I love that Gold is continuing it's momentum. Silver doesn't surprise me with it's lackluster activity, but it's far from justified considering the supply and demand fundamentals are so strong. I thought there'd be a shift away from market intervention once inventories became low but it seems they'll continue to play stupid games until they win stupid prizes.War drums in Europe are beating. Fear. Nice empowering bullish hammer

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

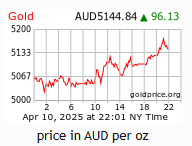

$̴3̴2̴0̴0̴ $̴3̴50̴0̴ $3̴90̴0̴ $400̴0̴ $410̴0̴ $5150 Gold!

- Thread starter ozcopper

- Start date

You know in 2024 the supply of Gold was 4974 tonnes. And demand in 2024 was... Wait for it... Exactly 4974 tonnes.

I mean, thats a bit weird.

For anyone interested, here are the years gold has apparently been in a deficit;

- *2013*: 171 tonnes

- *2014*: 161 tonnes

- *2015*: 171 tonnes

- *2019*: 127 tonnes

- *2020*: 161 tonnes

And over the years the Gold market has actually seen a surplus. The years in deficit listed above don't even come close to exceeding a year of mine supply. They barely reach 25% of annual mine supply combined. But meanwhile, we have a yearly deficit in the silver market that's over 25% of annual mine supply, and the prices go sideways or down. Make it make sense!

I'm also quite surprised by the lack of transparency and data surrounding Gold supply and demand.

I mean, thats a bit weird.

For anyone interested, here are the years gold has apparently been in a deficit;

- *2013*: 171 tonnes

- *2014*: 161 tonnes

- *2015*: 171 tonnes

- *2019*: 127 tonnes

- *2020*: 161 tonnes

And over the years the Gold market has actually seen a surplus. The years in deficit listed above don't even come close to exceeding a year of mine supply. They barely reach 25% of annual mine supply combined. But meanwhile, we have a yearly deficit in the silver market that's over 25% of annual mine supply, and the prices go sideways or down. Make it make sense!

I'm also quite surprised by the lack of transparency and data surrounding Gold supply and demand.

I feel there's every reason to have a Gold Survey like the Silver Institute does with silver.If there was ever an interest where one should not expect transparency or laws it would surely be in precious metals!