Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

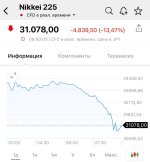

Japanese Market Crash!

- Thread starter ozcopper

- Start date

Wow now down 14%The Nikki is currently down nearly 10% and has already had a circuit break trading halt today!

32337.50 -3580.00 -9.97%

| 30779.00 | -5138.50 | -14.31% |

Its the NK new toys, so near pointing at JpThat's a target rich environment

Fear or not.

The question was asked: Why are markets melting down? Right now we are in what is being called manic Monday. Asian markets are falling hard, crypto is plummeting, and US/EU markets are to follow as we are seeing this already in futures market.A carry trade is a trading strategy that involves borrowing at a low-interest rate and re-investing in a currency or financial product with a higher rate of return.So for those who have been watching the Japanese bank has operated with negative or zero interest rates for quite some time. While US debt has been offering interest rates over 5%, because to lower inflation you raise interest rates. The Yen has been very weak and the USD has been very strong due to high interest rates, in 2021 it was 103 Yen for 1 USD but last June it weakened to 160 Yen for 1 USD. This makes imports very expensive. Last week the Bank of Japan raised its interest rates to 0.25%, and the Yen strengthened. The rising yen has fueled speculation about whether this could mark the end of the popular so-called “carry trade” — wherein an investor borrows in a currency with low interest rates, such as the yen, and reinvests the proceeds in a currency with a higher rate of return.Given this brief background I would recommend reading Zerohedge's story The $20 Trillion Carry Trade Has Finally Blown Up