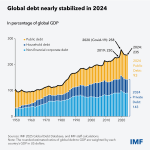

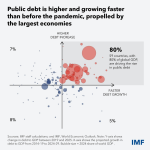

It looks like the DEBT Contagion is really taking hold in Western Countries

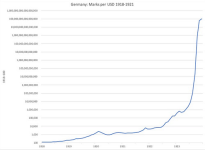

Germany is the latest to break it's Fiscally Responsible Rules of the " Maastricht Criteria ". Thus plunging into the DEBT spending pool

" This year, cleverly hidden from public view in so-called special funds, new debt of €140 billion is planned. Germany thus violates all Maastricht criteria with new borrowing of around 3.3 percent and a final total debt of over 65 percent ". ( the Maastricht Criteria " was put in place to stop exactly what they are now doing )

( the Maastricht Criteria " was put in place to stop exactly what they are now doing )

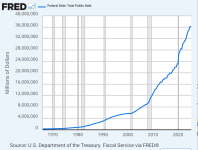

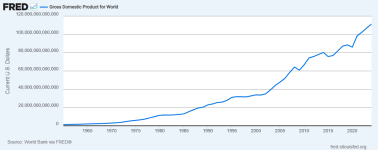

The USA, England & France are already ahead of Germany in sinking down into the DEBT pool. The cover story for all this is " we are going to GROW our way out of Debt ". How do the plan to do this Growth ? They are going to Borrow & Spend even more Debt money that they don't have

So it's a Deep Dive into the DEBT pool so as to " Spend even more Debt Money, to grow their way out of DEBT "

Germany is the latest to break it's Fiscally Responsible Rules of the " Maastricht Criteria ". Thus plunging into the DEBT spending pool

" This year, cleverly hidden from public view in so-called special funds, new debt of €140 billion is planned. Germany thus violates all Maastricht criteria with new borrowing of around 3.3 percent and a final total debt of over 65 percent ".

The USA, England & France are already ahead of Germany in sinking down into the DEBT pool. The cover story for all this is " we are going to GROW our way out of Debt ". How do the plan to do this Growth ? They are going to Borrow & Spend even more Debt money that they don't have

So it's a Deep Dive into the DEBT pool so as to " Spend even more Debt Money, to grow their way out of DEBT "