to Jail, while JP Morgan exits DoJ ‘Sin Bin’".

Tyler Durden Sun, 10/22/2023 - 23:20

Continue reading...

Submitted by Ronan Manly, BullionStar.us

There have been some interesting developments in the long running saga of criminal prosecutions by the US Department of Justice (DoJ) against J.P. Morgan and its lawbreaking traders for precious metals price manipulation and fraud.

While three of JP Morgan’s top former gold traders were sentenced to jail in late August and September 2023, JP Morgan itself walks free after now having exited its 3 year-long Deferred Prosecution Agreement (DFA) with the US Department of Justice (DoJ) – an agreement which was signed in late September 2019, but began on September 29, 2020 and which expired in late September 2023.

[URL='https://www.justice.gov/criminal-fraud/file/1323586/download']Source[/URL]

This Deferred Prosecution Agreement relates to the September 2019 deal where JP Morgan paid US$ 920 million “in a criminal monetary penalty, criminal disgorgement, and victim compensation" to buy a ‘Get out of Jail Free card“, and avoided prosecution by the DoJ while admitting criminal wrongdoing.

With the expiry of this Agreement, JP Morgan now effectively gets out of the DoJ penalty ‘sin bin’, and will no longer have the DoJ looking over its shoulder, and will no longer have to submit annual compliance reviews to the DoJ.

“You Told Many Lies to the Market"

On August 22, 2023, Michael Nowak, J.P. Morgan’s former Head of Global Precious Metals, and Gregg Smith, J.P. Morgan’s former New York head gold trader, were sentenced to prison “for engaging in fraud, attempted price manipulation, and spoofing as part of a market manipulation scheme that spanned over eight years…and resulted in over $10 million in losses to market participants.”

Nowak and Smith had been convicted a year earlier on 10 August 2022 after a jury trial in Chicago found them guilty of “wire fraud affecting a financial institution, commodities fraud, attempted price manipulation, and spoofing”, with Smith being described by the DoJ’s US Assistant Attorney as “the most prolific spoofer that the government has prosecuted to date.”

The case had been investigated by the FBI New York Field Office, assisted by the Commodity Futures Trading Commission (CFTC) Division of Enforcement, overseen by the DoJ “Market Integrity & Major Frauds Unit” led by Avi Perry, and prosecuted by DoJ trial attorneys Christopher Fenton, Matthew F. Sullivan, and Lucy B. Jennings, of the DoJ’s Criminal Division’s Fraud Section.

At sentencing in August, Gregg Smith was sentenced to 2 years in prison and a $50,000 fine, with US District Judge Edmond Chang saying to Smith, “You told many lies to the market. For many years, you injected fraud into the market.”

Michael Nowak (who was also on the board of the London Bullion Market Association (LBMA) when arrested by the US Government in September 2019) was sentenced to 1 year in prison and a $35,000 fine.

Specifically, according to the successfully prosecuted DoJ case, a group of JP Morgan precious metals traders, over an 8 year period, rigged the prices of not only gold and silver on COMEX, but of platinum and palladium on NYMEX as well:

“between approximately May 2008 and August 2016, Smith and Nowak, along with other traders on the JPMorgan precious metals desk, engaged in a widespread spoofing, market manipulation, and fraud scheme” involving “tens of thousands of deceptive trading sequences for gold, silver, platinum, and palladium futures contracts traded through the New York Mercantile Exchange Inc. (NYMEX) and Commodity Exchange Inc. (COMEX), which are commodities exchanges operated by CME Group Inc.”

The scheme involved the JP Morgan criminals injecting fake orders for precious metals futures contracts (that they intended to cancel before execution). These fake orders created “false and misleading information about the genuine supply and demand for precious metals futures contracts” which then drove “prices in a direction more favorable to orders they intended to execute on the opposite side of the market.”

Indeed, according to the New York Post, “prosecutors alleged the [JP Morgan] precious metals desk made as many as 50,000 spoof trades under Nowak’s watch” and that the global precious metals desk operated as an organized criminal enterprise.

