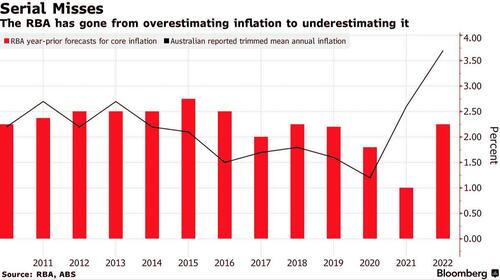

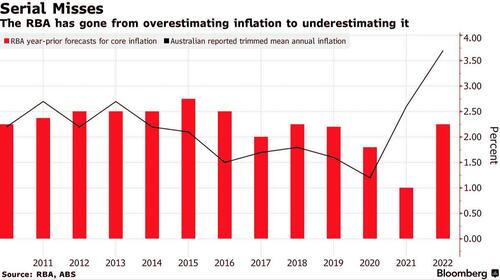

In a stunning admission in this age of delusion, the Australian government has launched a probe into the central bank's dismal forecasting and policy track record.

As The FT reports, the review comes after the institution was heavily criticized for delaying interest-rate hikes despite soaring, and persistent, inflation.

The RBA came under fierce criticism after it was forced into a U-turn three months ago when soaring inflation shredded its dovish policy stance.

Australia?s treasurer Jim Chalmers said the review would consider the performance of the central bank, its board composition and its inflation targeting strategy.

?We face a complex and changing economic environment, and now is the right time to ensure we?ve got the world?s best, the most effective central bank,? Chalmers told Australia?s public broadcaster ABC on Wednesday.

In fact, Philip Lowe, RBA governor, admitted in May that the central bank?s forecasting had been "embarrassing" given it had indicated that it would keep rates as low as possible until 2024.

?We should forecast this better. We didn?t,? he said.

Additionally, Lowe acknowledged the reputational damage from the ?disorderly? exit from yield control.

The review will consider how the RBA reacts during times of crisis when monetary policy moves are limited.

?The outlines of the review encompassing its governance, culture and recruitment processes are quite broad, and certainly broader than the recent reviews undertaken at the Fed and the ECB,? said Alvin Tan, the head of Asia currency strategy at RBC Capital Markets in Singapore.

?The outcome of the exercise could be more important on the governance and culture aspects rather than the inflation goal.?

The final report and recommendations, due by March 2023, will also come just six months before Lowe?s seven-year term expires.

How long before a similar probe is unleashed on The Fed's "embarrassing" track record... or worse still The ECB or BoJ's?

As The FT reports, the review comes after the institution was heavily criticized for delaying interest-rate hikes despite soaring, and persistent, inflation.

The RBA came under fierce criticism after it was forced into a U-turn three months ago when soaring inflation shredded its dovish policy stance.

Australia?s treasurer Jim Chalmers said the review would consider the performance of the central bank, its board composition and its inflation targeting strategy.

?We face a complex and changing economic environment, and now is the right time to ensure we?ve got the world?s best, the most effective central bank,? Chalmers told Australia?s public broadcaster ABC on Wednesday.

In fact, Philip Lowe, RBA governor, admitted in May that the central bank?s forecasting had been "embarrassing" given it had indicated that it would keep rates as low as possible until 2024.

?We should forecast this better. We didn?t,? he said.

Additionally, Lowe acknowledged the reputational damage from the ?disorderly? exit from yield control.

The review will consider how the RBA reacts during times of crisis when monetary policy moves are limited.

?The outlines of the review encompassing its governance, culture and recruitment processes are quite broad, and certainly broader than the recent reviews undertaken at the Fed and the ECB,? said Alvin Tan, the head of Asia currency strategy at RBC Capital Markets in Singapore.

?The outcome of the exercise could be more important on the governance and culture aspects rather than the inflation goal.?

The final report and recommendations, due by March 2023, will also come just six months before Lowe?s seven-year term expires.

How long before a similar probe is unleashed on The Fed's "embarrassing" track record... or worse still The ECB or BoJ's?