Israel & Inflation Spark Big Week For Bonds, Bullion, & Black Gold

JPM's boss summed shit up succinctly:

...and it was a short-week for bonds to deal with all this.

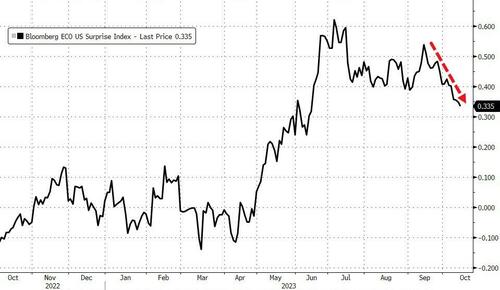

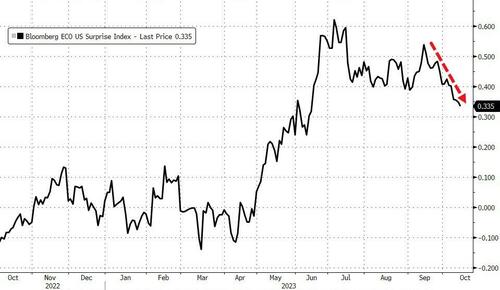

Stickier-than-expected 'actual' inflation and soaring 'expected' inflation piled on to geopolitical risk this week as US macro data disappointed...

Source: Bloomberg

...with 'soft' survey data starting to roll over and catch down to 'hard' data's dive...

Source: Bloomberg

But it was 'war hedges' that dominated...

Gold surged over 5% this week after the attacks on Israel - its biggest weekly jump since March - sending spot prices back above $1900...

Source: Bloomberg

Oil prices also soared with WTI up over 5% on the week (its second biggest weekly gain since April)...

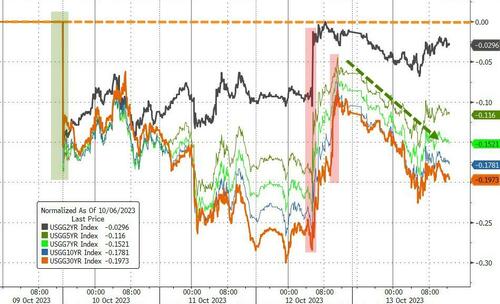

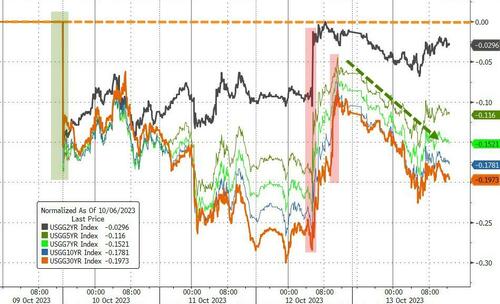

Bonds were bid with the long-end dramatically outperforming...

Source: Bloomberg

But 2Y yields bounced back above 5.00%, flattening the yield curve (2s30s) dramatically on the week (but still well off the mid-Sept lows)...

Source: Bloomberg

VIX spiked back above 20 as protection-buyers stepped in, sending skews and VVIX soaring...

Source: Bloomberg

On the week, Small Caps were clubbed like a baby seal but Nasdaq ended perfectly unchanged while the S&P and Dow managed modest gains - despite some ugly down-drafts intraday...

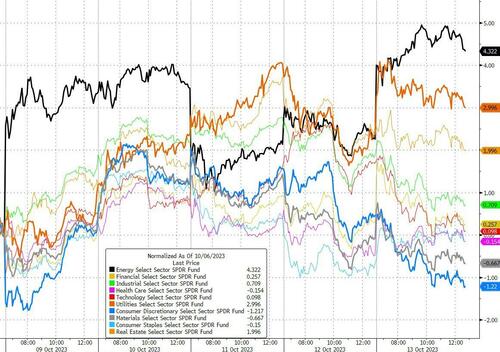

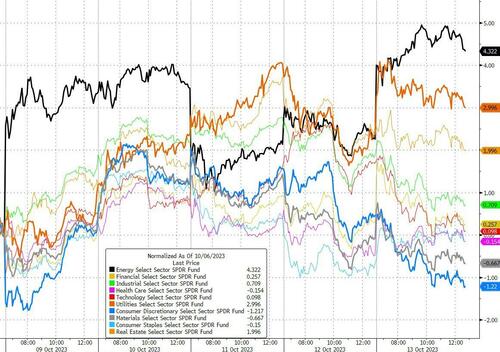

Energy and Utes outperformed while the consumer was punched in the face...