Separately, Nowak and Smith’s precious metals trading desk colleague Christopher Jordan appeared for sentencing on September 15, 2023 (also in front of US District Judge Edmond Chang), charged with fraud in connection with a spoofing scheme in the gold and silver futures markets. Jordan was sentenced to jail for 6 months for wire fraud as part of a “scheme to rig gold and silver markets in his favor”.

Specifically, Jordan had been a trader on JPMorgan’s precious metals desk in New York from 2006 to 2009 where he “engaged in a deceptive spoofing strategy while trading gold and silver futures contracts on the Commodity Exchange (COMEX)” injecting “thousands of spoof orders…. to move so he could then to execute orders on the opposite side of the market.” Jordan was fired from JP Morgan in 2009 after an internal JP Morgan investigation.

Although Jordan had been charged by the DoJ on the same indictment as Nowak and Smith in September 2019, Jordan’s lawyers had managed to get him a separate trial, arguing that he would not get a fair trial if tried jointly with Nowak and Smith. Unfortunately for Jordan, that tactic made no difference, since he too was convicted and has now been sentenced – to 6 months in jail.

Like the futures fake orders of Nowak and Smith, Jordan’s fake orders created “false and misleading information about the genuine supply and demand for gold and silver futures contracts into the markets.”

So not only is the COMEX futures market a structurally fake market where physical supply and demand for precious metals never influences price because more than 99.5% of trading volume is cash-settled, but the cash-settled market itself can’t be trusted to represent real entered orders of longs and shorts, because bullion banks even fake the demand and supply intentions of these cash-settled trades.

Undermining the Investing Public’s Trust

Described by the Department of Justice’s assistant attorney general as “some of the most powerful traders in the worldwide precious metals markets”, Nowak, Smith and Jordan “used their positions” to “engage in an egregious effort to manipulate prices for their benefit” that “undermines the investing public’s trust in the integrity of our commodities markets.”

“They had the power to move the market, the power to manipulate the worldwide price of gold,” said DoJ prosecutor Avi Perry during his closing arguments.

The Department of Justice conviction against the three JP Morgan gold traders was so significant, that the DoJ even made it a feature spread in the DoJ’s “Fraud Section Year in Review 2022” report.

US Department of Justice – “Fraud Section Year in Review 2022". [URL='https://www.justice.gov/criminal-fraud/file/1568606/download']Source [/URL]

Racketeering – Criminal Enterprise – Mafia Style

As a reminder, it is now just over 4 years ago on September 16, 2019 when the DoJ ‘unsealed’ the indictment against JP Morgan’s Nowak, Smith, and Jordan charging the three with “a Multi-Year Market Manipulation Racketeering Conspiracy”.

The charges were so serious that the DoJ rolled out the “Racketeer Influenced and Corrupt Organizations Act” (RICO Act) to charge the three with a RICO Conspiracy, legislation which is normally only used to bring down organized criminals in the Mafia.

The DoJ also charged Nowak, Smith and Jordan with a “Conspiracy to defraud the United States“, which is known as a “371 Conspiracy” with the name based on the US general conspiracy statute (18 U.S.C. § 371), which describes a conspiracy as where “two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose.

The DOJ also then in a superseding indictment during November 2019 charged JP Morgan precious metals desk salesman Geffery Ruffo (a colleague of Nowak, Smith and Jordan) with the RICO and 371 Conspiracy counts.

Specifically, the first two charges against Nowak, Smith and Jordan (and Ruffo) were all about “Conspiracy" i.e. plotting together:

COUNT ONE was “Conspiracy to Conduct or Participate in an Enterprise Engaged in a Pattern of Racketeering Activity“.

COUNT TWO was “Conspiracy to Commit Price Manipulation, Bank Fraud, Wire Fraud Affecting a Financial Institution, Commodities Fraud, and Spoofing".

On the RICO count, the DoJ charged Nowak, Smith and Jordan “and their co-conspirators” of being “members of an enterprise – namely, the precious metals desk of JP Morgan” where they ”conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.”

The DoJ had good reason to think that there had been a conspiracy for it had conducted a 4 year long investigation into the ‘global’ JP Morgan precious metals trading desk, and was 100% confident that the global JP Morgan precious metals desk was being run as a criminal enterprise.

