by Tyler Durden

Saturday, Jan 08, 2022 - 05:01 PM

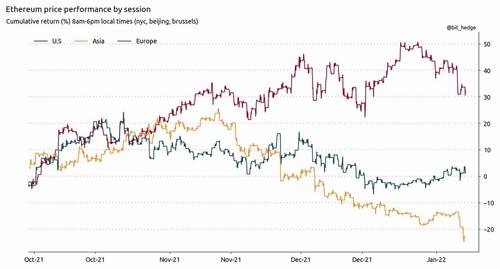

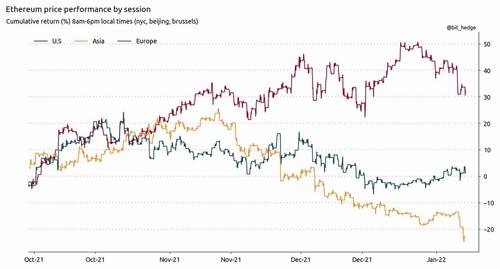

Late on Friday we joked that, in keeping with the recent trend of aggressive crypto selling taking place largely during the Asian session...

Source: Bit Hedge

... which as a reminder was the culprit behind the December 3 flash crash which took place literally at midnight ET on Friday heading into Saturday, just when liquidity is lowest - as shorting algos know all too well - we joked that we were patiently waiting for the latest overnight puke in cryptos to kick in (which offers delightful bargains for those not with cubic zirconium hands), adding to the pain of crypto longs who have seen their holdings lose more than 40% in just the past two months.

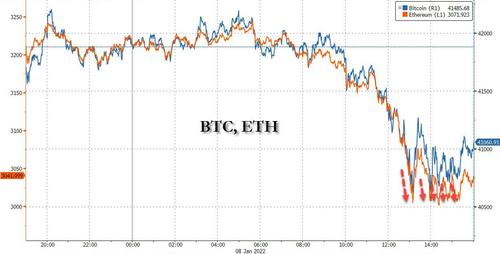

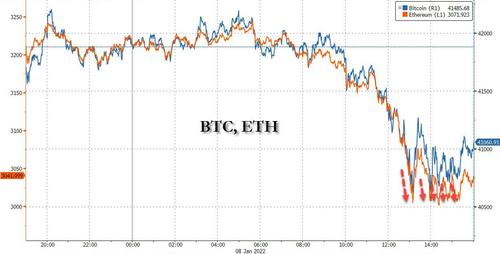

Naturally, with everyone expecting a rerun of the Dec 3 fireworks overnight to cap off a miserable week for cryptos, the selling did not come during the Asian session.... instead it waited patiently until the US was covered in sunlight on an extremely illiquid Saturday, before emerging with a bang and hammering the two largest cryptocurrencies, sending bitcoin to just above the $40,000 level that Mike Novogratz said was a key support.

Those same selling programs, knowing very well that in the world of crypto it is all about momentum and key trendlines, also pounded ethereum and launched not one, not two, not three but five attempts to push ETH below the critical $3000 support level, and despite sending it as low as 3,000.055, failed to drag it below this key level (as a reminder, ETH traded at 4,800 just a few weeks ago).

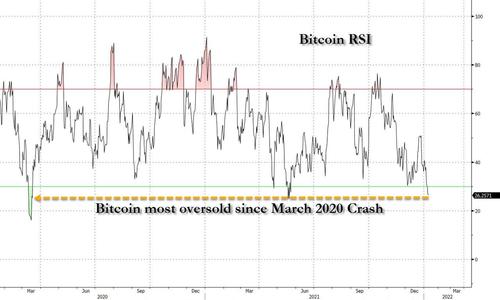

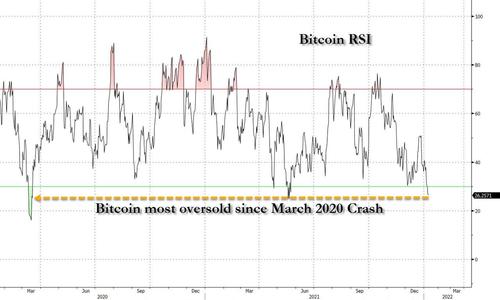

The furious selling in bitcoin, which sent it as low at $40,500, some 42% lower from its all time high hit on Nov 17, also sent its RSI below that hit during the May 2021 crash when it lost half its value, plunging from $60K to $30K in days, making it the most oversold it has been since the covid crash in March 2020, when it briefly traded below $4,000.

Today's panic pushed the bitcoin fear and greed index to one of its lowest levels on record.

Bitcoin Fear and Greed Index is 10 ? Extreme Fear

Current price: $41,837 pic.twitter.com/bXDAnSFX0H

? Bitcoin Fear and Greed Index (@BitcoinFear) January 8, 2022

In addition to a so-far failed attempt to push ETH below $3000, popular defi tokens such as Uniswap and Aave were also hammered into the weekend.

The aggressive shorting (and selling), which comes amid signs that the Federal Reserve is getting ready to withdrawal stimulus would remove liquidity from the system and depress speculative assets, takes place just as liquidity is lowest and is certainly intentional, meant to push bitcoin and ether below the key levels of $40K and $3K, respectively, at a time when buyers are few and far between.

Echoing Novogratz, Bloomberg Intelligence?s Mike McGlone - who believes that BTC and ETH will hit $100,000 and $5,000 respectively in 2022 - said $40,000 is an important technical support level for the digital token. Cryptocurrencies are a good barometer for the current reduction in risk appetite. But he projects that Bitcoin will eventually come out ahead as the world increasingly goes digital and the coin becomes the benchmark collateral.