Source: Bloomberg

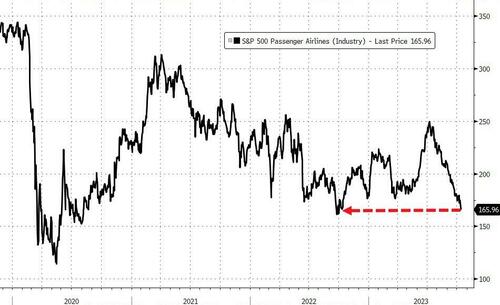

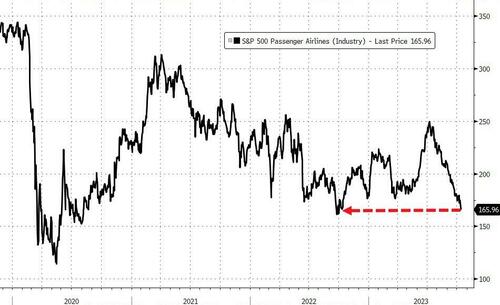

Airlines worst weekly drop since March...

Source: Bloomberg

JPM, WFC, and C all ended the week higher (helped by today's earnings)...

Source: Bloomberg

But, despite big bank earnings beats, the Regional Banks index was dumped...

"Most Shorted" stocks fell for the 9th week of the last 11 to its lowest weekly close since May 2020...

Source: Bloomberg

The dollar ended marginally higher, driven mostly by a post-CPI panic-bid yesterday. But notably, the Bloomberg dollar index stalled at the pre-payrolls level from last Friday..

Source: Bloomberg

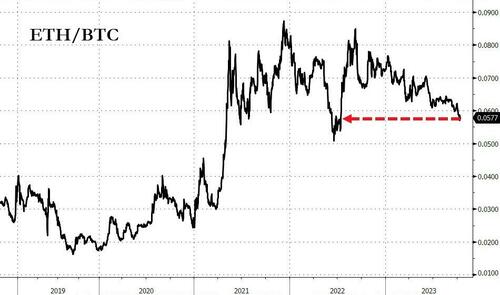

Crypto dropped on the week with Bitcoin finding support around $26,500...

Source: Bloomberg

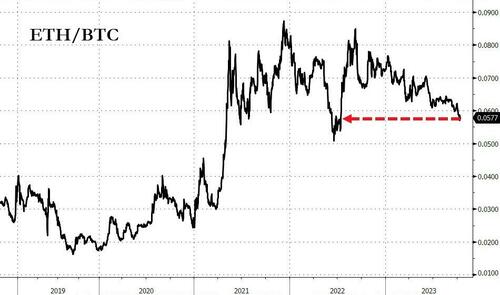

Ethereum was also monkeyhammered lower, now at its weakest relative to Bitcoin since July 2022...

Source: Bloomberg

Silver also soared with futures tagging $23 intraday...

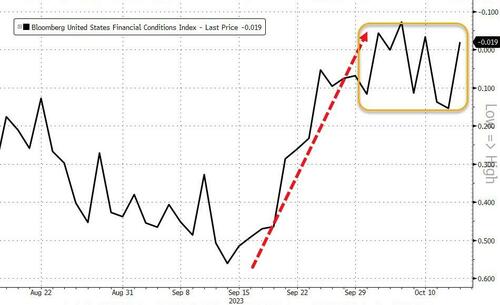

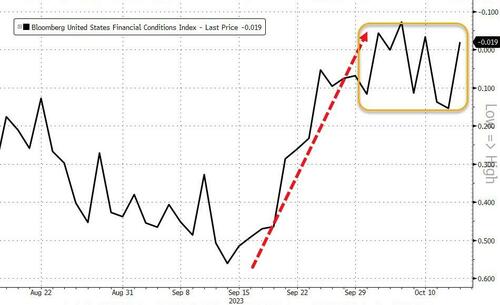

Finally, we note that financial conditions were basically flat this week after tightening dramatically from mid-Sept...