A secret Grand Jury of May 2019 had also handed down the verdict that the JP Morgan traders should be investigated for racketeering and conspiracy.

That is why the DoJ charged Nowak and Smith with a racketeering conspiracy in violation of the Racketeer Influenced and Corrupt Organisations Act (RICO Act) and with a 371 Conspiracy.

The DoJ was essentially saying that over the 8 years from 2008 – 2016 specified on the DoJ’s indictment, it viewed the JP Morgan precious metals desk (a group of associated individuals) as an organized crime gang, who operated as a criminal enterprise. ‘Racketeering’ means making money through fraudulent dishonest or illegal activities in a coordinated scheme.

That it was definitely a “pattern of racketeering activity" – which requires at least two acts of racketeering activity committed within ten years of each other – should be obvious, as in the case of the JP Morgan scheme, this consisted of a pattern of racketeering acts “tens of thousands of times”. And there was definitely “continuity" to the scheme as it spanned at least the 8 year period that the DoJ indictment specified. It was also “coordinated", as you will see below.

It was also a “global in scale" criminal enterprise. Even JP Morgan the Company admitted as much in it’s Deferred Prosecution Agreement announcement saying that:

“According to admissions and court documents … numerous traders and sales personnel on JPMorgan’s precious metals desk located in New York, London, and Singapore engaged in a Scheme to Defraud in connection with the purchase and sale of gold, silver, platinum, and palladium futures contracts (collectively, precious metals futures contracts) that traded on NYMEX and COMEX."

Given that the sheer number of JP Morgan precious metals traders that have been involved in this DoJ investigation is a bit mind-boggling, a summary is helpful here. The Mafia would be jealous.

JP Morgan’s Michael Nowak – center

Gang of 5 becomes Gang of 10

Apart from the JP Morgan traders Nowak, Smith and Jordan (and the salesman Ruffo), there were two other ‘named’ JP traders involved, John Edmonds and Christian Trunz. That makes a gang of six. But there were also 4 other JP Morgan traders ‘identified‘ in JP Morgan’s Deferred Prosecution Agreement (DPA) without being named (as you’ll see below). That overall makes at least 10 JP Morgan traders involved. Yes 10!

Anyone following this case will be familiar with the names John Edmonds and Christian Trunz. During the DoJ investigation, both Edmonds and Trunz (colleagues of Nowak, Smith and Jordan) turned state’s evidence and pleaded guilty to DOJ charges and then became witnesses for the DoJ testifying in the trials about the market manipulation carried out by Nowak, Smith and Jordan.

[Note – In July 2021, the DoJ had planned to call 34 witnesses to the trial of Nowak, Smith, Jordan and Ruffo, at least 12 of whom were from JP Morgan or formerly of JP Morgan.]

In October 2018, John Edmonds pleaded guilty to one count of commodities fraud and one count of conspiracy to commit wire fraud, commodities fraud, price manipulation, and spoofing.

In August 2019, Christian Trunz pleaded guilty to one count of conspiracy to engage in spoofing and one count of spoofing. From their testimony, it was definitely obvious that their was a conspiracy and collusion, and that JP Morgan’s global precious metals desk was run as a criminal enterprise.

For example, Trunz, when testifying during the trial of Nowak and Smith said that Smith was so fast at placing and cancelling bogus spoofing orders that the other traders on JP Morgan’s precious metals the trading desk joked that he needed to put ice on his fingers to cool them down, or that Smith must be double-jointed. The entire JP Morgan trading desk knew about the spoofing trades and that it was a topic for discussion.

Trunz worked on the JP Morgan precious metals trading desks in New York, Singapore and London between 2008 and 2019, and worked closely with Smith and Nowak.

“This was an open strategy on the desk,” said Trunz, “It wasn’t hidden.” Trunz said he “learnt how to spoof from Smith and others after joining Bear Stearns out of college in 2007, shortly before the bank was acquired by JPMorgan.”

“We all traded that way” Trunz said. “We utilized that strategy on the desk to make money for ourselves and for our clients.” Let that sink in. They all traded that way. This was racketeering and conspiracy. This was a criminal enterprise.

