Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

I have a theory that before the silver price can be let go (and I mean really let go. Not just $40 silver), it will absolute tank in price. Maybe even as low as $10 USD or less. All those commercials rolling over their short positions will be bleeding $$ if the price is able to climb without closing them off. I think we'll see another 2020 event over the coming years, and this may coincide with the "Next Pandemic".

Silver should be triple digits. There's no justifiable reason silver should be anywhere near $32... But I just see more of the same moving forward. Zzz. It would be nice to get a good dump for any buyers of the physical out there.What will this week bring ball gazers?

It baffles me how ABC Bullion can sell roos for $14 over spot. The most generic government coin you can get and they price it at one of the highest premiums. I wonder how many people actually buy them. I'd assume ABC would've previously been one of the top sellers of this coin in the past (before the massive premium hike), so it also makes me wonder if they price them to deter interest in the coin, and whether this is something Perth Mint and ABC have arranged together.

We all understand that the price of silver is heavily influenced by factors beyond our control. To establish a fair price for physical bullion rounds (not coins), we need to accurately assess their value for sale. In previous discussions, you've mentioned that silver should be priced in the three figures in AUD, which puzzles me since it currently isn't. However, you also note that free trade sales occur well below the three-figure mark. I'm confused—are we discussing paper value or physical value?

I'm not sure what you're trying to ask but it's more of a comparison between other Bullion coins. The Roo is selling for $14 over spot, yet the Maple or Britannias sell for $9 over spot on ABC's website. Why on earth would there be a $5 discrepancy for a coin that is minted here? Additionally, other dealers have no problem selling them for $8-$9 over spot, so why the hell would ABC place such a large premium on the Roo's? It's not even remotely competitive, and from a business standpoint, I cannot comprehend why they'd do that unless they were trying to deter investment into that particular coin.

I question whether ABC Bullion and Perth Mint are in an arrangement to price the Silver Kangaroo's in such a way to deter investment. Since 2020, the sale of Roo's had doubled and tripled the previous years. We're seeing similar things occuring with the US Mint (unlawfully) restricting their Silver Eagle sales.

This may also align with a post @pmbug shared where someone questioned them on why they stopped producing their 1kg bars (speculating they were producing 1000oz bar for the COMEX or LBMA).

I'm pretty sure ABC refines silver for the Perth Mint too, so I don't think it's beyond plausibility there may be some kind of backdoor arrangement going on.

I always found the excessive premium unusual but thought it may be temporary due to supply constraints going on at the time... But it's been like this for 2-3 years now and I'm beginning to suspect there's more to it than simply price gouging.

Last edited:

I agree. I'm not looking at the market to value the physical, I'm calling into question the tactics of ABC to price the Roo's the way they have.At current gold values per ounce, I don't understand why silver is not over $200 per ounce from the historical values. Look what I am trying to say is don't look at the market to value physical silver

@STKR - why not pick up the phone, call ABC and ask them why they charge an outsized premium vs. competitors and see what they say?

I might do that.

@STKR - why not pick up the phone, call ABC and ask them why they charge an outsized premium vs. competitors and see what they say?

I didn't expect much from that conversation. I mean, to really get to the bottom of it, you'd need to speak to someone in the know within the company. A simple phone call to a standard rep would only get you so far... And that's exactly what happened.

The answer was "they cost us more to buy"... But when I asked why other Bullion dealers can offer them $5-$6 cheaper, he responded "we have similar products minted by ABC that are much cheaper". I asked if he was alluding to the price being a deterrent to draw more interest to other Bullion products, he said "yes, that's fair.".

The more I spoke to him the more he was beginning to question to the price himself. It was clear he didn't actually know but when I raised the point about being able to import other government mint coins and sell them at a premium $5 below the kangaroos, he paused and understood the absurdity of it.

I think you'd never get an honest answer out of ABC no matter who you spoke to, but it's likely a well-written email to a more senior employee who understands the reasons behind the pricing discrepancy would be more fruitful.

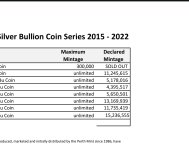

All-in-all, I'm still highly suspicious. I think ABC were once the largest reseller of the Silver Kangaroo. I find it curious the same year Perth Mints mintage declaration of the silver kangaroo ends (2022), is the same year ABC hikes their premium. If anyone can dig up mintage data for 2023 and 2024, I'd be grateful for your assistance.