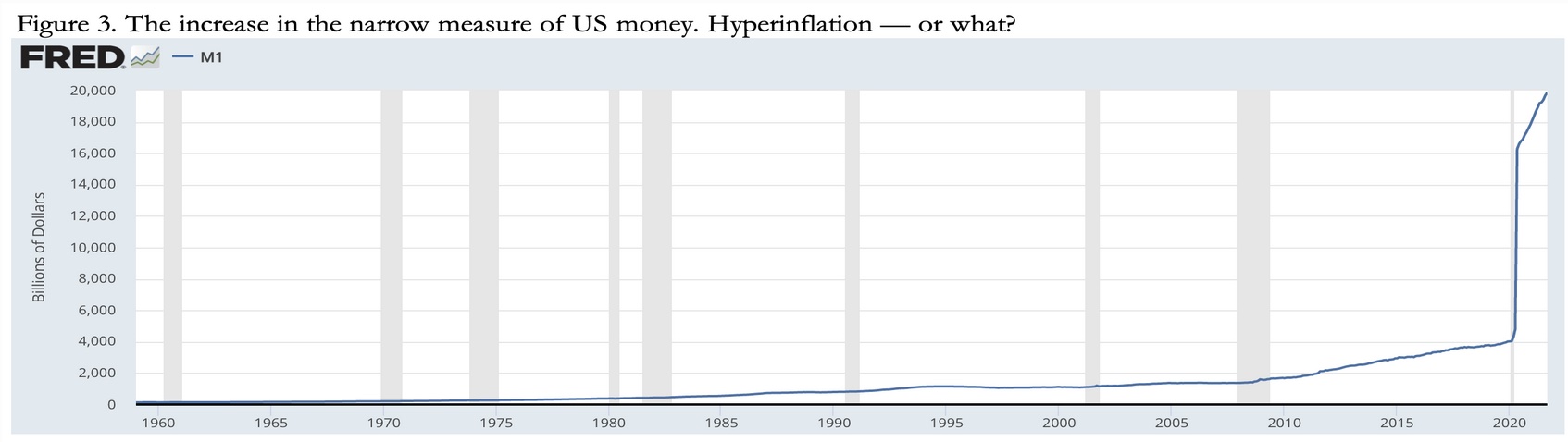

Are we being warned in advance? Lots of stories about hyperinflation in the mainstream media:

Hyperinflation: What is it and are the current warnings valid?

What is Hyperinflation?

Hyperinflation is a rapid and excessive increase in consumer prices, technically defined as prices rising by more than 50 per cent a month or 1000 per cent in a year.

It is a term that evokes a certain image in the public?s collective consciousness, of grocery bills in early 1920s Germany being paid with wheelbarrows full of near worthless money and children playing with piles of cash that were worth less than the paper they were printed on.

Historically hyperinflation has been triggered by a number of different reasons, such as wars, acute shortages of goods and excessive money printing.

More here: https://www.news.com.au/finance/economy/interest-rates/hyperinflation-what-is-it-and-are-the-current-warnings-valid/news-story/fec65f17e76b04c40882456e34df2dcd

Hyperinflation: What is it and are the current warnings valid?

What is Hyperinflation?

Hyperinflation is a rapid and excessive increase in consumer prices, technically defined as prices rising by more than 50 per cent a month or 1000 per cent in a year.

It is a term that evokes a certain image in the public?s collective consciousness, of grocery bills in early 1920s Germany being paid with wheelbarrows full of near worthless money and children playing with piles of cash that were worth less than the paper they were printed on.

Historically hyperinflation has been triggered by a number of different reasons, such as wars, acute shortages of goods and excessive money printing.

More here: https://www.news.com.au/finance/economy/interest-rates/hyperinflation-what-is-it-and-are-the-current-warnings-valid/news-story/fec65f17e76b04c40882456e34df2dcd