JP Morgan’s Gregg Smith leaving court

Gang of 10

The existence of price manipulation in a coordinated and conspiratorial scheme was even admitted to by JP Morgan in its Deferred Prosecution Agreement (DPA) with the US Department of Justice which was published on September 29, 2019, and which was actually signed by JP Morgan on September 25, 2019. You can see that document here.

The signing party on behalf of JP Morgan (the ‘Company’) was Stacey R Friedman, JP Morgan Chase General Counsel, who signed on behalf of all three JP Morgan entities that were prosecuted – JPMorgan Chase & Co, JPMorgan Chase Bank, N.A., and J.P. Morgan Securities LLC and admitted everything you’ll see below.

Signature of JP Morgan Chase General Counsel, [URL='https://www.jpmorganchase.com/about/our-leadership/stacey-friedman']Stacey R Friedman[/URL]

Point 4 (a) on pages 3 and 4 states that:

“The nature and seriousness of the offense conduct, which involved tens of thousands of instances of unlawful trading in gold, silver, platinum, and palladium (“precious metals”) futures contracts by ten former traders on the precious metals desk of the Company and the Related Entities resulting in at least $205,992,102 of loss to other precious metals futures market participants between March 2008 and August 2016."

This is JP Morgan admitting that there was a Conspiracy ‘by ten former traders‘. Not 3. Not 5, but 10. JP Morgan admitted to the Conspiracy just a few days after Nowak and Smith had been arrested.

The global structure of the criminal enterprise was even laid out in this same document – “the Company, together with its subsidiaries including JPMC and its affiliates, ran one of the world’s largest precious metals businesses through its Global Commodities Group with precious metals traders that worked in offices in New York, Singapore, and London, England, and that operated as part of a single, cohesive global unit or “desk” (the ‘Precious Metals Desk’)."

We can see the identities of these 10 as follows:

Page A5 of the DPA states:

Unlawful Precious Metals Trading

“18. During the Precious Metals Relevant Period, Smith, Nowak, Jordan, Trunz, Edmonds, Traders 1 through 4, and one or more other traders on the Precious Metals Desk (collectively, the “Subject PM Traders”) and Ruffo and one or more other salespeople on the Precious Metals Desk (together with the Subject PM Traders, the “Subject PM Desk Members”) engaged in a scheme to defraud in connection with the purchase and sale of precious metals futures contracts on and subject to the rules of a registered entity, specifically NYMEX and COMEX."

Precious Metals Relevant Period here refers to “from at least March 2008 until August 2016".

Pages A3 – A5 of the DPA list the 10 individuals:

section 7. Gregg Smith

section 8. Michael Nowak

section 9. Jeffrey Ruffo

section 10. Christopher Jordan

section 11. John Edmonds

section 12. Christian Trunz

Then sections 13 – 16 ‘identify’ the other four traders without naming them.

section “13: Trader 1 was employed as a precious metals trader at Bear Stearns from May 2007 until its acquisition by the Company in May 2008. Trader 1 was employed as a Managing Director and trader on the Precious Metals Desk in New York until he left JPMC in July 2014."

section “14: Trader 2 joined JPMC in 2003. He was employed as a trader on the Precious Metals Desk in London as an Executive Director at the beginning of the Precious Metals Relevant Period. Trader 2 became a Managing Director in May 2014 and ultimately supervised the precious metals traders in London until he left JPMC in July 2017."

section “15: Trader 3 joined JPMC in July 2005….Trader 3 became an Executive Director in November 2014 and remained in that position through the end of the Precious Metals Relevant Relevant Period, he worked in New York and London. Trader 3 left JPMC in October 2019 and was a Managing Director and the Global Head of Precious Metals Trading at the time of his departure.“

section “16: Trader 4 joined JPMC in 2004. …Trader 4 became a Vice President in 2010 and an Executive Director in February 2014. Trader 4 was terminated from JPMC in June 2014 in connection with an inquiry into his trading activity."