Others were less bullish. According to Eric Ervin, chief executive officer at Blockforce Capital, the declines across the asset class might be the beginnings of a ?mini bear market,? and recent investors may pull out, leaving the long-term holders as the primary owners.

?It is heart-pounding, nerve-racking for any investor that?s looking at it, especially if they come from a traditional equity market,? he said. But, he added, ?this is completely normal for this asset class.?

Needless to say, if stocks had dropped more than 40% in under two months, the Fed would be disclosing several market bailout scenarios each and every day.

Offering a more measured view, Bitwise CIO Matt Hougan told Bloomberg that it makes sense to see prices slump as the Fed starts to get more aggressive with its stimulus withdrawal. The downturn could linger a bit because there are no obvious near-term catalysts to help turn things around.

But, ?fundamentals of crypto are stronger than ever, even as prices are wobbly,? he said. ?Long-term, the fundamentals will win out.?

The good news for any new longs who are watching their investment bleed on a daily basis, is that every time bitcoin have been this oversold, it has risen by at least 10% over the next month. And while we wait to find out if this time will be different, let's end on some levity.

Jan, 8th 2021: $40,800

Jan, 8th 2022: $40,800

Seems like a pretty stable currency.

? Documenting Bitcoin (@DocumentingBTC) January 8, 2022

(@DocumentingBTC) January 8, 2022

Saturday, Jan 08, 2022 - 05:01 PM

Late on Friday we joked that, in keeping with the recent trend of aggressive crypto selling taking place largely during the Asian session...

Source: Bit Hedge

... which as a reminder was the culprit behind the December 3 flash crash which took place literally at midnight ET on Friday heading into Saturday, just when liquidity is lowest - as shorting algos know all too well - we joked that we were patiently waiting for the latest overnight puke in cryptos to kick in (which offers delightful bargains for those not with cubic zirconium hands), adding to the pain of crypto longs who have seen their holdings lose more than 40% in just the past two months.

Naturally, with everyone expecting a rerun of the Dec 3 fireworks overnight to cap off a miserable week for cryptos, the selling did not come during the Asian session.... instead it waited patiently until the US was covered in sunlight on an extremely illiquid Saturday, before emerging with a bang and hammering the two largest cryptocurrencies, sending bitcoin to just above the $40,000 level that Mike Novogratz said was a key support.

Those same selling programs, knowing very well that in the world of crypto it is all about momentum and key trendlines, also pounded ethereum and launched not one, not two, not three but five attempts to push ETH below the critical $3000 support level, and despite sending it as low as 3,000.055, failed to drag it below this key level (as a reminder, ETH traded at 4,800 just a few weeks ago).

The furious selling in bitcoin, which sent it as low at $40,500, some 42% lower from its all time high hit on Nov 17, also sent its RSI below that hit during the May 2021 crash when it lost half its value, plunging from $60K to $30K in days, making it the most oversold it has been since the covid crash in March 2020, when it briefly traded below $4,000.

Today's panic pushed the bitcoin fear and greed index to one of its lowest levels on record.

Bitcoin Fear and Greed Index is 10 ? Extreme Fear

Current price: $41,837 pic.twitter.com/bXDAnSFX0H

? Bitcoin Fear and Greed Index (@BitcoinFear) January 8, 2022

In addition to a so-far failed attempt to push ETH below $3000, popular defi tokens such as Uniswap and Aave were also hammered into the weekend.

The aggressive shorting (and selling), which comes amid signs that the Federal Reserve is getting ready to withdrawal stimulus would remove liquidity from the system and depress speculative assets, takes place just as liquidity is lowest and is certainly intentional, meant to push bitcoin and ether below the key levels of $40K and $3K, respectively, at a time when buyers are few and far between.

Echoing Novogratz, Bloomberg Intelligence?s Mike McGlone - who believes that BTC and ETH will hit $100,000 and $5,000 respectively in 2022 - said $40,000 is an important technical support level for the digital token. Cryptocurrencies are a good barometer for the current reduction in risk appetite. But he projects that Bitcoin will eventually come out ahead as the world increasingly goes digital and the coin becomes the benchmark collateral.

Others were less bullish. According to Eric Ervin, chief executive officer at Blockforce Capital, the declines across the asset class might be the beginnings of a ?mini bear market,? and recent investors may pull out, leaving the long-term holders as the primary owners.

?It is heart-pounding, nerve-racking for any investor that?s looking at it, especially if they come from a traditional equity market,? he said. But, he added, ?this is completely normal for this asset class.?

Needless to say, if stocks had dropped more than 40% in under two months, the Fed would be disclosing several market bailout scenarios each and every day.

Offering a more measured view, Bitwise CIO Matt Hougan told Bloomberg that it makes sense to see prices slump as the Fed starts to get more aggressive with its stimulus withdrawal. The downturn could linger a bit because there are no obvious near-term catalysts to help turn things around.

But, ?fundamentals of crypto are stronger than ever, even as prices are wobbly,? he said. ?Long-term, the fundamentals will win out.?

The good news for any new longs who are watching their investment bleed on a daily basis, is that every time bitcoin have been this oversold, it has risen by at least 10% over the next month. And while we wait to find out if this time will be different, let's end on some levity.

Jan, 8th 2021: $40,800

Jan, 8th 2022: $40,800

Seems like a pretty stable currency.

? Documenting Bitcoin