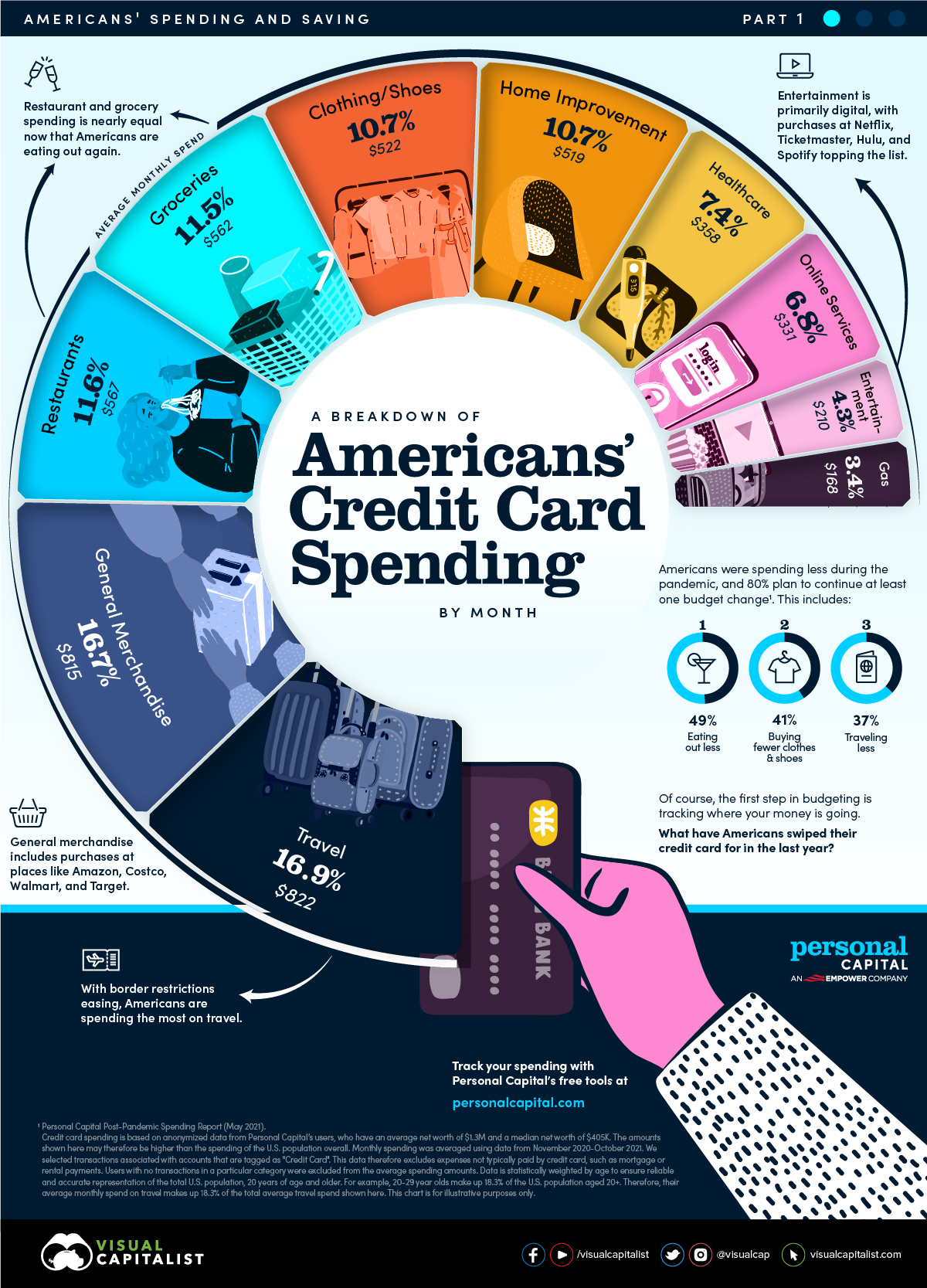

Americans? Monthly Credit Card Spending

If you were fortunate enough to keep your job during the pandemic, you probably noticed a financial benefit: you spent less. Amid restrictions, credit card spending on fun activities?like going out for dinner?became less frequent.

Looking ahead, the majority of Americans plan to continue at least one budget change post-pandemic, including eating out less (49%), buying fewer clothes and shoes (41%), and traveling less (37%). Of course, the first step in budgeting is tracking where your money is going.

In the above graphic from Personal Capital, we break down Americans? monthly credit card spending by category. It?s the first in a three-part series that will explore the spending and saving of Americans.

Behind the Numbers

Credit card spending is based on anonymized data from Personal Capital users, who tend to have a higher-than-average net worth. For this particular subset of users, people had an average net worth of $1.3 million and a median net worth of $405,000. Therefore, the credit card spending amounts may be higher than those of the general U.S. population.

It?s also worth noting that the data reflects credit card spending only. It does not include expenses such as mortgage or rental payments, which are typically paid through other methods.