It’s actually easy enough to name 75% of these additional 4 traders by cross-referencing media sources, and not least because the DoJ stated the names of most of them in July 2021 when it moved to introduce “the salary and bonus information for the defendants and their co- conspirators.“

Details of the eye-watering compensation (in US dollars) of the JP Morgan precious metals trader defendants and their co-conspirators between 2008 – 2016. [URL='https://fxnewsgroup.com/forex-news/institutional/court-allows-doj-to-present-bonus-salary-info-about-jpmorgan-traders-in-spoofing-trial/']Source[/URL]

In addition to Nowak, Smith, Jordan, Ruffo, Trunz, and Edmonds, this salary and bonus information was revealed for Donald Turnbull, Stuart Piller and Michel Simonian (in the case of Simonian between 2008 – 2014).

From this article here, we see that:

“After another JPMorgan trader, Michel Simonian, was fired in 2014 for spoofing, Nowak called his traders into his office to ask if they’d been doing the same, according to Edmonds. No one said anything. The incident shocked Edmonds, he said, as Nowak knew it had been going on for years."

Trader 4 was Michel Simonian.

An article here from September 13, 2019 states that:

“Edmonds also said he entered trades for Stu Piller and Robert Gottlieb.

Piller, who left the firm in July 2017, was formerly a managing director and head of precious metals trading for Europe and Asia at J.P. Morgan, according to his LinkedIn profile."

Trader 2 was Stu Piller.

JP Morgan precious metals trader Donald Turnbull took a case against JP Morgan in 2022 saying that he was illegally terminated by JP Morgan in October 2019 after cooperating with the DoJ into the JP Morgan precious metals desk manipulation. Turnbull had “joined JPMorgan’s precious metals trading desk in 2005" and he left JP Morgan in October 2019 and was a Managing Director and the Global Head of Precious Metals Trading at the time of his departure." The legal document for that case makes it clear that…Trader 3 was Donald Turnbull.

Extracts from the case by Donald Turnbull against JP Morgan

The identity of “Trader 1" may be Robert Gottlieb, who joined JP Morgan’s precious metals desk in 2008 from Bear Sterns alongside Gregg Smith and Christian Trunz. However Gottlieb had joined Bear Stearns in January 2006 from HSBC, and not in May 2007, as section 13 above states about Trader 1. Gottlieb had worked together with Christopher Jordan at HSBC and at Republic National Bank of New York before it was taken over by HSBC. See Amended Consolidated Class Action Complaint.

There is good reason to think that Gottlieb is Trader 1 as he also made an appearance in a 2015 civil case brought by three independent precious metals traders ) against JP Morgan and in which Goottlieb, Michael Nowak and John Edmonds were defendants. Gottlieb was described as controlling “the decision making for J. P. Morgan’s silver positions and took the primary role in trading JP Morgan’s silver spreads."

[URL='https://preciousmetalsfuturesclassactionsettlement.com/docs/Court%20Document%20Page/Class%20Plaintiffs%E2%80%99%20Motion%20for%20Preliminary%20Approval/7.pdf']Source[/URL]

Gottlieb had left JP Morgan and gone to work at Koch Industries. That civil suit was halted in 2018 when the DoJ was pursuing its criminal case against Nowak et al, but then this civil case was eventually settled by JP Morgan in 2020 for an undisclosed sum. Which was then revealed to be US$ 60 million. See here.

So overall, it was all very strange that the jury which heard the cases of Nowak and Smith and returned its verdict on August 10, 2022, did not find them guilty of conspiracy and racketeering, but only of breaking numerous laws individually, as follows:

- Nowak guilty of attempted price manipulation, commodities fraud, wire fraud and spoofing (i.e. guilty of 4 different offences under 13 counts)

- Smith guilty of attempted price manipulation, commodities fraud, wire fraud and spoofing (i.e. guilty of 4 different offences under 11 counts)

See BullionStar article from August 22, 2022 here.

Full jury verdict (as per the Docket Entry of the Court Clerk):

“This docket entry was made by the Clerk on Wednesday, August 10, 2022:

MINUTE entry before the Honorable Edmond E. Chang:

Jury deliberations held.

