Is the Gold Price Suppressed on the COMEX Futures Exchange?

By The Gold Observer

From examining the roll data of gold futures contracts on the COMEX I have found no evidence of gold price suppression.

One of the most discussed topics in the gold space is long-term gold price suppression on the COMEX futures exchange in New York. It?s an interesting theory, because we know that in the past the United States has been active in ?stabilizing? the gold price to make to dollar look stronger. But that was done openly in the 1960s and 1970s by selling physical gold. Is any entity still suppressing the gold price, and does it use the futures market?

Price manipulation through spoofing, which can be small intraday price movements up or down, has been proven time and again, but not long-term suppression.

Introduction

In a recent video precious metals commentator Andrew Maguire was talking about gold price suppression and mentioned that traders can roll large futures positions. Towards the regulator he stated:

What? You mean you can roll it over for ad infinitum? ? If there is one thing you should focus on it is that.

Gold futures can indeed be rolled ad infinitum, just like corn, sugar, oil, stock indices, bond, FX, and crypto futures. Rolling is an essential feature of the futures market. Though, Maguire brings up an excellent point for investigating if a massive short position in the gold futures market is suppressing the price: the roll data.

How it Works

Futures can be traded many months into the future. For gold February, April, June, August, October and December are actively traded months?the rest be can ignored. The ?near month? always captures the bulk of trading volume and open interest. At the time of writing the most actively traded contract (near month) on the COMEX is February.

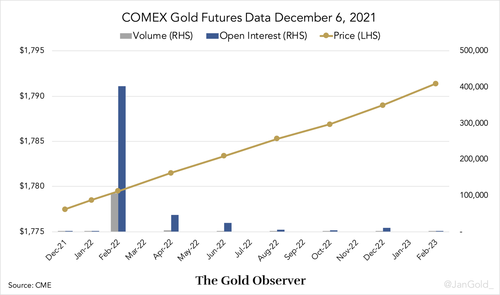

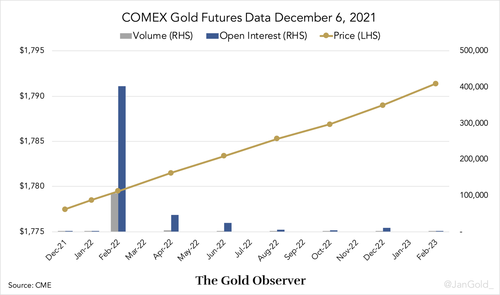

The price, volume, and open interest of fifteen gold futures contracts traded at the COMEX on December 6, 2021. One contract represents 100 troy ounces of gold.

Let?s run though a scenario of long-term price suppression on the COMEX, to subsequently examine roll data and see if this is actually happening.

Suppose, a crooked entity sells short hundreds of thousands of contracts. This is very difficult because the regulator sets position limits for all traders, but we will assume the crooked entity has found a way to circumvent the restrictions. The massive short is opened in the near month, driving down the futures price, and through arbitragers the futures price is translated to the spot market: the price of physical gold is suppressed too.

Now what? Any futures position will eventually expire. The massive short seller has three options. The first possibility is to close the short position by opening an opposite position. In case of a massive short position an equal amount of contracts will have to be bought long for the clearinghouse to net it all out. The result would be that the initial price suppression of the massive short would be undone?closing a short leads to the price going up. The second possibility for the massive short is to physically delivery the metal. From COMEX delivery data, however, we know only a small percentage of the open interest is physically delivered. No big short is delivering hundreds to thousands of tonnes of gold every other month.

The third possibility for the massive short is to roll, by closing its near month position and open a new massive short in the next active month. But a large roll would leave traces in futures prices. When a massive short is rolled the price of the expiring month is pushed up, and the price of the next active month is pushed down. The spread between the contracts?calculated as the next active month minus the near month?would decline during the roll period.

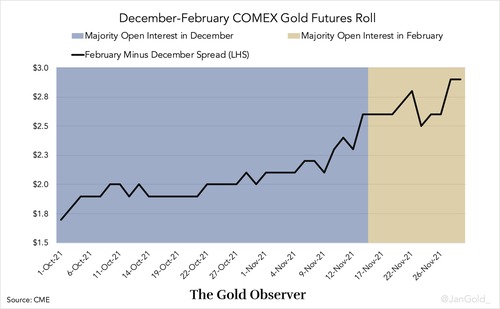

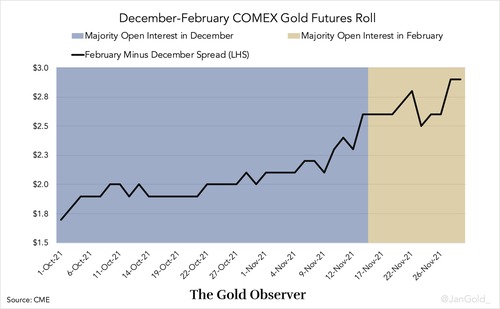

What I did is grab the settlement prices from the COMEX website and made a chart. Below you can see the progression of the spread (between the December 2021 and February 2022 contract) from the beginning of October until the end of November. The last day of November was the start of the delivery procedure for December, so most traders rolled (or closed) their December positions prior to that.

