Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Australia to be "functionally cashless" by 2025

- Thread starter ozcopper

- Start date

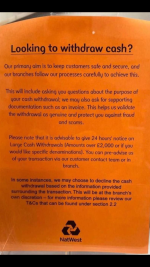

It's a ridiculous position to claim they're trying to protect you with an interrogation. You can essentially transfer currency online to any account and all they require from you is a confirmation. The same should be true with a cash withdrawal. This nanny-style intervention creating barriers between our freedom and personal responsibilities is absurd. The banks have not been commissioned to become hand-holding advisors. A simple disclaimer would be enough, stating that once cash is withdrawn from the bank, the bank cannot protect you against fraud or scams.

This is clearly about tracking and documenting each transaction. It's a drip-feed of institutional control, readying us for further impositions down the road.

This is clearly about tracking and documenting each transaction. It's a drip-feed of institutional control, readying us for further impositions down the road.

I was just thinking

Maybe a way around this is to just say "I understand that once cash has been withdrawn, the bank has no responsibility towards me to protect against fraud or scams".

Because all of these requirements come from obligations imposed by the government or other "authorities" to "protect" customers. This is worth digging into further to see where/when/how these obligations have originated.

Maybe a way around this is to just say "I understand that once cash has been withdrawn, the bank has no responsibility towards me to protect against fraud or scams".

Because all of these requirements come from obligations imposed by the government or other "authorities" to "protect" customers. This is worth digging into further to see where/when/how these obligations have originated.

There's more to it than "protecting" customers against scams. Think about it, when has a bank ever been made liable for a customer who willingly withdrew money and gave it to a scammer.Maybe a way around this is to just say "I understand that once cash has been withdrawn, the bank has no responsibility towards me to protect against fraud or scams".

There's various AML/CTF laws that prevent the bank employees from even telling you why they're asking for more information. Bank tellers can be personally fined $300K+ if they "tipped off" a customer.

There's various AML/CTF laws that prevent the bank employees from even telling you why they're asking for more information. Bank tellers can be personally fined $300K+ if they "tipped off" a customer.

I never knew that. I doubt the tellers themselves are aware of such things. Most of them just say "I have to ask"...

Being interrogated by the bank for withdrawing cash makes me so fkn furious that I've avoided the need to go in there by having multiple cards with multiple banks that all have a $2000 withdrawal limit. The only time I'd go in to the bank is if I needed a $20K+ cash withdrawal, and that's not very often.

There's more to it than "protecting" customers against scams. Think about it, when has a bank ever been made liable for a customer who willingly withdrew money and gave it to a scammer.

I agree. But the banks use fraud and scams as their excuse. Removing them from their duties and responsibilities could be an easy bypass to an interrogation and assessment.

Giving them any information allows them to make a determination whether to give you cash or not. No information, no assessment, no determination.

It's been like this for while now but there was a time when they didn't ask questions. Figuring out what law or policy caused them to adopt such practices could be very helpful.

Woolworths and Coles targeted in new cashless bombshell

‘Cash is legal tender, and it’s illegal to refuse its use.’

Withdrew cash for a car last month &!the cashier asked what it was for in a girly kind of way. I said you don’t want to know. She replied yes I do. I repeated you don’t want to know. Then she left it alone.

A third time & I would have asked her why she was harassing me.

A third time & I would have asked her why she was harassing me.

You sound like a Colombian drug lord to meWithdrew cash for a car last month &!the cashier asked what it was for in a girly kind of way. I said you don’t want to know. She replied yes I do. I repeated you don’t want to know. Then she left it alone.

A third time & I would have asked her why she was harassing me.

... I repeated you don’t want to know. Then she left it alone.

A third time & I would have asked her why she was harassing me.

From Michael Lewis' book Boomerang regarding Kyle Bass famously buying $1 million worth of nickels in 2011:

“The value of the metal in a nickel is worth six point eight cents,” he said. “Did you know that?..I just bought a million dollars’ worth of them,” he said, and then, perhaps sensing I couldn’t do the math: “twenty million nickels.”... “How do you buy twenty million nickels?” “Actually, it’s very difficult,” he said, and then explained that he had to call his bank and talk them into ordering him twenty million nickels. The bank had finally done it, but the Federal Reserve had its own questions. “The Fed apparently called my guy at the bank,” he says. “They asked him, ‘Why do you want all these nickels?’ So he called me and asked, ‘Why do you want all these nickels?’ And I said, ‘I just like nickels.’” He pulled out a photograph of his nickels and handed it to me. There they were, piled up on giant wooden pallets in a Brink’s vault in downtown Dallas.

The WEF-controlled nation of Australia is forcing the public to switch to a Central Bank Digital Currency system (CBDC) and has warned citizens that they risk losing all of their money if they refuse.

One of Australia’s biggest banks, Macquarie Bank, told customers last week that it will completely eliminate cash this year – and if customers refuse to use CBDC’s they will own nothing: In case you missed it, we’re phasing out our cash and cheque services for all products. To prepare for this change, you’ll need to start transacting digitally – a safe, quick, and more convenient way to bank. We’re removing our cash and cheque facilities in a phased approach.”

Dailyhodl reports: The bank says customers will no longer be able to access a list of over-the-counter services at Macquaries’ physical locations, nor deposit or collect checks or order new checkbooks.Once the changes are rolled out, Macquarie customers will only be able to withdraw paper money from their accounts using ATMs owned by rival banks, with withdrawals capped at $2,000 AUD per day.

dailyhodl.com

dailyhodl.com

One of Australia’s biggest banks, Macquarie Bank, told customers last week that it will completely eliminate cash this year – and if customers refuse to use CBDC’s they will own nothing: In case you missed it, we’re phasing out our cash and cheque services for all products. To prepare for this change, you’ll need to start transacting digitally – a safe, quick, and more convenient way to bank. We’re removing our cash and cheque facilities in a phased approach.”

Dailyhodl reports: The bank says customers will no longer be able to access a list of over-the-counter services at Macquaries’ physical locations, nor deposit or collect checks or order new checkbooks.Once the changes are rolled out, Macquarie customers will only be able to withdraw paper money from their accounts using ATMs owned by rival banks, with withdrawals capped at $2,000 AUD per day.

$267,000,000,000 Bank To Abolish Cash, Warns Customers To Prepare for Massive Digital Overhaul - The Daily Hodl

One of the largest banks in Australia is rolling out a plan to terminate cash and checking services.

dailyhodl.com

dailyhodl.com

I don't even view Macquarie as a retail bank anymore. I'm not sure what it is about Macquarie that attracts high end commercial clients but that seems to be their main customer base. But I'm really just pulling these views out of my arse from anecdotal evidence.