Jury reaches a verdict on the three trial Defendants and on all the charges.

[A.] Defendant Smith found not guilty on Counts 1 (RICO conspiracy) and 2 (371 conspiracy); guilty on Count 3 (attempted price manipulation); guilty on Counts 5 through 12 (wire fraud); guilty on Count 24 (commodities fraud); and guilty on Count 26 (spoofing).

[B.] Defendant Nowak found not guilty on Counts 1 (RICO conspiracy) and 2 (371 conspiracy); guilty on Count 4 (attempted price manipulation); guilty on Counts 13 through 22 (wire fraud); guilty on Count 25 (commodities fraud); and guilty on Count 27 (spoofing)."

Why was Mike Nowak even on the LBMA Board?

In all of the above, one question is baffling? Why did Michael Nowak, head of JP Morgan’s precious metals trading desk, join the board of the London Bullion Market Association (LBMA) in July 2019, if he, and people in the JP Morgan organization, as well as people in the DoJ, FBI and CFTC all knew that he and the JP Morgan precious metals desk was under criminal investigation?

Isn’t the LBMA supposed to be the ‘Global Authority on Gold’?

As a recap, Michael Nowak (known as Mike) joined the LBMA Board in July 2019, while he was under DoJ investigation, which was a month before he was put on leave by JP Morgan, and two months before be was arrested by the DoJ.

You can see the LBMA Board profile page here:

Mike Nowak’s profile listed alongside the other LBMA board members. [URL='https://web.archive.org/web/20190917072446/http://www.lbma.org.uk/committees']Source.[/URL]

Nowak attended his first (and only) LBMA Board meeting on July 12, 2019, and the minutes of the meeting can be seen here and in archive here.

In this Board meeting, the LBMA Board congratulated Mike Nowak on his appointment to the Board for a 2 year term.

Minutes of the LBMA Board meeting July 12, 2019

Then on August 20, 2019, Christian Trunz, part of Nowak’s precious metals desk, “pleaded guilty in the Eastern District of New York to an information charging him with one count of conspiracy to engage in spoofing and one count of spoofing“. Trunz then resigned from JP Morgan on the same day.

According to CNBC, Michael Nowak “was placed on leave around late August" [2019].

On September 16, 2019, Mike Nowak and Gregg Smith were arrested, and their indictment was unsealed. While this indictment was only “unsealed" on September 16, 2019, it has an original date stamped on it of August 22, 2019, and it refers to a “SPECIAL MAY 2019 GRAND JURY”.

The original indictment against Nowak, Smith and Jordan is dated 22 August 2019 [URL='https://www.justice.gov/opa/press-release/file/1202466/download']Source.[/URL]

This “SPECIAL MAY 2019 GRAND JURY” was a special court which had met since (or been selected during) May 2019 to hear evidence on the DoJ case against the JP Morgan manipulators. August 22 was the date on which the Grand Jury returned the sealed indictment.

The meaning of a ‘Grand Jury’ is as follows:

“A grand jury does not determine guilt or innocence, but whether there is probable cause to believe that a crime was committed.

The evidence is normally presented by an attorney from the States Attorney’s Office. The grand jury must determine from this evidence whether a person should have formal charges filed by the government.

If the grand jury finds probable cause, then it will return a written statement of the charge called an indictment.

Grand jury proceedings are held in closed rooms, and the public is not allowed to witness it."

This “SPECIAL MAY 2019 GRAND JURY” then returned a 14-count sealed indictment on August 22, 2019 charging Nowak, Smith and Jordan with a racketeering conspiracy:

“On August 22, 2019, a grand jury in the United States District Court for the Northern District of Illinois, Eastern Division returned a 14-count sealed indictment (the “Indictment”), charging defendants Nowak and Smith, as well as a third individual, Christopher Jordan, with conspiracy to conduct or participate in an enterprise engaged in a pattern of racketeering activity“

Which means that a lot of insiders in the DoJ and the CFTC, and the Illinois courts, and even JP Morgan senior executives, would have known about the existence of the Grand Jury back in May 2019 2 months before the LBMA added Nowak to the LBMA Board.