On November 16 the majority of the open interest shifted from December to February.

Clearly, the spread increased leading up to the end of November, signaling the longs were more eager to roll than the shorts. In other words, it looks like more longs than shorts rolled.

Conclusion

If there was any period suited for holding down the price of gold it was in the past few months when the world was shocked by the highest inflation numbers in 30 years. In the data at my disposal, however, I see no evidence of a massive short suppressing the gold price on the COMEX.

The only critique of my methodology I can think of is that I used settlement prices instead of bid and ask quotes. Unfortunately, I don?t have the resources to obtain the latter. Supporting my findings is a similar investigation performed by Keith Weiner from Monetary Metals (read here), who used spot and futures bid and ask quotes over several decades. His conclusion is the same as mine: there is no evidence for gold price suppression on the COMEX.

Having said that, I would be happy to change my mind if anyone has new evidence.

If you enjoyed reading this article please consider to support The Gold Observer and subscribe to the newsletter.

By The Gold Observer

From examining the roll data of gold futures contracts on the COMEX I have found no evidence of gold price suppression.

One of the most discussed topics in the gold space is long-term gold price suppression on the COMEX futures exchange in New York. It?s an interesting theory, because we know that in the past the United States has been active in ?stabilizing? the gold price to make to dollar look stronger. But that was done openly in the 1960s and 1970s by selling physical gold. Is any entity still suppressing the gold price, and does it use the futures market?

Price manipulation through spoofing, which can be small intraday price movements up or down, has been proven time and again, but not long-term suppression.

Introduction

In a recent video precious metals commentator Andrew Maguire was talking about gold price suppression and mentioned that traders can roll large futures positions. Towards the regulator he stated:

What? You mean you can roll it over for ad infinitum? ? If there is one thing you should focus on it is that.

Gold futures can indeed be rolled ad infinitum, just like corn, sugar, oil, stock indices, bond, FX, and crypto futures. Rolling is an essential feature of the futures market. Though, Maguire brings up an excellent point for investigating if a massive short position in the gold futures market is suppressing the price: the roll data.

How it Works

Futures can be traded many months into the future. For gold February, April, June, August, October and December are actively traded months?the rest be can ignored. The ?near month? always captures the bulk of trading volume and open interest. At the time of writing the most actively traded contract (near month) on the COMEX is February.

The price, volume, and open interest of fifteen gold futures contracts traded at the COMEX on December 6, 2021. One contract represents 100 troy ounces of gold.

Let?s run though a scenario of long-term price suppression on the COMEX, to subsequently examine roll data and see if this is actually happening.

Suppose, a crooked entity sells short hundreds of thousands of contracts. This is very difficult because the regulator sets position limits for all traders, but we will assume the crooked entity has found a way to circumvent the restrictions. The massive short is opened in the near month, driving down the futures price, and through arbitragers the futures price is translated to the spot market: the price of physical gold is suppressed too.

Now what? Any futures position will eventually expire. The massive short seller has three options. The first possibility is to close the short position by opening an opposite position. In case of a massive short position an equal amount of contracts will have to be bought long for the clearinghouse to net it all out. The result would be that the initial price suppression of the massive short would be undone?closing a short leads to the price going up. The second possibility for the massive short is to physically delivery the metal. From COMEX delivery data, however, we know only a small percentage of the open interest is physically delivered. No big short is delivering hundreds to thousands of tonnes of gold every other month.

The third possibility for the massive short is to roll, by closing its near month position and open a new massive short in the next active month. But a large roll would leave traces in futures prices. When a massive short is rolled the price of the expiring month is pushed up, and the price of the next active month is pushed down. The spread between the contracts?calculated as the next active month minus the near month?would decline during the roll period.

What I did is grab the settlement prices from the COMEX website and made a chart. Below you can see the progression of the spread (between the December 2021 and February 2022 contract) from the beginning of October until the end of November. The last day of November was the start of the delivery procedure for December, so most traders rolled (or closed) their December positions prior to that.

On November 16 the majority of the open interest shifted from December to February.

Clearly, the spread increased leading up to the end of November, signaling the longs were more eager to roll than the shorts. In other words, it looks like more longs than shorts rolled.

Conclusion

If there was any period suited for holding down the price of gold it was in the past few months when the world was shocked by the highest inflation numbers in 30 years. In the data at my disposal, however, I see no evidence of a massive short suppressing the gold price on the COMEX.

The only critique of my methodology I can think of is that I used settlement prices instead of bid and ask quotes. Unfortunately, I don?t have the resources to obtain the latter. Supporting my findings is a similar investigation performed by Keith Weiner from Monetary Metals (read here), who used spot and futures bid and ask quotes over several decades. His conclusion is the same as mine: there is no evidence for gold price suppression on the COMEX.

Having said that, I would be happy to change my mind if anyone has new evidence.

If you enjoyed reading this article please consider to support The Gold Observer and subscribe to the newsletter.