Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

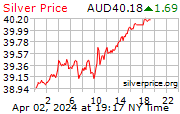

$40+ Silver

- Thread starter Administrator

- Start date

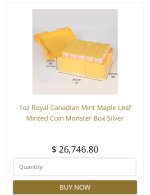

It's crazy how far away we are to $50 usd given the circumstances. The changes made to Comex position limits in 2011 has been a big factor in this suppression, along with a clear intention to utilise above-ground stockpiles to manage the price. Anyone who holds the view that the POS was/is not manipulated needs to get their head checked. But ultimately, the management of the price in a market with yearly deficits has all come down to available aboveground stockpiles.

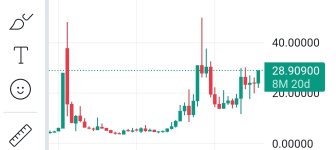

We've finally broke through the $26 usd resistance. If it holds and becomes a strong support, we can see $30 usd being tested. If we break through, then there isn't much in the way between $30 and $50.

I don't really care about the price because I don't intend to sell but I do care about the perception of value as we move forward. In AUD terms, we are just around the corner from the ATH in silver. It looks like we may have some exciting times ahead and I'll be watching the markets closely with you all.

We've finally broke through the $26 usd resistance. If it holds and becomes a strong support, we can see $30 usd being tested. If we break through, then there isn't much in the way between $30 and $50.

I don't really care about the price because I don't intend to sell but I do care about the perception of value as we move forward. In AUD terms, we are just around the corner from the ATH in silver. It looks like we may have some exciting times ahead and I'll be watching the markets closely with you all.

Last edited:

I remember I bought an ounce of Au $(AUD)1200 and so was a kilo of Ag, I should find my receipt. I had a bit of buyers remorse about the silver for a while.i missed the 2009 run to fifty $ aud.

Riveted this time

That was about 30:1 ratio. Gold has tripled since then but silver is pretty much flat.

I'm optimistic about both metals now.

It's like it's setting up for a brutal smackdown at $30USD. It would be lovely if it could pass the infamous $30 mark by a few $$ and then test and hold $30 for a solid support.

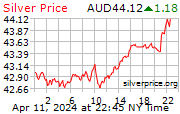

And the Aussie dollar got slammed overnight, which allowed Gold and Silver to rise in AUD, even though the price fell in USD.

And the Aussie dollar got slammed overnight, which allowed Gold and Silver to rise in AUD, even though the price fell in USD.

I'm entirely expecting and hoping for a smack down, although I'd be happy to watch it take off.

It's an interesting setup, it could get to 30USD at the end of the week and close, that will put AUD around or above previous high, and then on monday open AUD goes first. It could cause a bit of hype and push it above 30USD.

Or it could crash down again, wait and see.

It's an interesting setup, it could get to 30USD at the end of the week and close, that will put AUD around or above previous high, and then on monday open AUD goes first. It could cause a bit of hype and push it above 30USD.

Or it could crash down again, wait and see.