Source: Bloomberg

It's notable because, as Nomura's Charlie McElligott notes, this leads to a dysfunctional feedback loop where, ironically, via the Fed’s extreme FCI reflexivity “The Fed says ‘the market did the (tightening) job’ for them over multiple weeks…but then the market undoes that job in the matter of just a few days”

McElligott's current state of “the psychological chop”:

Will it "be over" enough to warrant action?

Tyler Durden Fri, 10/13/2023 - 16:00

Continue reading...

JPM's boss summed shit up succinctly:

“This may be the most dangerous time the world has seen in decades,” Jamie Dimon said in a statement accompanying the bank’s quarterly earnings, warning of “far-reaching impacts on energy and food markets, global trade and geopolitical relationships.”

...and it was a short-week for bonds to deal with all this.

Good: Earnings (this morning, results from JPM, WFC, Citi, and UNH are all being taken positively)

Bad: Inflation (CPI, PPI, & UMich all hotter than expected) and Consumer Confidence tumbled (on cost of living concerns)

Ugly: Geopolitical chaos (you know that story) and long-bond auctions (is the world turning its back?)

Stickier-than-expected 'actual' inflation and soaring 'expected' inflation piled on to geopolitical risk this week as US macro data disappointed...

Source: Bloomberg

...with 'soft' survey data starting to roll over and catch down to 'hard' data's dive...

Source: Bloomberg

But it was 'war hedges' that dominated...

Gold surged over 5% this week after the attacks on Israel - its biggest weekly jump since March - sending spot prices back above $1900...

Source: Bloomberg

Oil prices also soared with WTI up over 5% on the week (its second biggest weekly gain since April)...

Bonds were bid with the long-end dramatically outperforming...

Source: Bloomberg

But 2Y yields bounced back above 5.00%, flattening the yield curve (2s30s) dramatically on the week (but still well off the mid-Sept lows)...

Source: Bloomberg

VIX spiked back above 20 as protection-buyers stepped in, sending skews and VVIX soaring...

Source: Bloomberg

On the week, Small Caps were clubbed like a baby seal but Nasdaq ended perfectly unchanged while the S&P and Dow managed modest gains - despite some ugly down-drafts intraday...

Energy and Utes outperformed while the consumer was punched in the face...

Source: Bloomberg

Airlines worst weekly drop since March...

Source: Bloomberg

JPM, WFC, and C all ended the week higher (helped by today's earnings)...

Source: Bloomberg

But, despite big bank earnings beats, the Regional Banks index was dumped...

"Most Shorted" stocks fell for the 9th week of the last 11 to its lowest weekly close since May 2020...

Source: Bloomberg

The dollar ended marginally higher, driven mostly by a post-CPI panic-bid yesterday. But notably, the Bloomberg dollar index stalled at the pre-payrolls level from last Friday..

Source: Bloomberg

Crypto dropped on the week with Bitcoin finding support around $26,500...

Source: Bloomberg

Ethereum was also monkeyhammered lower, now at its weakest relative to Bitcoin since July 2022...

Source: Bloomberg

Silver also soared with futures tagging $23 intraday...

Finally, we note that financial conditions were basically flat this week after tightening dramatically from mid-Sept...

Source: Bloomberg

It's notable because, as Nomura's Charlie McElligott notes, this leads to a dysfunctional feedback loop where, ironically, via the Fed’s extreme FCI reflexivity “The Fed says ‘the market did the (tightening) job’ for them over multiple weeks…but then the market undoes that job in the matter of just a few days”

McElligott's current state of “the psychological chop”:

Will it "be over" enough to warrant action?

Tyler Durden Fri, 10/13/2023 - 16:00

Continue reading...