Natasha Poole

24 June 2022

With the ASX having hit its lowest point since December 2020 earlier this week, and housing prices in major cities taking a turn, experts have stated that we may have entered a period of stagflation. This is often a good indication that a recession is on the cards.

America has officially entered a bear market and we will most likely follow suit, especially under the current government?s economic approach of either cancelling everything (even, electricity!) or spending everything?

The RBA, along with all of Australia?s major banks, have increased interest rates more than they have in over 20 years. Given this, is likely we will see a significant drop in the housing market. This ought to have been anticipated after over 30 per cent increases in house prices in some areas last year and a virtually interest-free period which had to come to a close.

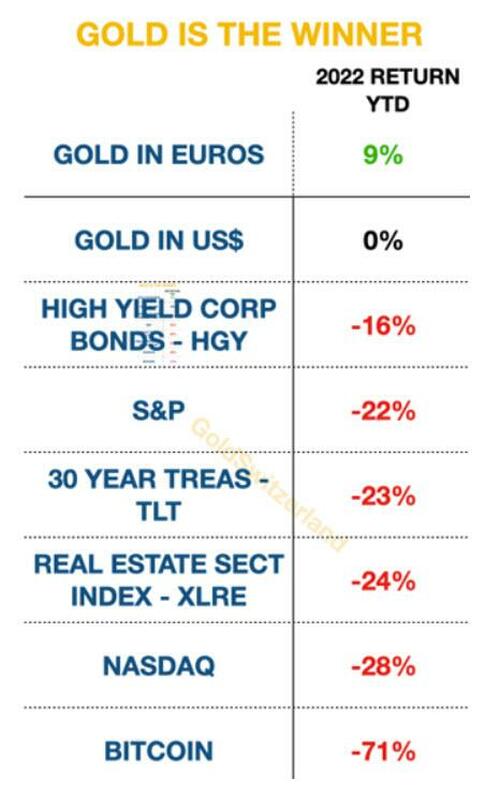

The cryptocurrency market has taken a huge downturn too, as has the S&P 500. Investors, in many cases, are being forced to withdraw their funds from Bitcoin, altcoins, or shares to repay their mortgages or meet living costs.

As inflation is predicted to reach 7 per cent in Australia by the end of the year, the contingent of investors who previously had the disposable income to invest in cryptocurrency, property, or the stock market, is likely to shrink.

The minimum wage has been increased by the ALP ? placing an enormous strain on business owners and employers ? meaning the cost of living is very much at the forefront of people?s minds.

Energy prices have already increased and are set to continue to do so as the ALP hastily attempts to transition to renewables without any justification or rationale behind such precarious plans.

The stock market is ultimately about one underlying principle, ?confidence?. When people are panicking about food prices, mortgage repayments, and a predicted energy crisis, most investors who may have felt that their savings were better in shares than in the bank, and who may have doubts that they will be able to outlast a bear market, will sell, driving prices down lower.

Share trading (and in particular, alternative currency trading), has become increasingly popular amongst recreational traders over the last 10 years. However, these investors will also be likely to withdraw from the activity due to having a lower disposable income, to quite literally, dispose of.

Cryptocurrency trading and its counterparts will no longer be a frivolous luxury people can afford.

We can see this occurring as the cryptocurrency. Meta-currency markets currently sit at their lowest points since 2018, with some previously considered relatively stable coins down by over 75 per cent since last year. The trend of buying crypto no longer appears financially viable, nor profitable, when there are actual concerns within society that ought to be addressed. Only those who have invested for the long term can afford to stay in this type of market and these individuals tend to be educated investors, who most likely would have anticipated an economic crisis, given the global events of the past two and a half years to three years, as well as the current geopolitical climate.

So, what options do investors currently have when the housing market is likely to take a significant downturn, when share markets are heading towards two-quarters of negative growth, and when alternative or digital currencies are at their lowest point in almost 5 years?

One might argue that currency trading is always an option. However, would you risk your savings on currency investing during a time that is as uncertain and unprecedented as this? The idea sounds rather like ?potluck? to me, or, indeed, a stab in the dark given the number of ?Woke? totalitarians around who seem quite perplexingly intent on crippling economies left, right, and centre of them.

Regardless of the surrounding lunacy being displayed, perhaps we ought to go back to the basics of investing and to what we have seen has been proven to have the ability to outlast a major fall in the stock market on many an occasion throughout history ? gold.

Gold is one of the only investments that have consistently displayed a negative correlation between its growth and a fall in stocks over 50 years.

During almost all stock market crashes over the last 50 years, gold has either negated the negative growth or significantly buffered it.

How can we combat inflation? Perhaps, instead of playing the stock market for lucrative profit, which only contributed to inflation in the first place, we ought to consider sticking to the simplest option and investing in the concept of consolidation, which in this case, presents itself as an investment in gold?

There is nothing quite like going back to traditional values in life and adopting an originalist approach.

As Marcus Tullius Cicero pointed out in the 1st century BC, ?If you have a garden and a library, you have everything you need.?

Thankfully for the West?s integrity, the greedy gains from crypto may no longer be an option.