Why then did the LBMA only remove Nowak from the LBMA Board on September 20, 2019? See BullionStar article here.

Nowak and his precious metals traders also knew about the DoJ investigation months before he was appointed by the LBMA. Christian Trunz was interviewed by the FBI on August 19, 2019. See Footnote 8 page 20 – ”FBI 302 of Christian Trunz interview dated August 19, 2019”. A “302” is the form used by F.B.I. agents to summarize an interview.

That document talks about a period “after they [Trunz and Nowak] both had learned of the government’s investigation and were represented by counsel, but before either had been charged. In his interviews with the FBI and at trial, Trunz said that he and Mike spoke often about the investigation in this period, during Mike’s regular trips to the London office.”

Trunz pleaded guilty in court on August 20, 2019. So before Trunz was charged on August 20, 2019, Nowak knew about the DoJ investigation and was already represented by counsel. Before the Grand Jury returned a 14-count sealed indictment charging Nowak, Nowak knew of the government investigation. As Trunz told the FBI, they often spoke about the investigation, during Mike’s regular trips to London (not just one trip, trips in plural, regular trips).

This was the exact time that Mike Nowak joined the Board of Directors of the London Bullion Market Association (LBMA) on July 12, 2019. Nowak knew he was under investigation by the DoJ when he joined the LBMA Board of Directors in July 2019.

Why didn’t the LBMA not see it fit to ask Nowak (or any new Board member) a question such as: “Is there anything that might prevent you from being on the LBMA Board?" And why did Nowak not tell them?

In Additional, Nowak was already a defendant in a civil suit in New York concerning precious metals manipulation which was getting covering from 2015 up until 2018. See here and here.

And also see the JP Morgan quarterly reports which had to divulge this litigation. For example, see the JP Morgan first quarter 10-Q filing dated May 1, 2019:

“Several putative class action complaints have been filed in the United States District Court for the Southern District of New York against the Firm and certain current and former employees, alleging a precious metals futures and options price manipulation scheme in violation of the Commodity Exchange Act."

Why didn’t the LBMA know?

Additionally, one of Nowak’s traders, John Edmonds, had pleaded guilty in November 2018 “to commodities fraud and a spoofing conspiracy in connection with …fraudulent and deceptive trading activity in the precious metals futures contracts markets.“

According to the DoJ at that time: “for years, John Edmonds engaged in a sophisticated scheme to manipulate the market for precious metals futures contracts". he “By conspiring with his trading partners to place spoof orders, he blatantly attempted to profit off of an unfair market that he helped create."

Why did the LBMA not know in 2018 about this prosecution of Nowak’s trader Edmonds?

“In July 2017, a panel of the COMEX Business Conduct Committee found that [Gregg] Smith had spoofed in the gold futures markets in July and August 2013", and was ordered to pay a fine."

Why did the LBMA not know in 2017 about this case and that Smith, one of Nowak’s chief traders, had been fined?

In fact, it was common knowledge across investment bank trading floors that the DoJ began to investigate the JP Morgan precious metals desk in 2018 for spoofing.

[URL='https://www.dol.gov/sites/dolgov/files/OALJ/PUBLIC/WHISTLEBLOWER/DECISIONS/COURT_DECISIONS/21-03217-Turnbull-SD-NY-02-24-2022.pdf']Source[/URL]

Why did the event organizers the LBMA not know this, or did they?

After Nowak was dropped from the LBMA Board, the LBMA Board had its next meeting on September 26, 2019, and the minutes did not mention Nowak’s ousting at all. Crickets. See here and in archive here.

Then on 7 November 2019, Nowak was suspended and prohibited from working in a bank by the US Senior Deputy Comptroller for Large Bank Supervision

“NOTICE OF SUSPENSION AND PROHIBITION To: Michael Nowak, Managing Director JPMorgan Chase Bank, N.A., Columbus, Ohio

TAKE NOTICE, THEREFORE, that the Comptroller, acting by virtue of the authority conferred by 12 U.S.C. § 1818(g), hereby:

SUSPENDS Respondent from office at the Bank and PROHIBITS Respondent from further participation in any manner in the conduct of the affairs of the Bank, and 3 additionally PROHIBITS Respondent from participation in any manner in the conduct of the affairs of any depository institution, EFFECTIVE IMMEDIATELY.

