Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

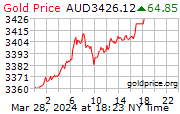

$̴3̴2̴0̴0̴ $̴3̴50̴0̴ $3̴90̴0̴ $400̴0̴ $410̴0̴ $4200 Gold!

- Thread starter ozcopper

- Start date

Hopefully a sustainable move and not some technical short squeeze. All good in the Stacker communityParabolic???View attachment 11724

^^^ Patience needed grasshopper. Death of the USD loomes, and not so much as traders but country's are looking to dump their us$ reserves before they are left with a soggy basket of useless toilet paper. When panic sets in silver could blits gold as a % return.

Possibly...but how much patience? Silver stackers have beards of silver,loads so heavy can barely carry them and decades of false promises and hope...its price it was while back least gold has reached its ATH again and surpassed it, problem is no one want to buy, just silver at premium adding to weight we cant carry. Food and basic necessities in any aspect of life has increased multiple times but silver has slowly moved up,back and back to where it was...so far proving to be neither security or investment. We get excited for long shot that it returns to price was 10plus years ago and still isnt there. Hopes good but to blindly do so in such a world we live in especially these days can leave u weighted down,drowning in 1 underperforming asset class...thats spotted and lost its shine^^^ Patience needed grasshopper. Death of the USD loomes, and not so much as traders but country's are looking to dump their us$ reserves before they are left with a soggy basket of useless toilet paper. When panic sets in silver could blits gold as a % return.

Look At These Shocking Price Targets For Gold & Silver! Plus Other Surprises!

Stunning 2019 Gold, Silver & Oil Price Targets

Graddhy out of Sweden: My minimum price targets for the commodities bull are still the same as in 2019:

Gold $10,000-$15,000

Silver $370

Oil $250-$300

(in today’s value)

Source: https://kingworldnews.com/look-at-these-shocking-price-targets-for-gold-silver-plus-other-surprises/

Stunning 2019 Gold, Silver & Oil Price Targets

Graddhy out of Sweden: My minimum price targets for the commodities bull are still the same as in 2019:

Gold $10,000-$15,000

Silver $370

Oil $250-$300

(in today’s value)

Source: https://kingworldnews.com/look-at-these-shocking-price-targets-for-gold-silver-plus-other-surprises/

many people bought into ever rising Chinese property market before covid, after covid they were foreclosed, lost all the cash and still owe the bank $$ and and left standing without much of anything, no metal holder. but bitcoin went up again.Possibly...but how much patience? Silver stackers have beards of silver,loads so heavy can barely carry them and decades of false promises and hope...its price it was while back least gold has reached its ATH again and surpassed it, problem is no one want to buy, just silver at premium adding to weight we cant carry. Food and basic necessities in any aspect of life has increased multiple times but silver has slowly moved up,back and back to where it was...so far proving to be neither security or investment. We get excited for long shot that it returns to price was 10plus years ago and still isnt there. Hopes good but to blindly do so in such a world we live in especially these days can leave u weighted down,drowning in 1 underperforming asset class...thats spotted and lost its shine

I personally don't class silver as a precious metal anymore, after the fiat revolution, but as the world turns green energy it will be a commodity in the highest demand! Reserves are held by the elite controlling prices, and in my eye's, after decades following the metal the pricks will let the spring go when terms suit them for trillions of $ profits. I have made some good money over the decades, and not so good on some due to the lack of knowledge that's life. But I feel we the world is waking up to corruption in government elite pigs and faith in fiat will wain. Gold is king that's for sure. Silver well it is a metal that can go past all our expectations in time. I wait in patience if it comes my way in my life time so be it if not not some prick will be digging it up and saying ohhh! What do we have here.

Look At These Shocking Price Targets For Gold & Silver! ...

Made you look!

Gold ~4-7x

Silver >10x

Timeframe? Apparently open ended if he made set the targets 5 years ago.

Crystal ball predictions is a game worse than get rich quick by buying lottery tickets.

~~~

Gold is money and it acts like it because central banks are not happy with the USD.

Silver is a speculative commodity play that may or may not pay off bigly in the future. I think it's strongly possible, but am aware that I could be wrong.

When they run out of above ground reserves, silver will be competed for by the entire world. There is A LOT of gold in the hands of central banks. Sure, they want it now but one day they won't need as much as their as acquiring, as acceptance and faith in a new monetary system becomes widespread. I'd rather be holding a basket of metal that's needed and critical to sustained global progression than a gold, but I'm happy with my gold acquisition. I care not what fiat price any of my gold or silver reaches, because I don't intend give it up within this monetary paradigm.