By Mike McGlone, Bloomberg commodity strategist

Peaking commodities and the declining yield on the Treasury long bond point to risks of reviving deflationary forces in 2022, with positive ramifications on Bitcoin and gold. A primary uncertainty heading into the new year is whether the U.S. stock market can keep rising amid Federal Reserve restraint, with implications for all assets.

1. Money Supply Test: Sustainability vs. Vulnerability

Asset class performance in 2022 is likely to be all about the potential for reversion toward the upward trajectory of U.S. money supply, which should favor gold, especially if stock-market returns normalize some. What's different about that outlook, which has been relevant throughout much of history, is the proliferation of crypto assets. The fact that our graphic excludes the Bloomberg Galaxy Crypto Index (BGCI) due to distortions of its outsized performance, is a top reason cryptos are gaining exposure in portfolios.

So, will the trend turn, or are we in for more of the same? Our bias is the latter, notably because the BGCI has overcome about a 60% correction in 2021 vs. the S&P 500, which hasn't had a 10%-plus drawdown since the 2020 trough. Underperforming commodities face increasing pressure.

Gold Too Low, Stocks Too High vs. Money Supply?

2. How Sustainable Is This Disparity?

A bit of a backup in market expectations for Federal Reserve rate hikes in 2022 -- a top determinant of asset-price performance -- is gaining potential from 2021 peaks in copper, crude oil and bond yields. It took about seven years at zero before the Fed began hiking in 2015. Fed funds futures show rates jumping toward 1% by the end of 2022. History has proven that a primary force to stop this process is some stock-market reversion. Our graphic depicts the S&P 500 the most extended above its 60-month moving average in two decades, and what we see as a consolidating gold bull market waiting on a catalyst to revisit $2,000-an-ounce resistance.

The 2021 bounce in commodities and bond yields may be over, with implications for a resumption of enduring deflationary forces.

Is a Fed Rate-Hike Cycle in 2022 a Dream?

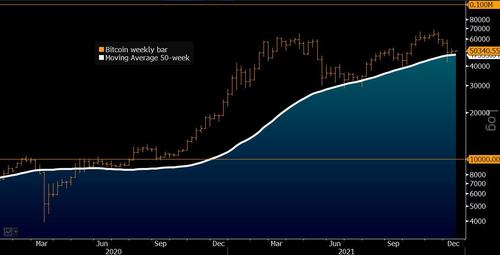

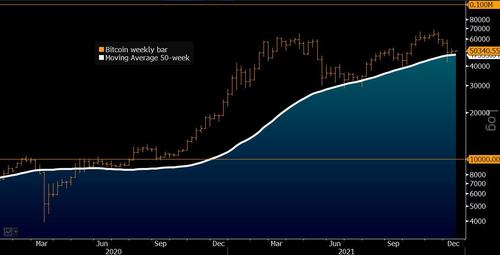

3. Bitcoin Says: Why Complicate a Bull Market?

Bitcoin is a risk asset that's evolving into a digital reserve asset in a world going that way, with positive implications for its price. Demand and adoption are rising and still appear in early days vs. supply, which is declining. The key question nearing the end of 2021 is whether Bitcoin is too hot, and our chart shows the crypto fairly priced at about its upward-sloping 50-week moving average. Not too extended and within an upward trajectory sets the stage for a potentially strong 2022. Bitcoin ended 2020 around 140% above its annual mean.

The overextended condition a year ago has been relieved, and it's now a question of a consolidating bull or the beginning of a reversal. Our bias is with the former, on the back of favorable demand vs. supply fundamentals. About $100,000 is good target resistance.

100,000 Bitcoin, Target Resistance for 2022?

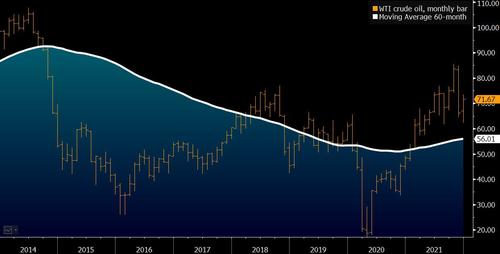

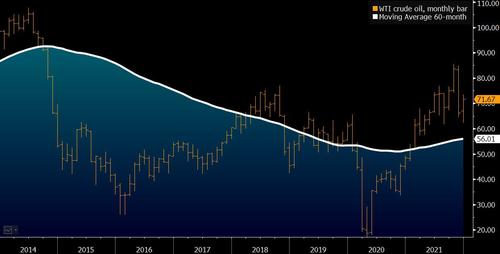

4. Crude Wonders: Why Complicate a Bear Market?

The big difference between commodities -- notably oil -- and Bitcoin is elasticity of supply, which points downward for crude prices in 2022. In 2021, West Texas Intermediate stretched the greatest distance above its 60-month moving average since the peak in 2008. This is a bad sign for prices. The price bounce is accelerating the paradigm shift of the U.S. gaining enduring status as a net crude and liquid-fuel exporter, and encouraging the proliferation of substitutes and electric vehicles.

