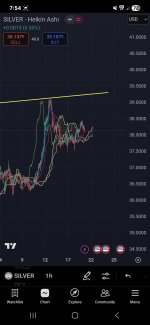

This maybe the move to cover shorts. Just my opinion.

But word about is that " they " are losing control of the markets ( paper shorting physical ) & need to get out of their shorts. They need the lowest price possible to get out of their short positions, to cut their losses.

This is pure speculation - but what are the real world factors that can hammer prices down ? I have no info that would point to a lower Gold/Silver price. This is manipulation at work.

These people are " all in " for billions of dollars. This is their game & they are playing to win.