Nevertheless, my words for those who wish to beat the bank and have worked hard for their savings are, as the Judgement of Paris also highlighted: nothing has the potential to deliver during a recession or a fear of deprivation more than gold.

It is about time all these meta-currency maniacs of late came down from their high horses and put their feet firmly on the ground?

I have no doubts that the same people who have been spending benefits on bikinis and Botox, handouts on hangovers from Bourbon and coke, and the taxpayer?s money on marijuana, are also the ones who have been buying Bitcoin when they don?t even know what Warren Buffett?s stance on it is, (which, I might add, is also mine on cryptocurrency in its present state).

?Qu?ils mangent de la brioche.? ? Let them eat cake.

Source: https://www.spectator.com.au/2022/06/back-to-gold/

24 June 2022

With the ASX having hit its lowest point since December 2020 earlier this week, and housing prices in major cities taking a turn, experts have stated that we may have entered a period of stagflation. This is often a good indication that a recession is on the cards.

America has officially entered a bear market and we will most likely follow suit, especially under the current government?s economic approach of either cancelling everything (even, electricity!) or spending everything?

The RBA, along with all of Australia?s major banks, have increased interest rates more than they have in over 20 years. Given this, is likely we will see a significant drop in the housing market. This ought to have been anticipated after over 30 per cent increases in house prices in some areas last year and a virtually interest-free period which had to come to a close.

The cryptocurrency market has taken a huge downturn too, as has the S&P 500. Investors, in many cases, are being forced to withdraw their funds from Bitcoin, altcoins, or shares to repay their mortgages or meet living costs.

As inflation is predicted to reach 7 per cent in Australia by the end of the year, the contingent of investors who previously had the disposable income to invest in cryptocurrency, property, or the stock market, is likely to shrink.

The minimum wage has been increased by the ALP ? placing an enormous strain on business owners and employers ? meaning the cost of living is very much at the forefront of people?s minds.

Energy prices have already increased and are set to continue to do so as the ALP hastily attempts to transition to renewables without any justification or rationale behind such precarious plans.

The stock market is ultimately about one underlying principle, ?confidence?. When people are panicking about food prices, mortgage repayments, and a predicted energy crisis, most investors who may have felt that their savings were better in shares than in the bank, and who may have doubts that they will be able to outlast a bear market, will sell, driving prices down lower.

Share trading (and in particular, alternative currency trading), has become increasingly popular amongst recreational traders over the last 10 years. However, these investors will also be likely to withdraw from the activity due to having a lower disposable income, to quite literally, dispose of.

Cryptocurrency trading and its counterparts will no longer be a frivolous luxury people can afford.

We can see this occurring as the cryptocurrency. Meta-currency markets currently sit at their lowest points since 2018, with some previously considered relatively stable coins down by over 75 per cent since last year. The trend of buying crypto no longer appears financially viable, nor profitable, when there are actual concerns within society that ought to be addressed. Only those who have invested for the long term can afford to stay in this type of market and these individuals tend to be educated investors, who most likely would have anticipated an economic crisis, given the global events of the past two and a half years to three years, as well as the current geopolitical climate.

So, what options do investors currently have when the housing market is likely to take a significant downturn, when share markets are heading towards two-quarters of negative growth, and when alternative or digital currencies are at their lowest point in almost 5 years?

One might argue that currency trading is always an option. However, would you risk your savings on currency investing during a time that is as uncertain and unprecedented as this? The idea sounds rather like ?potluck? to me, or, indeed, a stab in the dark given the number of ?Woke? totalitarians around who seem quite perplexingly intent on crippling economies left, right, and centre of them.

Regardless of the surrounding lunacy being displayed, perhaps we ought to go back to the basics of investing and to what we have seen has been proven to have the ability to outlast a major fall in the stock market on many an occasion throughout history ? gold.

Gold is one of the only investments that have consistently displayed a negative correlation between its growth and a fall in stocks over 50 years.

During almost all stock market crashes over the last 50 years, gold has either negated the negative growth or significantly buffered it.

How can we combat inflation? Perhaps, instead of playing the stock market for lucrative profit, which only contributed to inflation in the first place, we ought to consider sticking to the simplest option and investing in the concept of consolidation, which in this case, presents itself as an investment in gold?

There is nothing quite like going back to traditional values in life and adopting an originalist approach.

As Marcus Tullius Cicero pointed out in the 1st century BC, ?If you have a garden and a library, you have everything you need.?

Thankfully for the West?s integrity, the greedy gains from crypto may no longer be an option.

Nevertheless, my words for those who wish to beat the bank and have worked hard for their savings are, as the Judgement of Paris also highlighted: nothing has the potential to deliver during a recession or a fear of deprivation more than gold.

It is about time all these meta-currency maniacs of late came down from their high horses and put their feet firmly on the ground?

I have no doubts that the same people who have been spending benefits on bikinis and Botox, handouts on hangovers from Bourbon and coke, and the taxpayer?s money on marijuana, are also the ones who have been buying Bitcoin when they don?t even know what Warren Buffett?s stance on it is, (which, I might add, is also mine on cryptocurrency in its present state).

?Qu?ils mangent de la brioche.? ? Let them eat cake.

Source: https://www.spectator.com.au/2022/06/back-to-gold/