We see unfavorable production vs. consumption, along with a challenging economic backdrop, and prices more likely to revert toward lower means. Our graphic depicts WTI appearing too hot at about $72 a barrel vs. its 60-month mean closer $56.

2021 Crude Bounce May have Cured The Recovery

5. Alert to the Great Commodity Deflation

The risk of, and propensity for, some typical reversion in broad commodity prices may be a top development in 2022. Our graphic depicts the potential early days of normalization for the Bloomberg Commodity Spot Index following an almost uninterrupted rally from 2020's bottom. Commodity prices rising with China in decline is basically an oxymoron, based on historical patterns. The second cut of China's reserve requirement ratio in 2021 (and likelihood of more to come), running alongside declining yields on the U.S. Treasury long bond is a poor mix for higher prices.

China has been a primary source of demand for commodities, notably since 2003, and higher rates in the U.S. underpin the dollar, which typically is a headwind for commodity prices.

Extreme Commodity Deflation Risks in 2022?

Peaking commodities and the declining yield on the Treasury long bond point to risks of reviving deflationary forces in 2022, with positive ramifications on Bitcoin and gold. A primary uncertainty heading into the new year is whether the U.S. stock market can keep rising amid Federal Reserve restraint, with implications for all assets.

1. Money Supply Test: Sustainability vs. Vulnerability

Asset class performance in 2022 is likely to be all about the potential for reversion toward the upward trajectory of U.S. money supply, which should favor gold, especially if stock-market returns normalize some. What's different about that outlook, which has been relevant throughout much of history, is the proliferation of crypto assets. The fact that our graphic excludes the Bloomberg Galaxy Crypto Index (BGCI) due to distortions of its outsized performance, is a top reason cryptos are gaining exposure in portfolios.

So, will the trend turn, or are we in for more of the same? Our bias is the latter, notably because the BGCI has overcome about a 60% correction in 2021 vs. the S&P 500, which hasn't had a 10%-plus drawdown since the 2020 trough. Underperforming commodities face increasing pressure.

Gold Too Low, Stocks Too High vs. Money Supply?

2. How Sustainable Is This Disparity?

A bit of a backup in market expectations for Federal Reserve rate hikes in 2022 -- a top determinant of asset-price performance -- is gaining potential from 2021 peaks in copper, crude oil and bond yields. It took about seven years at zero before the Fed began hiking in 2015. Fed funds futures show rates jumping toward 1% by the end of 2022. History has proven that a primary force to stop this process is some stock-market reversion. Our graphic depicts the S&P 500 the most extended above its 60-month moving average in two decades, and what we see as a consolidating gold bull market waiting on a catalyst to revisit $2,000-an-ounce resistance.

The 2021 bounce in commodities and bond yields may be over, with implications for a resumption of enduring deflationary forces.

Is a Fed Rate-Hike Cycle in 2022 a Dream?

3. Bitcoin Says: Why Complicate a Bull Market?

Bitcoin is a risk asset that's evolving into a digital reserve asset in a world going that way, with positive implications for its price. Demand and adoption are rising and still appear in early days vs. supply, which is declining. The key question nearing the end of 2021 is whether Bitcoin is too hot, and our chart shows the crypto fairly priced at about its upward-sloping 50-week moving average. Not too extended and within an upward trajectory sets the stage for a potentially strong 2022. Bitcoin ended 2020 around 140% above its annual mean.

The overextended condition a year ago has been relieved, and it's now a question of a consolidating bull or the beginning of a reversal. Our bias is with the former, on the back of favorable demand vs. supply fundamentals. About $100,000 is good target resistance.

100,000 Bitcoin, Target Resistance for 2022?

4. Crude Wonders: Why Complicate a Bear Market?

The big difference between commodities -- notably oil -- and Bitcoin is elasticity of supply, which points downward for crude prices in 2022. In 2021, West Texas Intermediate stretched the greatest distance above its 60-month moving average since the peak in 2008. This is a bad sign for prices. The price bounce is accelerating the paradigm shift of the U.S. gaining enduring status as a net crude and liquid-fuel exporter, and encouraging the proliferation of substitutes and electric vehicles.

We see unfavorable production vs. consumption, along with a challenging economic backdrop, and prices more likely to revert toward lower means. Our graphic depicts WTI appearing too hot at about $72 a barrel vs. its 60-month mean closer $56.

2021 Crude Bounce May have Cured The Recovery

5. Alert to the Great Commodity Deflation

The risk of, and propensity for, some typical reversion in broad commodity prices may be a top development in 2022. Our graphic depicts the potential early days of normalization for the Bloomberg Commodity Spot Index following an almost uninterrupted rally from 2020's bottom. Commodity prices rising with China in decline is basically an oxymoron, based on historical patterns. The second cut of China's reserve requirement ratio in 2021 (and likelihood of more to come), running alongside declining yields on the U.S. Treasury long bond is a poor mix for higher prices.

China has been a primary source of demand for commodities, notably since 2003, and higher rates in the U.S. underpin the dollar, which typically is a headwind for commodity prices.

Extreme Commodity Deflation Risks in 2022?