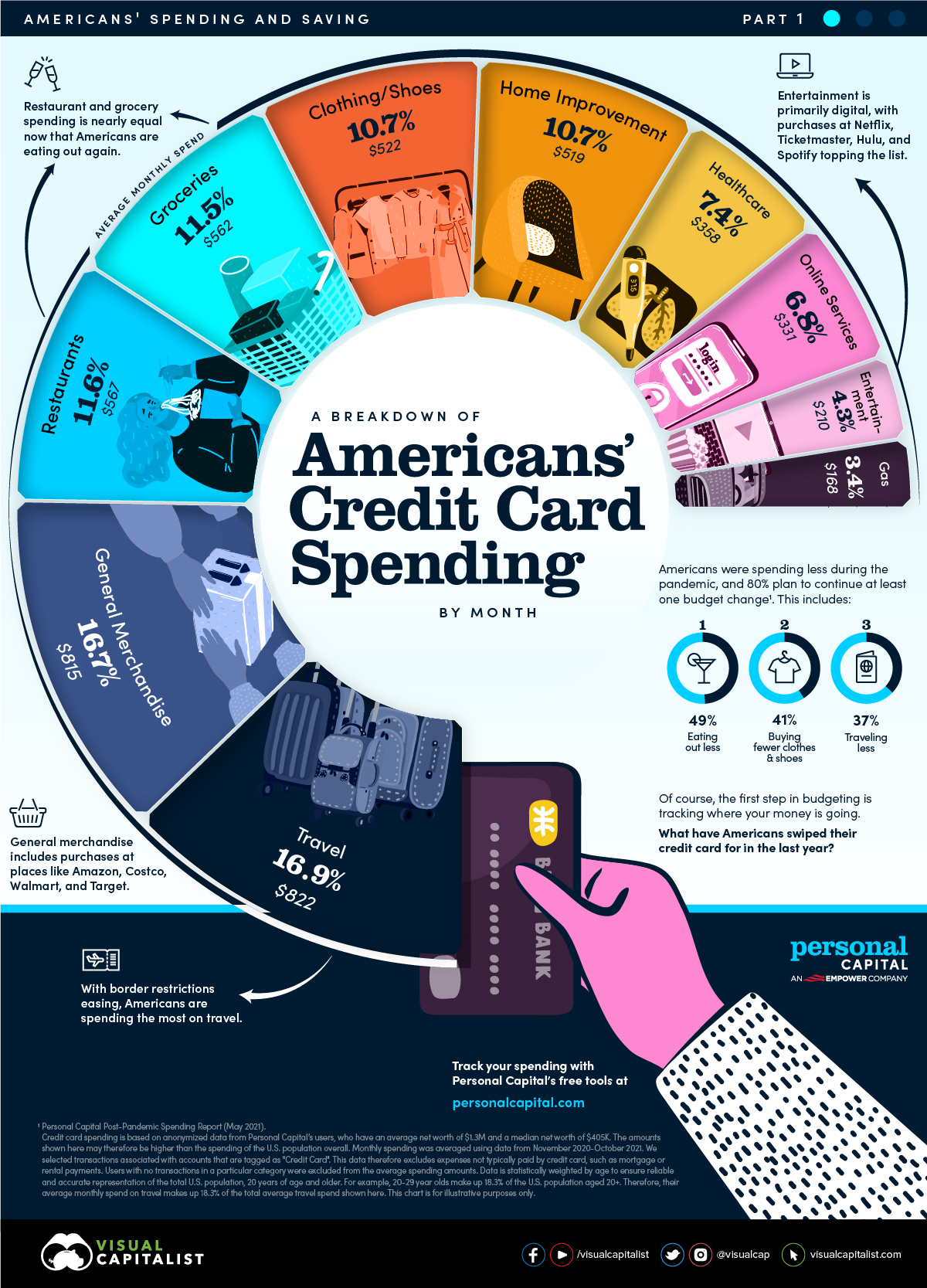

If you were fortunate enough to keep your job during the pandemic, you probably noticed a financial benefit: you spent less. Amid restrictions, credit card spending on fun activities?like going out for dinner?became less frequent.

Looking ahead, the majority of Americans plan to continue at least one budget change post-pandemic, including eating out less (49%), buying fewer clothes and shoes (41%), and traveling less (37%). Of course, the first step in budgeting is tracking where your money is going.

In the above graphic from Personal Capital, we break down Americans? monthly credit card spending by category. It?s the first in a three-part series that will explore the spending and saving of Americans.

Behind the Numbers

Credit card spending is based on anonymized data from Personal Capital users, who tend to have a higher-than-average net worth. For this particular subset of users, people had an average net worth of $1.3 million and a median net worth of $405,000. Therefore, the credit card spending amounts may be higher than those of the general U.S. population.

It?s also worth noting that the data reflects credit card spending only. It does not include expenses such as mortgage or rental payments, which are typically paid through other methods.