Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

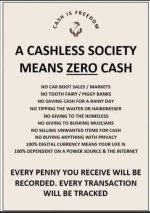

Cash transaction ban

- Thread starter Administrator

- Start date

FED NOW, will force the banks out

same as CBDC will dis-intermediations

so now the banks are forcing cashlessness on the customers, later they will be DE_BANKED lol

the business model no longer viable given the operating environment

DEBT based system with half-life cycle, will no longer work, since the Global South no longer subscribe this same system.

same as CBDC will dis-intermediations

so now the banks are forcing cashlessness on the customers, later they will be DE_BANKED lol

the business model no longer viable given the operating environment

DEBT based system with half-life cycle, will no longer work, since the Global South no longer subscribe this same system.

Macquarie Bank announces shock move to scrap cash in all branches

A major bank had made a shock decision which could have massive implications for the way Aussies access their cash.

As well as scrapping over-the-counter cash transactions, Macquarie will also stop accepting payments via telephone banking from May next year.

The move means customers wishing to withdraw or deposit cash will only be able to do so via an ATM.

News of the decision was met with dismay by some businesses, who said it was ?inevitable? other banks would go down the same path as Macquarie.

?People in regional areas constantly have challenges around internet access so using cash is often an easier option, making the local bank branch and cash services important to those in country towns,? General Manager of Junee Licorice and Chocolate Factory, Rhiannon Druce, said.

?There is concern other banks will follow Macquarie Bank?s lead which unfortunately feels inevitable.?

...

https://www.news.com.au/finance/money/macquarie-bank-announces-shock-move-to-scrap-cash-in-all-branches/news-story/da5ee045eb5470adcd038a8481cb98e4

A major bank had made a shock decision which could have massive implications for the way Aussies access their cash.

As well as scrapping over-the-counter cash transactions, Macquarie will also stop accepting payments via telephone banking from May next year.

The move means customers wishing to withdraw or deposit cash will only be able to do so via an ATM.

News of the decision was met with dismay by some businesses, who said it was ?inevitable? other banks would go down the same path as Macquarie.

?People in regional areas constantly have challenges around internet access so using cash is often an easier option, making the local bank branch and cash services important to those in country towns,? General Manager of Junee Licorice and Chocolate Factory, Rhiannon Druce, said.

?There is concern other banks will follow Macquarie Bank?s lead which unfortunately feels inevitable.?

...

https://www.news.com.au/finance/money/macquarie-bank-announces-shock-move-to-scrap-cash-in-all-branches/news-story/da5ee045eb5470adcd038a8481cb98e4

Keeping cash costs every customer $40, Commonwealth Bank says - as it warns services like ATMs are becoming 'unsustainable'

The boss of Commonwealth Bank has told a government inquiry that continuing to make physical cash available to Australians costs the business $400million a year despite less and less customers using it.Matt Comyn said this week that 'transporting and making cash available around our vast country involves the considerable expense of logistics and security.'

His comments follow CommBank, NAB and ANZ making some of their branches cashless and Macquarie Bank announcing just days ago that its cash services would be phased out entirely by 2025.

...

Commonwealth Bank warns ATMs are becoming 'unsustainable'

Bosses of Australia's 'big four' banks were this week grilled at Parliament House in Canberra about regional branch closures and removal of in-person cash services.

Simple solution is more people start using cash. In the UK, they've seen a 7% increase in demand for cash and many businesses are going "cash only", offering a discount for cash payments or displaying a sign saying "cash payments preferred".

What we'll probably see is most banks removing the option for cash withdrawals, and a subsequent rise in private companies installing ATM's that charge a fee. The fees will increase to a point where it's not practical to withdraw small amounts, which will not only limit cash withdrawals but eventually make their business model unfeasible.

See, if we had a government that actually served the interests of the people they'd never be able to get away with limiting or removing cash. Besides the fact that a small portion of cash is used for criminal activity, any legitimate government would recognise that cash represents our freedom to transact privately, and they'd also recognise that our freedoms and liberties are valued above all.

What we'll probably see is most banks removing the option for cash withdrawals, and a subsequent rise in private companies installing ATM's that charge a fee. The fees will increase to a point where it's not practical to withdraw small amounts, which will not only limit cash withdrawals but eventually make their business model unfeasible.

See, if we had a government that actually served the interests of the people they'd never be able to get away with limiting or removing cash. Besides the fact that a small portion of cash is used for criminal activity, any legitimate government would recognise that cash represents our freedom to transact privately, and they'd also recognise that our freedoms and liberties are valued above all.

Last edited:

Michele Bullock - Governor of the Reserve Bank of Australia said:...

We also remain focused on access to cash for Australians. This issue has received some attention in the media recently and I would like to provide some context and discuss the work that is underway.

The use of cash for payments has been in decline for many years as consumers have switched to digital payments. The share of consumer payments made using cash declined from 70 per cent in 2007 to 13 per cent in 2022 (when our latest consumer payments survey was conducted). Despite this decline, cash remains an important means of payment for some people and is widely held for precautionary or store-of-wealth purposes. Cash is also an important backup method of payment during system outages or natural disasters, when electronic payments might be unavailable.

For these reasons, the RBA places a high priority on the community continuing to have reasonable access to cash withdrawal and deposit services. The Government also highlighted the importance of maintaining adequate access to cash services as a key priority in its Strategic Plan for the Payments System.

The challenge we face is that as the transactional use of cash declines, it is affecting the economics of providing cash services and putting pressure on the cash distribution system. ...

Reasonable access. Adequate access. Guess who decides what is reasonable and adequate.

A surcharge for cash payments? What could happen as Australians ditch notes and coins

From vulnerable Australians to courier companies, what happens when we no longer deal in hard, cold cash?

A surcharge for cash payments? What could happen as Australians ditch notes and coins

From vulnerable Australians to courier companies, what happens when we no longer deal in hard, cold cash?

When Ava Martina started busking her melodies were accompanied by clinking of coins.

“Before the pandemic, I feel like cash was much more acceptable. Since the pandemic, a lot of places have switched," Martina said. "With busking, that was kind of the main source of income."

To adapt to an increasingly cashless society, Martina adopted QR codes so people could donate digitally.

Advertisement

"People got really used to scanning QR codes, so it's almost become quite a natural process for people," she said.

...