//s// Digitally Signed, Date: 2019.11.07 Maryann H. Kennedy Senior Deputy Comptroller for Large Bank Supervision

In FINRA BrokerCheck, Nowak’s status now says ‘Discharged’. See here.

[URL='https://brokercheck.finra.org/individual/summary/5741670']Source[/URL]

It’s therefore very strange then that after being prohibited from working in a bank by the US Government and after having been sentenced to jail, the Linkedin page of Micheal Nowak still now says that he works for JP Morgan as a Managing Director and as Global Head of Base and Precious Metals.

[URL='https://www.linkedin.com/in/michael-nowak-327137a2/']Source[/URL]

Conclusion

Despite years of precious metals manipulations by multiple JP Traders across gold, silver, platinum and palladium:

JP Morgan Securities is still a trading member of the COMEX and NYMEX.

JP Morgan Securities is still a clearing member firm of the CME for COMEX and NYMEX.

JP Morgan Chase Bank NA stills runs one the biggest COMEX gold depositories in New York.

JP Morgan Chase Bank is still one of the seven Full Market Makers of the London Bullion Market Association.

JP Morgan is still one of the 4 members of the London Precious Metals Clearing Limited (LPMCL).

JP Morgan is still one of the direct participants of the LBMA Gold Price and the LBMA Silver Price auctions.

JP Morgan runs one of the biggest gold and silver vaults in the LBMA vault network in London.

JP Morgan Chase Bank NA is now one of the two custodians of the SPDR Gold Trust (GLD) having only been appointed recently.

J.P. Morgan Securities LLC is still an Authorized Participant of the SPDR Gold Trust.

JP Morgan is still custodian of the iShares Silver Trust (SLV).

JP Morgan is still a Market Making member of the London Platinum and Palladium Market (LPPM), and other JP Morgan entities (J P Morgan SE and J P Morgan Securities plc) are still associate members of the LPPM.

How is any of this possible? Maybe ask the LBMA/LPPM at its annual 2023 conference which is on (as I write) in Barcelona, between 15-17 October.

I’ll tell you why it’s possible. It is possible because JP Morgan paid US$ 920 million to get out of jail free, while sacrificing a handful of traders.

As the Financial Times said on September 24, 2020 about JP Morgan’s settlement with the DoJ:

“Two people familiar with the situation said that the settlement would not result in any restrictions on JPMorgan’s trading or operations.

One of the people said the bank was negotiating a deferred prosecution agreement, which allows banks to continue with their activities as long as they fulfil certain conditions.”

If you read the DPA, you’ll see that those conditions were just compliance guff about annual compliance review, compliance hiring, monitoring, compliance training, something which traders just throw in the trash can. Something which ChatGPT could spew out in a few seconds.

They say that a leopard never changes its spots. Now that JP Morgan has exited its Deferred Prosecution Agreement with the US Department of Justice, how long before it’s back to its old tricks? Roll up and take your bets.

As well as JP Morgan being embedded into every aspect of trading, clearing and vaulting in the New York and London precious metals markets, JP Morgan has also managed to get its tentacles on to nearly all the LBMA committees.

For there are JP Morgan representatives still on the LBMA Finance Committee, the LBMA Regulatory Affairs Committee, the LBMA Physical Committee, and the LBMA Vault Managers Working Group, and the LPMCL Board of Directors.

The question is whether there is a JP Morgan representative on the LBMA Financial Crime Working Group? Yes it exists.

JP Morgan’s ‘first hand’ input would indeed be valuable to this Financial Crime Working Group given that the JP Morgan precious metals trading desk, which operated as a criminal enterprise, was an ideal ‘working’ example of organized ‘Financial Crime’.

This article was originally published on the BullionStar.us website under the same title "JP Morgan Gold Traders go to Jail, while JP Morgan exits DoJ ‘Sin Bin’".

Tyler Durden Sun, 10/22/2023 - 23:20

Continue reading...